[ad_1]

(Bloomberg) – Former Goldman Sachs Group Inc. partner Ryan Toll’s Panview Capital has assets of $1.1 billion, and the Hong Kong-based firm will stop accepting money from new investors starting at the end of the year. The official said. problem.

Most Read Articles on Bloomberg

Assets have grown nearly sevenfold from $160 million in January 2020, said the person, who requested anonymity because the information is private. For now, the company will only accept new funding to replace existing investors. Mr. Toll declined to comment.

The Panview Asia Equity Fund has generated positive returns every year since its launch in November 2019, with 21% returns last year and even more in the first two months of 2024, according to a newsletter seen by Bloomberg News. It made a profit of 9.8%.

Over the past three years, the company has stood out as its regional peers have struggled to generate revenue and raise capital, as geopolitical tensions and a slowing Chinese economy weigh on markets and investor appetite. .

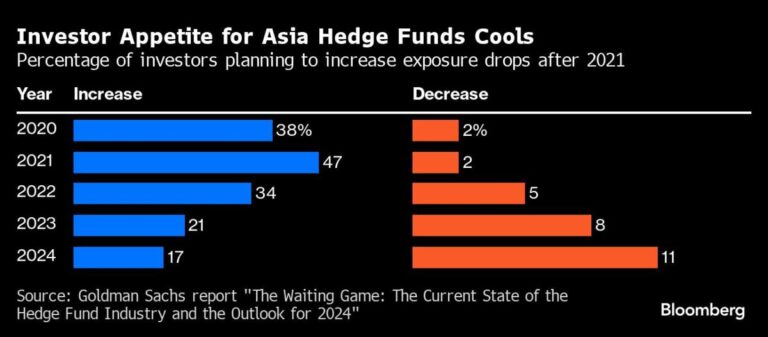

Hedge funds focused on Asian equities lost an average of 6.5% annually from the end of 2020 to January 2024, while their global equity peers rose 0.8%, according to data from Eurekahedge Pte. Ltd. was recorded. 47% of investors planned to increase their exposure to Asian hedge funds in 2021, but this fell to 17% in Goldman Sachs’ latest survey released last month.

Still, investors appear to favor companies with a broader geographic focus and a track record of steady earnings amid market turmoil.

Another example is Singapore-based Keystone Investors Pte. The spinoff from Schoenfeld Strategic Advisors, led by Liu Shuang, has more than doubled its assets to more than $2 billion from $800 million when it was founded in April 2022, and has made new investments since early April. It will no longer accept homes, chief executive Ken Tonkinson confirmed.

Keystone is focused on China but can trade global themes. The CEO acknowledged that the pan-Asian hedge fund’s return was about 10% in the first two months, after soaring nearly 21% last year. We also haven’t had a losing year.

Mr. Toll previously co-led Oryza Capital, a hedge fund affiliated with Goldman Sachs Investment Partners, with Hideki Kinohata, which has focused on Asia and has grown since its founding in 2013. Within a year, it had raised $1 billion. They also oversaw GSIP’s investments in Asia for global hedging. Fund. Goldman Sachs closed the two funds in 2018, when easy monetary policy fueled a decade-long rally in equity benchmarks and hedge funds’ performance lagged behind investments in these products. This was due to the fickle demand for houses.

As of the end of February, Japan was Panview’s largest market in terms of combined bullish and bearish bets, followed by Greater China. The company made more long-term than short-term investments in Japan, while maintaining a roughly balanced exposure to Greater China, according to the newsletter.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link