[ad_1]

For the first time in a year and a half, fund managers are no longer predicting a U.S. recession, according to a closely tracked survey.

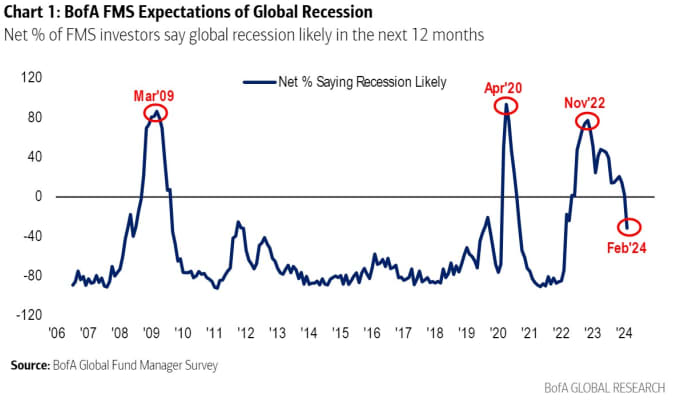

Bank of America’s monthly survey of global fund managers shows that the proportion expecting a global recession in the next 12 months has turned negative for the first time since April 2022.

The survey counted 249 panelists with $656 billion in assets under management in February and is often used not only to represent market views but also as a source of contrarian ideas.

The proportion expecting the economy to do well over the next 12 months remains negative, but -25% is the most optimistic since February 2022. Only 11% expect a hard landing, and about two-thirds still say a soft landing is most desirable. This will probably be the case in the global economy as well.

This economic optimism led fund managers to lower their cash levels in February to 4.2% from 4.8% in January, the opposite of Bank of America, where cash was below 4%. The level is close to a sell signal.

Fund managers find ‘long the Magnificent Seven’ trades to be the most crowded, with 61% in October 2022, when 64% of longs said the most crowded trade was in the US dollar. % most crowded.

Related: The Magnificent Seven is so large that it is worth as much as all the stocks in Japan, France, and Britain combined.

The second most crowded trade was shorting Chinese stocks at 25%.

Despite recent warnings from New York Community Bancorp NYCB, US commercial real estate has taken the number one spot as the most likely source of system credit.

Aozora Bank 8304,

Blue zoi,

and Deutsche Pfandbriefbank PBB,

The biggest allocation changes were rotations into communications, broader equities, technology and the US, and from emerging markets into real estate investment trusts, consumer staples and cash.

Overall, investors are bullish on technology, healthcare, stocks, US and telecoms, and bearish on UK, REITs, utilities, energy and banks.

The S&P 500 SPX ended Monday just shy of a new all-time high and is up 21% over the past 52 weeks.

The yield on the 10-year US Treasury note BX:TMUBMUSD10Y has risen 31 basis points since the beginning of the year, reflecting growing optimism about the US economy.

[ad_2]

Source link