[ad_1]

The truth is, if you invest long enough, you’ll eventually end up with some losing stocks.But in the long run GDEX Berhad (KLSE:GDEX) shareholders have had a particularly tough time over the past three years. Sadly for them, the stock price has fallen 51% during this time.

With that in mind, it’s worth checking whether a company’s underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for GDEX Berhad.

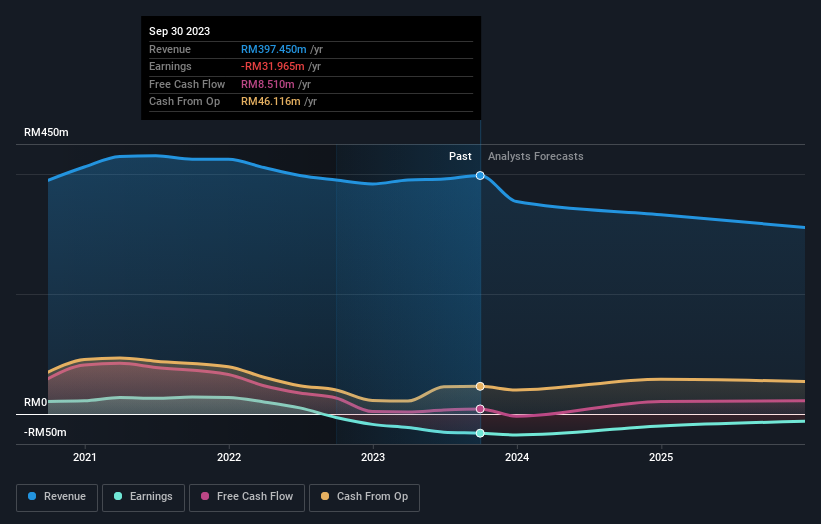

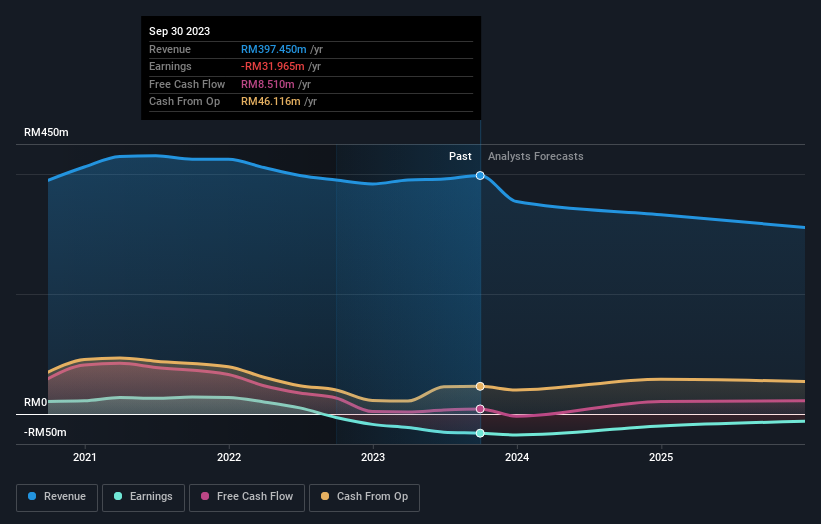

GDEX Berhad was not profitable in the last 12 months. You’re unlikely to see a strong correlation between share price and earnings per share (EPS). The next best option is probably revenue. Generally speaking, unprofitable companies are expected to have steady revenue growth every year. As you can imagine, sustaining rapid revenue growth often leads to rapid profit growth.

Over the past three years, GDEX Berhad’s revenue has decreased by 2.4% per year. That’s not what investors generally want. With declining sales and profitable but dreamy conditions, it’s easy to understand why the stock price is falling at 15% per year. That said, if growth is to come in the future, now may be the time for the company to decline. We generally don’t like owning companies that are in the red and don’t have growing earnings. But any company deserves attention when it makes its first profit.

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is important.It might be well worth taking a look at ours free Report how your financial situation has changed over time.

different perspective

It’s good to see that GDEX Berhad returned a total return of 31% to shareholders over the last twelve months. And this includes dividends. Notably, the five-year annualized TSR loss is 5% per year, which compares very unfavorably to recent share price performance. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. Shareholders might wish to check this detailed history graph of past earnings, revenue and cash flow.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link