[ad_1]

Assessing the sustainability of HIG’s dividend payments

The Hartford Financial Services Group (NYSE:HIG) recently announced a dividend of $0.47 per share, payable on April 2, 2024, with an ex-dividend date of March 1, 2024. The company’s dividend history, yield, and growth rate are also in focus as investors look forward to future payouts. Let’s take a closer look at Hartford Financial Services Group’s dividend performance and assess its sustainability using data from GuruFocus.

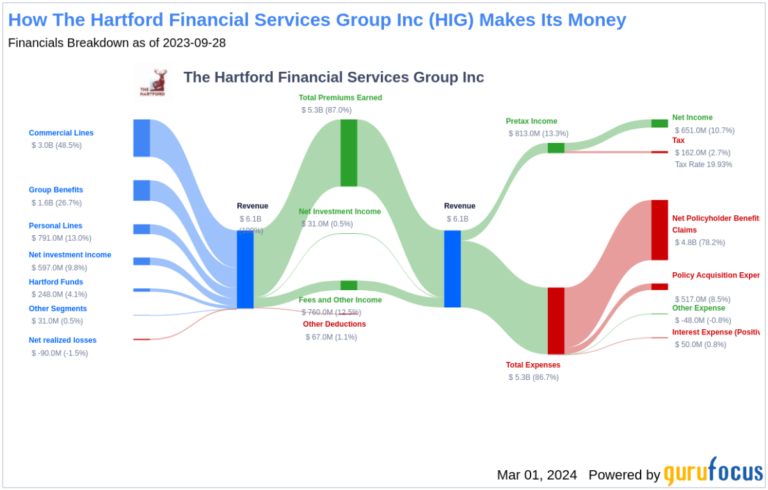

What does Hartford Financial Services Group do?

The Hartford Financial Services Group provides a variety of insurance and financial services, including property and casualty insurance, group benefits, and mutual funds. In addition to its corporate division, the company operates through multiple segments, including commercial operations, personal operations, property and casualty insurance and other operations, group benefits, and The Hartford Funds.

