[ad_1]

Alinea Invest, a fintech app offering AI-powered wealth management targeted at Gen Z women, raises $3.4 million in seed funding ahead of launch of virtual AI assistant to assist users with their investment needs are doing. The funding comes on the heels of 225,000 downloads of the Alinea app and a revenue run rate of $1.8 million, allowing her six-person team at the New York-area startup to operate profitably.

Founded in the midst of the Covid-19 pandemic, Alinea was founded by co-founders Anam Lakhani and Eve Halimi, who met at Barnard College and Columbia University, and CTO Daniel Nissenbaum. Mr. Lakhani and Mr. Halimi, now co-CEOs, interned on Wall Street and had similar worries about money. I didn’t know the best way to invest. This idea led to creating a business plan for the app while taking an entrepreneurship class in school. The founders then took full-time jobs at investment banks and then took jobs at growth-stage startups during the coronavirus pandemic.

The pandemic ultimately gave the team more time to develop the app, which led them to apply and join startup accelerator Y Combinator in 2021.

“The problem we felt was that people like us, young women, Gen Z, children of immigrants, we don’t know where to start. Financial literacy is a huge issue across the United States. “There are,” Lakhani points out. “We wanted to build an alternative platform that was truly personalized, that taught you how to build wealth, and that did it for you.”

Alinea Hallima Eve and Lakhani Anam in orange/Credit: Alinea Invest

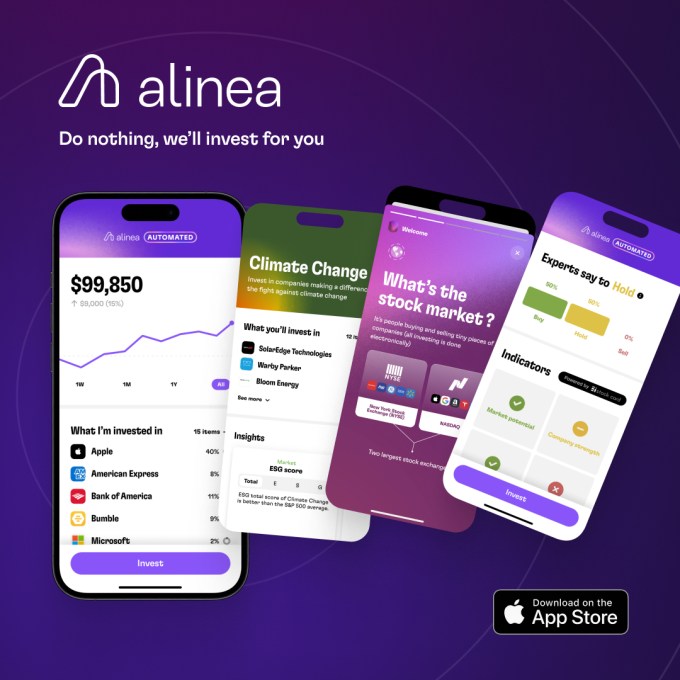

Described as “Wealthfront meets Robinhood,” the app is built with the Gen Z audience in mind. This includes a focus on approachable design to reduce investment anxiety. The goal is to attract users who have just graduated from college, started a job, or received their first paycheck and help them automate their portfolios. This is what sets Alinea apart from other women-focused fintechs like her Ellevest.

Many users start with Alinea’s automated investing model, but as they become more sophisticated investors they take advantage of the option to buy and sell stocks.

However, unlike Robinhood and other companies, Alinea operates on a subscription business model with a flat fee of $120 per year.

Another differentiator for Alinea is “playlists.” These allow users to build their own direct index in a way similar to her curation of music on Spotify. Alinea investors are currently customizing their own ETFs around themes such as climate change, women’s leadership, AI, fashion, and even abortion rights. Every day, users can create thousands of playlists and also share them with others.

Image credits: Alinea Investment

So far, the company has been successful in attracting users through content marketing, especially on TikTok, where founders talk about their investments and startup journeys. To date, their following has generated more than 100 million views across the hashtag on the short video platform, the founders told TechCrunch.

With a $3.4 million seed round, Alinea hopes to further expand into the AI market by launching an AI financial advisor. The app already leverages a combination of AI and expert advisors to make stock recommendations, but a new feature set to launch later this year will offer an interactive way to seek investment help.

AI helpers are added to new subscriptions.

“Essentially, there’s an additional premium layer where you’re kind of like an AI co-pilot, an AI financial advisor who answers all your questions and it’s very personalized,” Halimi says. says Mr.

When answering questions, AI considers a variety of factors, including your age, risk tolerance, and past performance. The team plans to release this feature around the second or third quarter of this year.

Although competition is fierce in the fintech space, Alinea believes he can tap into specific demographics: younger generations, Gen Z investors, and primarily women. (80% of the app’s users are women). Alinea’s average investor makes $80,000 a year and is approximately 22 to 24 years old.

The new funding was led by F7 Ventures and GFR, with participation from Worklife Ventures (Bri Kimmel), FoundersX Fund, Gainels, and Dropbox co-founder Arash Ferdowsi. Alinea previously raised $2.3 million in a pre-seed round from Goodwater, Kima Ventures, Harvard, Diaspora, and former Robinhood employees. The founders will not be joining the board of directors with the new funds, but rather will invest in further product development, including an AI co-pilot, personalization, and other educational initiatives.

“Financial literacy and investing are important paths to wealth and financial security for women and Gen Z,” said F7 General Partner Kelly Graziadei. “We are proud to invest in Eve & Anam, which uses Alinea to build AI-powered investments, making it easier and easier than ever for people to build AI-powered investments based on their interests and values. “It makes investing more accessible. I can’t think of a better team to pave the way to wealth creation for a new generation,” she added.

[ad_2]

Source link