[ad_1]

Chip stocks have been popular with investors over the past year, but not all stocks have benefited from the market. Although many companies in this sector have accumulated profits, Navitas Semiconductor (NASDAQ:NVTS) has gone in the opposite direction, with a year-to-date loss of 46%.

Small cap is a designer of power chips that utilize gallium nitride (GaN) and silicon carbide (SiC). Classified as wide bandgap (WBG) semiconductors, these materials offer advantages over traditional silicon substrates in certain applications. Basically, WBG semiconductors can handle higher voltages and operate more efficiently. As a result, GaN and SiC are increasingly being adopted in fast charging systems, EVs, and premium mobile devices.

The company’s success is reflected in very strong growth. In its latest quarterly release, Q4 2023 revenue increased 111% year-over-year to $26.06 million, beating consensus by just $0.67 million. Navitas also exceeded expectations on the revenue front. EPS of -$0.04 beat expectations by $0.01.

But one reason for the economic downturn may be a disappointing outlook. Due to the impact of seasonality and various macro headwinds (interest rates, softer end market demand) that impact overall end markets, the company forecast first quarter sales of $23 million at the midpoint, down from the expected $24.4 million. It fell below the dollar. Additionally, while the company had previously expected strong performance through the first half of 2024, it now expects weakness to continue through much of that period, with any prospects for a significant recovery delayed until the second half of 2024.

But Deutsche Bank analyst Ross Seymour’s bullish stance is driven by long-term growth prospects.

“As NVTS continues to make progress toward its long-term goals, further accelerates new end-market expansion goals with the inclusion of GeneSiC (which the company will acquire in 2022), and begins to deliver attractive revenue growth, investors “Confidence in NVTS should increase as it continues to rise and is a big boon for NVTS stock,” the 5-star analyst said.

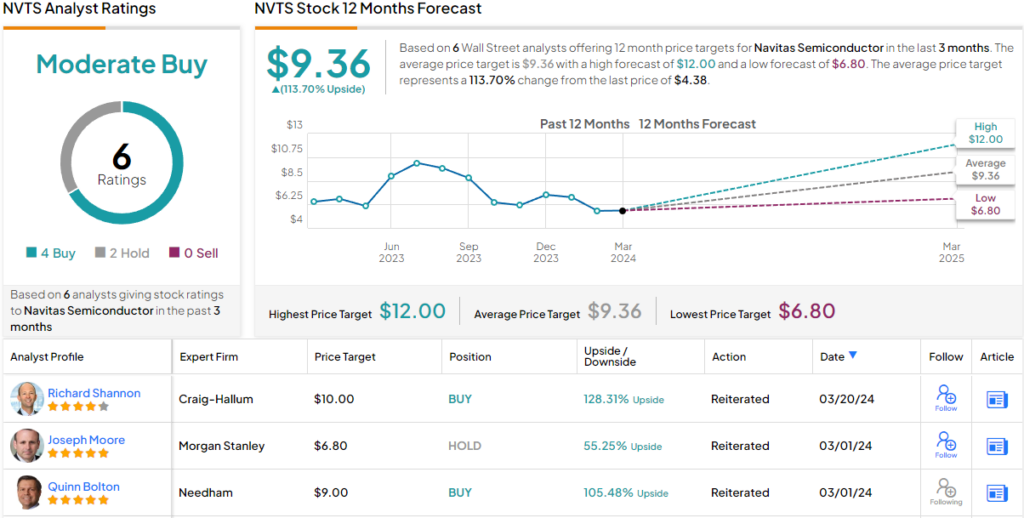

Seymour ranks in the top 1% of Street stock professionals for the accuracy of his recommendations and is one of the few analysts not to take a bullish stance on Nvidia, but his The outlook is completely different. He rates Navitas stock a Buy and has set a $9 price target, reflecting potential one-year growth of around 107% from current levels. (Click here to see Seymour’s track record)

Overall, Seymour is in line with 3 other analysts who rate NVTS a Buy, and adds 2 Holds, giving the stock a Moderate Buy consensus rating. The average target is even more bullish than Seymour’s target. This number suggests that the stock, at $9.36, could grow ~114% over the next year. (look Navitas stock price forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link