[ad_1]

Wall Street’s five-week winning streak ended, with the S&P 500 dropping 0.42% for the week, the Dow Jones Industrial Average dropping 0.11% and the Nasdaq Composite dropping 0.82%. This week has been a rollercoaster, driven largely by inflation statistics. Tuesday’s better-than-expected consumer price index spooked stocks, sending the Dow Jones Industrial Average to its steepest decline in a year. Stocks rebounded over the next two days due in part to a weak retail sales report, but the January producer price index fell again on Friday. As I said this week, I’m not too worried about the higher-than-expected inflation numbers. A month doesn’t create a trend, plus it shows the economy is resilient and could buy the Federal Reserve time to gather more data before cutting rates. Other notable reports: January’s industrial production report was weaker than expected, and housing starts in January were much lower than expected, falling 14.8% month-on-month versus expectations for flatness. Club earnings season will pick up speed again next week, with four holdings scheduled to release their quarterly results. Overall, results have been strong, with 75% of the 79% of S&P 500 companies that have reported so far reporting better-than-expected earnings and 65% reporting better-than-expected earnings results, according to FactSet. Please note that US markets will be closed on Monday, February 19th for President’s Day. Palo Alto: Expectations are certainly high for this cybersecurity stock, which has already seen strong gains following the Feb. 6 earnings results of peers Fortinet, Tenable, and Check Point. All three companies exceeded expectations in sales, bottom line, and consensus numbers. Palo Alto hasn’t been updated since then, according to FactSet. As a result, it’s reasonable to assume that buy-side analysts will be disappointed if earnings, revenue, and guidance all fall short of expectations. Free cash flow generation is another important focus, as many analysts use it as the financial metric of choice when evaluating Palo Alto. Apart from the numbers, we like to know about the pace of deal activity and contract lengths, both of which have been headwinds. The term of the contract and the timing of the transaction can affect the billing amount, which represents the total amount billed within a particular period. We placed more emphasis on remaining performance obligations (RPO), which includes both invoiced amounts and the backlog of orders that have not yet been invoiced. Although not as secure due to the possibility of cancellation, it is still an important indicator of future sales. Palo Alto stock is up 24% this year and nearly 107% over the past 12 months. Nvidia: While the chipmaker’s valuation still doesn’t look too bleak based on future earnings, the scale and speed of the stock’s rise has been significant, up nearly 47% this year. And any price increase will almost certainly be met with a sell-off. Even with these beats, there could still be some profit-taking if guidance is not significantly higher than expected. Good news: The spending outlook from some of Nvidia’s biggest customers, including Amazon, Microsoft, Alphabet, and Meta Platforms, should certainly provide a positive outlook. The majority of these companies’ data center and AI infrastructure spending goes to Nvidia. Beyond the numbers, we’d also like to hear about China, how the company is navigating export restrictions, and any updates on the next H200 and B100 scheduled for release this year. Bausch Health: When it comes to Bausch Health, we’re not holding our breath. Even if the numbers are better than expected, the upside remains until the legal battle over Xifaxan is resolved (or at least some positive information is obtained) and the timing of BCH’s monetization becomes more certain. We expect it to be limited. Bausch & Lomb stock. Kotera Energy. Management doesn’t set the world price of oil and gas, so what we’re looking for is the implementation of things that management can control. This means higher production with less capital expenditure, indicating production efficiency. Additionally, given the calming natural gas environment, I’d be interested to see if they can shift more focus to oil production. Monday, February 19th The New York Stock Exchange, Nasdaq, and bond markets are closed. Tuesday, February 20th, before the bell: Walmart (WMT), Home Depot (HD), Axom Therapeutics (AXSM), Medtronic (MDT), Barclays Bank (BCS), LGI Homes (LGIH), Armstrong・World Industries (AWI), Ceragon Networks (CRNT), Tri Pointe Homes (TPH), Camtek (CAMT), Dana Incorporated (DAN), DigitalBridge Group (DBRG), Fluor (FLR), KBR (KBR), Oil States International (OIS), Tactile Systems Technology (TCMD), ALLETE (ALE), Allegion plc (ALLE), CenterPoint Energy (CNP), Equitrans Midstream Corporation (ETRN), Expeditors International of Washington (EXPD) After: Palo Alto Networks ( PANW), SolarEdge Technologies (SEDG)), Realty Income (O), Teladoc Health (TDOC), Enovix Corporation (ENVX), Caesars Entertainment (CZR), NeoGenomics (NEO), Diamondback Energy (FANG), Medifast (MED), Toll Brothers (TOL), RingCentral ( RNG), Ternium SA (TX), Celanese Corp (CE), Matterport (MTTR), Amplitude (AMPL), Chesapeake Energy (CHK), CVR Energy (CVI) Wednesday, February 21, pm 2 p.m. ET: Before the Federal Reserve bell: Vertiv Holdings Co (VRT), Medical Properties Trust (MPW), Analog Devices (ADI), Photoronics (PLAB), Wingstop (WING), Wix.com ( WIX), Global-e Online (GLBE), Exelon (EXC), HSBC Holdings plc (HSBC), ALIT, Avista (AVA), Bausch & Lomb Corporation (BLCO), HF Sinclair Corporation (DINO), Pagaya Technologies (PGY) ), Gibraltar Industries (ROCK), Wolverine World Wide (WWW), Garmin (GRMN) After the Bell: NVIDIA (NVDA), Rivian Automotive (RIVN), Etsy (ETSY), Synopsys (SNPS), Lucid Group (LCID), Sunnova Energy International (NOVA), Bros Netherlands (BROS), Apache (APA), Marathon Oil (MRO), Suncor Energy (SU), Mosaic Co. (MOS), FNF Group (FNF), Sunrun (RUN), Exact Sciences ( EXAS), ANSYS (ANSS), Coeur d’Alene Mine (CDE), Digital Ocean (DOCN), Trip.com Group Limited (TCOM), B2Gold (BTG), Joby Aviation (JOBY), Range Resources (RRC), Alamos Gold (AGI) ), Jackson Financial (JXN), Nutrien (NTR), Pan American Silver (PAAS), Sm Energy Company (SM), Cheesecake Factory (CAKE) Thursday, February 22nd 8:30am ET 10am 10:00 a.m. ET: Before the existing home sales bell: Bausch Health Companies (BHC), Moderna (MRNA), Newmont Mining (NEM), Nikola Corporation (NKLA), Cheniere Energy (LNG), Fiverr International ( FVRR), Wayfair (W), Pioneer Natural Resources (PXD) ), Eagle Point Credit (ECC), Lantheus Holdings (LNTH), First Majestic Silver (AG), Builders FirstSource (BLDR), Planet Fitness (PLNT), Grab Holdings Limited (GRAB), Novocure (NVCR), Quanta Services (PWR) ), NICE (NICE), Dominion Energy (D), Harmony Bioscience Holdings (HRMY), Tech Resources Limited (TECK), Intellia Therapeutics (NTLA ), Keurig Dr Pepper (KDP) After the Bell: Cotera Energy, (CTRA), Block, (SQ), MercadoLibre (MELI), Carvana Co. (CVNA), Ardelyx, (ARDX), Booking Holdings (BKNG), Intuit (INTU), indie Semiconductor (INDI), Live Nation Entertainment (LYV), Applied Optoelectronics (AAOI), Vale SA (VALE), Copart (CPRT), Insulet (PODD), EOG Resources (EOG), VICI Properties (VICI) , Rocket Companies (RKT) Friday, February 23, Before the Bell: Warner Bros. Discovery (WBD), Bloomin’ Brands (BLMN), AerCap Holdings NV (AER), Docebo (DCBO), Diana Shipping (DSX), NW Natural Holdings (NWN), Calumet Specialty Products Partners, LP (CLMT), Frontier Communications Parent ( (FYBR) (See here for a complete list of Jim Cramer Charitable Trust stocks. ) As a subscriber to Jim Cramer’s CNBC Investment Club, you will receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in a charitable trust’s portfolio. If Jim talks about a stock on his CNBC TV, he will issue a trade alert and then he will wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.

