[ad_1]

(Bloomberg) — Singapore hedge funds are offering investors a relatively rare, client-friendly fee structure as capital flows into the industry slow and rising interest rates make cash more attractive.

Most Read Articles on Bloomberg

Dimon Asia Capital is creating a new share class with a so-called hurdle rate as part of a $1 billion financing for a multi-strategy hedge fund. This means investors in that share class will not charge performance fees until they have earned at least 5% annually.

“Essentially, anything less than 5% is not eligible for compensation,” Daimon founder and chief executive Danny Yong said in an interview at his Singapore office.

Hurdle rates are common in private equity funds, and hedge funds may offer them to their largest or early backers, but most funds do not grant hurdle rates to their entire client group. Dimon will be available to investors participating in the $1 billion financing it went public with last year, as well as existing customers who want to switch.

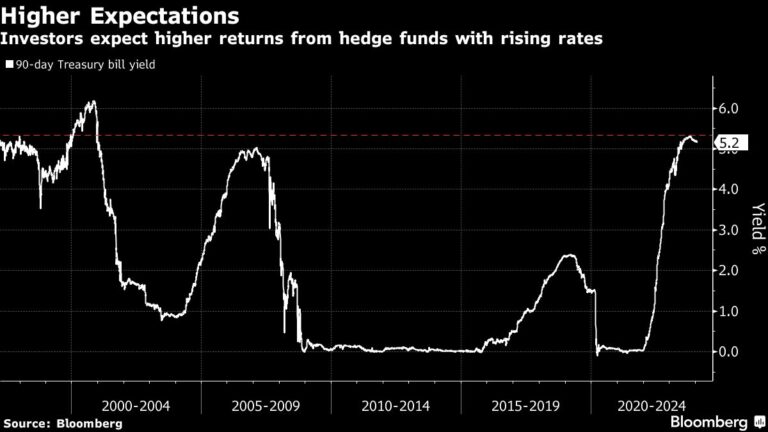

Dimon’s move comes as hedge funds face increasing pressure from investors to justify fees and expenses in a high-interest rate environment where relatively low-risk products offer decent returns. Ta. The yield on 90-day U.S. Treasury bills, a cash alternative, hit a 22-year high in October and remains above 5%.

Mr. Yong’s firm manages about $4.3 billion in hedge funds and other assets, but investors have asked him to invest in absolute returns and other hedge funds because many of them offer low returns when interest rates are high. He said he was told it was difficult to do so.

Under the performance fee structure for the new share class, Dimon will charge 15% for the top 5% of returns, rising to 25% for returns above 15%.

An executive at a rival hedge fund, speaking on condition of anonymity to discuss confidential matters, said client requests for hurdles have increased over the past four months due to the rise in the cash rate.

Institutional investors such as charitable foundations typically must pay out at least 5% of the value of their assets each year, according to a report by the Alternative Investment Management Association. Add in 2% inflation and most companies will target returns in excess of his 7%.

“Hurdle rates are becoming an increasingly popular tool for allocators to use in determining the performance fees that funds charge,” said John, global head of research and communications at AIMA, whose members manage a combined $3 trillion. Tom Kehoe says. “The current rising interest rate environment is forcing some business owners to clear higher hurdles.”

Read more: Talent-hungry hedge funds likely to drive pod shop M&A in 2024

Dimon aims to generate an after-fees return of 10% to 15% annually after posting a 12% net profit in 2023. The firm, which started as a macro hedge fund manager, announced to clients in 2019 that it would exit macro hedge funds. Enter a new pod shop business by hiring a team of investors to trade with different strategies. Although the 2022 return rate of 5.1% fell short of the target, Yong said the company was still undergoing restructuring at the time.

Yong said Dimon has already received enough interest from customers to meet its $1 billion funding goal. This would be in addition to his $2.3 billion in multi-strategy products.

To diversify the investment, Mr. Dimon plans to receive the new funding in four equal installments, with the first $250 million arriving at the end of March, Mr. Yong said. The firm plans to hire an additional 25 portfolio managers this year, on top of the 53 currently employed. Mr. Dimon separately manages another $2 billion in businesses outside of hedge funds, he added.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link