[ad_1]

Written by Serena Lee and Xie Yu

HONG KONG (Reuters) – Asia’s top financial leaders are weighing geopolitical tensions, the upcoming U.S. presidential election and Chinese government policy as investors look to other regional markets such as India for better returns. We expect confidence in Chinese investment to continue to waver in 2024 due to uncertainty.

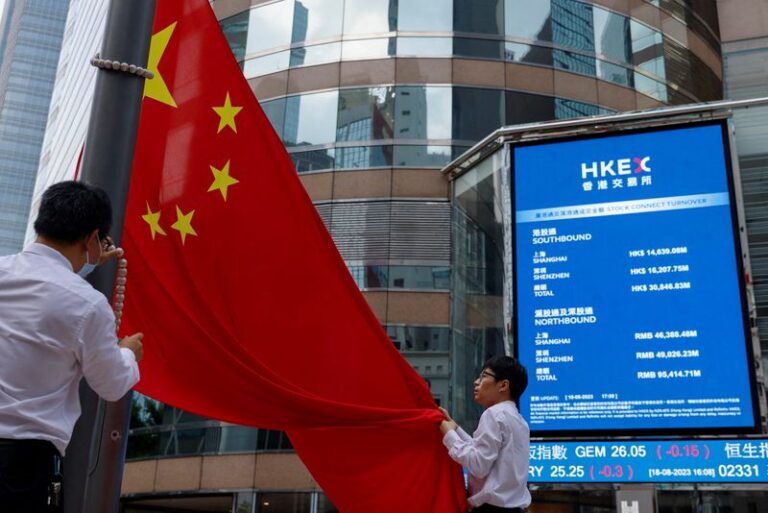

China is trying to use policy tools to support its plummeting domestic stock market. The company announced on Wednesday a cut in bank reserve requirements aimed at releasing about 1 trillion yuan ($139.64 billion) of liquidity to support weak mainland and Hong Kong stock prices.

But restoring confidence will not be easy and more geopolitical headwinds are expected in 2024, exchange operators and asset managers said during a panel discussion at the Asian Financial Forum in Hong Kong on Thursday. executives said.

“To be honest, it’s very difficult to explain (the situation in China),” said Rene Buhlman, global CEO of investments at British asset management firm Abdon.

“We all know that valuations are quite low and we have some great companies in our portfolio,” he said, adding that the return of international capital will only happen if confidence is restored.

This requires systemic changes in Chinese government policy, rather than single measures, Bühlmann said.

China’s benchmark CSI300 index is down 47% from its February 2021 high.

Over the past 12 months, Hong Kong’s benchmark Hang Seng Index has fallen 26%, the CSI 300 has fallen 22% and the broader Shanghai Composite Index has fallen 15%. Over the same period, Japan’s Nikkei Stock Average rose 24%, and the US S&P 500 index rose 27%.

Hong Kong Exchanges and Clearing CEO Nicholas Aguzin said on Thursday that Hong Kong’s stock market, trading near a 15-month low, was weighed down by global geopolitical flashpoints and U.S.-China tensions. He said he has received it.

Aguzin said the run-up to the US presidential election in November will boost investor confidence in 2024.

Although he did not provide figures, he added that private investors and hedge funds have recently begun to shift their focus to new capital inflows into the Hong Kong market.

Minglan Tan, APAC chief investment officer at UBS, said investors were looking for alternatives to China, making India “an essential part of the future.”

“India still has room to take it to the next level because what we are seeing at the moment is a lot of public infrastructure, stable demographics and higher investment rates,” he said.

He added, “The U.S. presidential election is in November.It is also important whether pressure on China will increase further.”

(1 dollar = 7.1612 Chinese Yuan)

(Reporting by Serena Lee and Xie Yu in Hong Kong; Writing by Scott Murdoch in Sydney; Editing by Kim Cogill and Jamie Freed)

[ad_2]

Source link