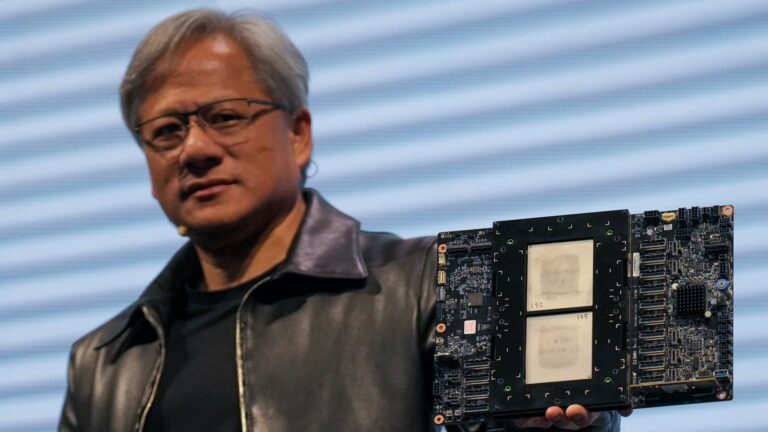

NVIDIA President Jensen Huang holds a Grace hopper superchip CPU used for generative AI during the COMPUTEX 2023 supermicro keynote.

Walid Belazeg | Light Rocket | Getty Images

[ad_2]

Source link