[ad_1]

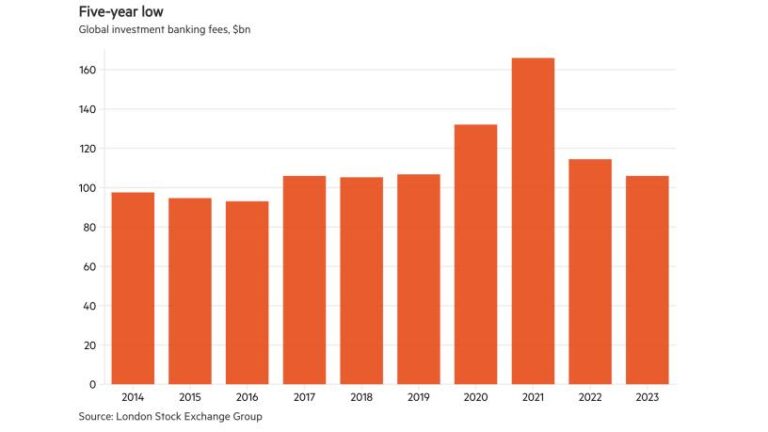

Global revenues will fall to a five-year low in 2023 as the weak mergers and acquisitions (M&A) market impacts investment banking fees, according to LSEG data.

Global investment banking fees will fall to $106 billion in 2023, down 7% from a year ago and the lowest annual level since 2018, the firm reported.

A slowdown in M&A volume and valuations overshadowed positive trends in both equity and debt underwriting fees. Equity capital markets fees reached $14.7 billion for the full year, an increase of 2% from 2022 levels, while debt capital markets fees showed a notable increase of 11%. Despite these increases, M&A advisory fees declined by a significant 25% year over year to $29.6 billion. In addition, fees from syndicated lending activities also faced a downturn, dropping by 10% to $25.8 billion.

Geographically, the Americas region accounted for the largest share, accounting for 47% of global fees, or $49.6 billion. But it also saw the most significant decline, by 11%. The $24.6 billion earned in Europe, the Middle East and Africa was down 6%. Fees also fell by 6% in the Asia-Pacific region.

But amidst the global recession, there were some notable bright spots. Stock market activity in Japan and India experienced significant growth, contributing to fee increases of 24% and 28%, respectively.

While India’s M&A activity fell to a three-year low, equity underwriting saw a notable 68% increase, with a contribution of $343.5 million in fees, totaling $1.3 billion. This is the highest amount for India since LSEG began recording in 2020.

The Indian stock market is currently experiencing continued boom. Industry commentators attribute this to a number of factors, including positive investor sentiment supported by optimistic growth forecasts and a desire by companies to secure funding in anticipation of the general election scheduled for May. There is. According to IMF forecasts, India’s economy is expected to grow by 6.3% in 2024, higher than the global average of 3%.

Meanwhile, in Japan, stock prices have reached a 33-year high, supported by a general economy that shows signs of overcoming decades of deflation and by measures taken by stock exchanges to strengthen governance. Funds raised from new stock sales and follow-on offerings in Japan reached about $31 billion in 2023, more than triple the total for all of 2022, according to separate figures published by Bloomberg.

Among the global investment banking fee rankings, JPMorgan maintained its top position, accounting for $7.2 billion in earned fees and a 6.8% share of total investment banking fee wallets. Goldman Sachs remained in second place with an estimated share of 5.5%, despite a 15% decline in acquisition fees year over year. Bank of America secured third place with a 4.8% share.

[ad_2]

Source link