[ad_1]

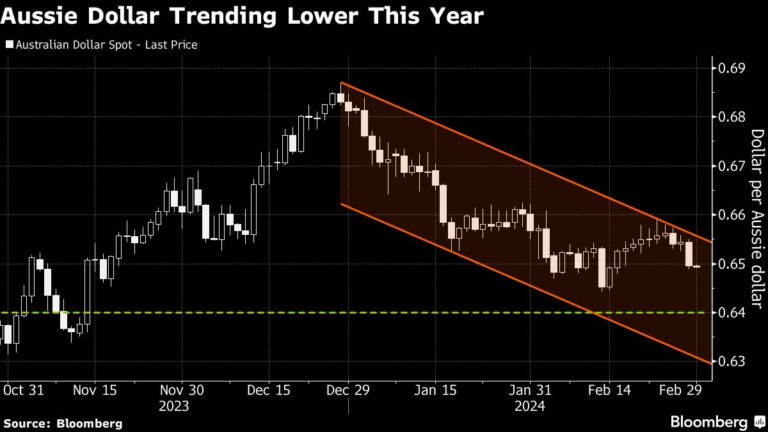

(Bloomberg) — Wealth managers are accelerating bearish bets on the Australian currency after seeing the central bank more likely to cut interest rates than raise them.

Most Read Articles on Bloomberg

Real money funds held a near-record short position in the Australian dollar at 99,366 contracts as of February 27, according to data from the Commodity Futures Trading Commission. This is despite the Reserve Bank of Australia saying it was considering raising interest rates to rein in prices that remain too high, according to minutes from February’s monetary policy meeting.

“We see a risk of the Australian dollar falling to around $0.64 next month,” said Christina Clifton, Sydney-based senior economist at Commonwealth Bank of Australia. She added: “We expect the RBA to cut the cash rate by much more than market expectations, with a 150bp cut by around mid-2025.” The currency ended last week at USD 65.27.

But the central bank’s hawkish rhetoric appears to be falling on deaf ears, as swap traders are pricing in a RBA rate cut rather than a rate hike this year. Australian economists have also brought forward the start of the Reserve Bank’s easing cycle from the fourth quarter to the third quarter, citing a slight downward revision to inflation expectations.

Real money funds will be hoping that Australia’s fourth quarter growth data, due out on March 6, will raise market expectations for further RBA rate cuts, putting further pressure on the Australian dollar. Economists expect growth to slow to 1.4% in the last three months of this year from 2.1% in the same period last year.

The fall in the price of iron ore, one of Australia’s main exports, is also weighing on the currency, with prices falling to four-month lows last week as hopes for a recovery in Chinese steel demand after the Lunar New Year holiday fade. did.

While there are certainly good reasons for asset managers to be bearish, some strategists see limits to further declines in the Australian dollar.

“With the dollar continuing to strengthen, I think AUD/USD will fall to $0.64 in the coming months,” said Alvin Tan, head of Asian FX strategy at RBC Capital Markets in Singapore. “Downside will be limited to a combination of the RBA continuing to maintain a more hawkish policy path than the Fed and further stimulus to support China’s local economy.”

This week’s key Asian economic data includes:

-

Monday, March 4: Australia’s fourth quarter inventories and corporate operating profits, New Zealand’s fourth quarter terms of trade, Japan’s fourth quarter capital investment and corporate profits, South Korea’s industrial production.

-

Tuesday, March 5: Australia’s fourth quarter GDP net exports and BoP current account, Bank of Japan Governor Ueda’s speech, Tokyo CPI, China Caixin PMI, South Korea’s fourth quarter GDP, Philippine CPI, Singapore retail sales

-

Wednesday 6th March: Australian Q4 GDP, South Korea CPI, New Zealand Q4 total building volume

-

March 7th (Thursday): Japanese worker cash income and Bank of Japan speech by Nakagawa, China’s trade balance, Malaysian central bank interest rate decision, New Zealand’s fourth quarter manufacturing activity, Australia’s trade balance and housing loans, Taiwan CPI

-

March 8th (Friday): Korea BOP current account balance, Taiwan trade balance

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link