[ad_1]

It is no secret that investment strategies continue to change in line with unique macro environments and evolving market regimes. Fund selectors in particular are reevaluating how they approach and think about this year’s challenges and opportunities for investors, as revealed in a recent study by Natixis Investment Managers. .

Complexity and uncertainty remain key factors for markets in 2024 as investors grapple with a variety of risk factors. The 2024 Natixis Global Fund Selector Outlook survey included his 500 investment professionals from 26 countries with approximately $35 trillion in assets under management. The results, conducted between November and December 2023, highlight the challenges investors will face this year.

Overall macro uncertainty weighed on long-term return assumptions, which fell from 8.8% in 2023 to 6.3% this year. Growing concerns about the resilience of consumers and the job market have led to heightened concerns about the economy. When it comes to economic concerns, recession risk due to slowing growth forecasts is at the top of the list (52%), with stagflation risk rising as well.

“Ultimately, predicting a recession may actually be a case of preparing for the worst and hoping for the best,” said study author Natixis Center for Investor Insights. wrote Dave Gussel, executive director of.

For 50% of respondents, concerns about war and terrorism come close behind concerns about recession this year. That’s not surprising given the current geopolitical arena. Other key risk factors in focus this year include the timing of interest rate cuts and rising energy prices.

Where fund selectors see opportunities

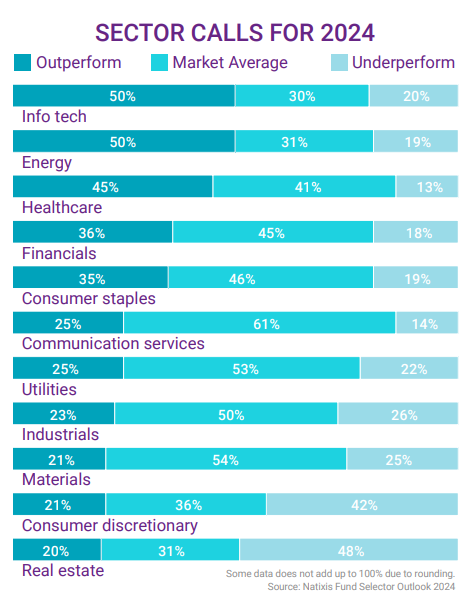

Despite the uncertainty and lackluster outlook, fund selectors believe there are some opportunities. In an environment of rising energy prices and recession risks, the technology sector is likely to be the main beneficiary.

Image Source: 2024 Natixis Global Fund Selector Outlook Survey

Fund selectors also believe that AI will continue to be a source of opportunity in 2024. “In fact, two-thirds believe AI will accelerate growth in tech. Only 34% think AI is a bubble, and most think the boom will last.” Gussell wrote.

There is strong bullish sentiment for 2024 bonds on the back of expectations for rate cuts and easing inflation. Overall, 70% of respondents think Europe, Middle East and Africa (EMEA) bonds are the most promising this year, followed by UK bonds at 66% and US bonds at 65%. Other opportunities for bonds in 2024 include private debt.

“Valuation is important in 2024”

The stock market has been mixed this year, with fund pickers split between bullish and bearish sentiment. Among global stock markets, North America is the most optimistic (55% bullish), but investors should be wary of high valuations.

“In fact, more than two-thirds (69%) of fund selectors around the world are concerned that valuations still do not reflect company fundamentals,” Goodsell explained. “Given the prospect of further market volatility, more than three-quarters (77%) of those surveyed expect the market to recognize that valuations matter in 2024. ”

Overseas, China and global growth concerns are weighing on the outlook for emerging market stocks. Although emerging markets are not expected to outperform, opportunities still exist. About half of fund selectors plan to maintain their current emerging market exposure, while more than a third plan to increase their allocation. Areas of opportunity include Asia excluding China, Eastern Europe, and Latin America.

Image Source: 2024 Natixis Global Fund Selector Outlook Survey

Part 2 discusses how a fund selector’s macro outlook is reflected in portfolio construction and strategy selection.

For more news, information and analysis, visit: Portfolio construction channel.

For more information, please visit ETFTrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link