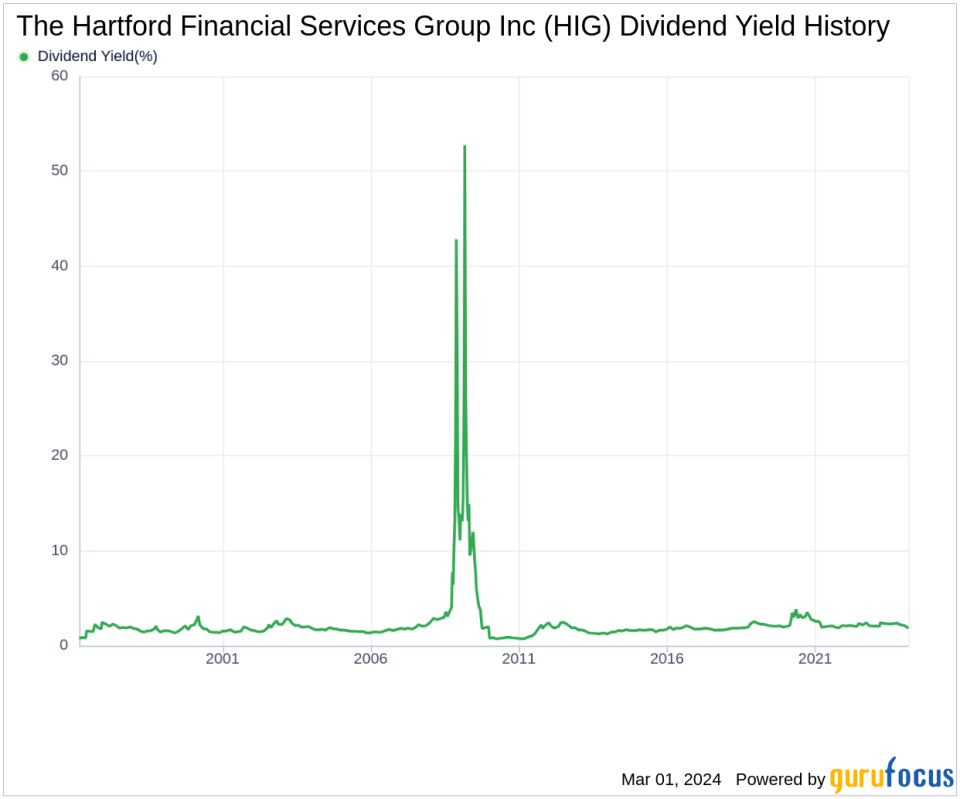

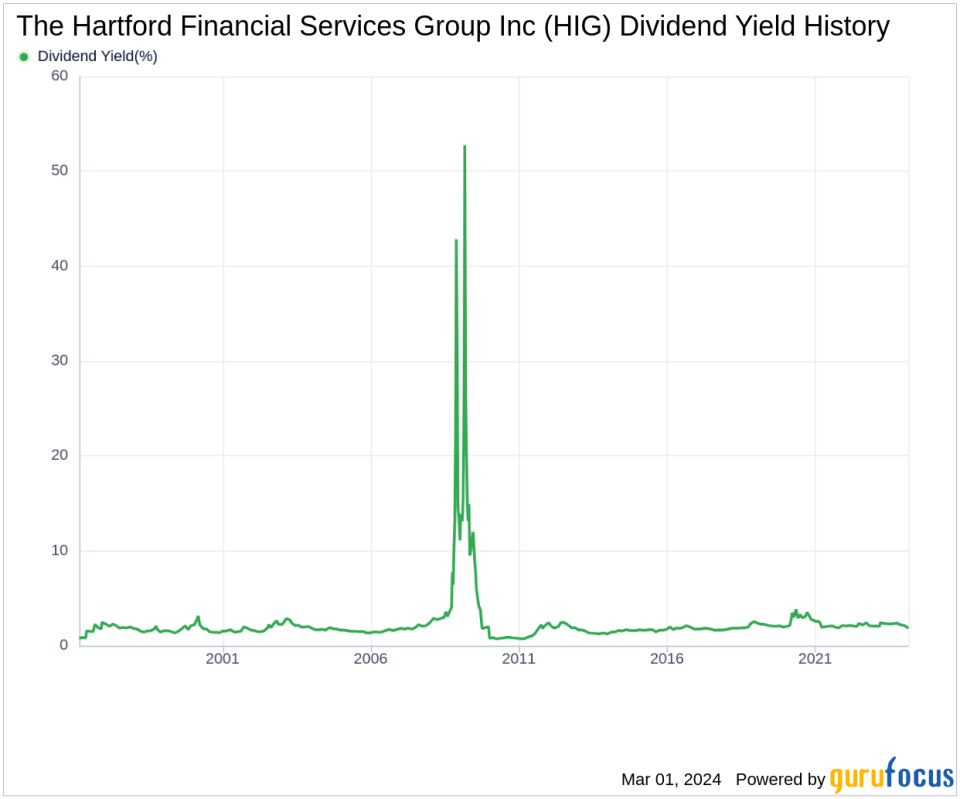

A glimpse at Hartford Financial Services Group’s dividend history

Hartford Financial Services Group has maintained a history of stable dividend payments since 1996, with dividends paid quarterly. Additionally, the company has increased its dividend every year since 2009, earning it the title of Dividend Achiever, which recognizes companies that have consistently increased their dividends for at least the past 15 years. Below is a graph of annual dividends per share to track historical trends.

Analyzing Hartford Financial Services Group’s dividend yield and growth rate

As of today, Hartford Financial Services Group, Inc. boasts a 12-month trailing dividend yield of 1.83% and a 12-month forward dividend yield of 1.97%. This indicates that the dividend is expected to increase over the coming year.

Looking at the past 3 years, Hartford Financial Services Group’s annual dividend growth rate was 10.30%. When extended to a five-year span, this rate decreases slightly to 9.70% per year. However, over the past 10 years, Hartford Financial Services Group’s annual dividend per share growth rate was a solid 12.20%.

Considering Hartford Financial Services Group’s dividend yield and 5-year growth rate, the 5-year cost yield for the company’s stock is currently approximately 2.91%.

Questions about sustainability: Dividend payout ratio and profitability

To assess dividend sustainability, we examine Hartford Financial Services Group’s payout ratio. Dividend payout ratio indicates how much of the profit is allocated to dividends. A lower ratio means a company is retaining more profits for growth and stability. As of December 31, 2023, Hartford Financial Services Group’s dividend payout ratio was 0.20, indicating a healthy balance between distributing profits and preserving funds for future needs.

As of December 31, 2023, the company’s profitability rank, which shows its earnings performance compared to other companies in the same industry, is 7th out of 10. This rank indicates that the company has reported a net income in nine of the past 10 years and has a good outlook for profitability.

Growth indicators: future outlook

Hartford Financial Services Group has a growth rank of 7 out of 10, indicating an encouraging growth trajectory compared to its competitors. The company’s earnings per share and his three-year earnings growth rate indicate a strong earnings model with an average annual growth rate of 11.50%, outperforming around 73.74% of its global competitors.

Hartford Financial Services Group’s 3-year EPS Growth rate is also noteworthy, with an average annual growth rate of 21.10%, higher than around 74.48% of its global competitors. Moreover, the company’s 5-year EBITDA growth rate is 12.10%, which outperforms around 70.99% of its global competitors.

fascinating conclusion

In conclusion, Hartford Financial Services Group’s consistent dividend payments, solid dividend growth rate, prudent payout ratio, solid profitability, and favorable growth metrics suggest an overall sustainable dividend policy . These factors not only provide some reassurance to current shareholders, but also make a compelling case for potential investors looking for a reliable source of income. As Hartford Financial Services Group Inc. navigates its future, we believe it is well-positioned to maintain its reputation as a dividend achiever. Will the company’s strategic initiatives and market position enable it to continue this trend? For investors seeking high dividend yield opportunities, GuruFocus Premium offers a high dividend yield screener to discover similar investment prospects We provide tools.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link