[ad_1]

(Bloomberg) — A veteran of alternative investment management has begun pitching a new type of securitization that banks say can reduce the carbon footprint of their balance sheets.

Most Read Articles on Bloomberg

Andrew Hornes, a former managing director at hedge fund Mariner Investment Group who now runs Newmarket Capital, said he is currently in talks with several banks to build these novel transfers. Ta.

For banks, repackaging and transferring credit risk from their loan books to less regulated private fund managers is nothing new. What’s attractive to investors on the other side of such deals is that banks receive capital relief, freeing them up to do more business while still earning double-digit profits.

Newmarket, a Philadelphia-based alternative asset management firm specializing in structured credit, is currently helping banks repackage and transfer so-called financial emissions, which represent greenhouse gas pollution associated with lending and investment activities. proposed a similar mechanism. For example, banks that invest large sums of money in the fossil fuel industry will exit large sums of money.

The idea is to “transfer the credit risk and at the same time transfer the so-called emissions risk to third-party investors outside the banking system like us,” Horns said.

Such structured products come as high finance wizards experiment with new means of tackling climate risks, including everything from debt-to-nature swaps to novel uses of carbon offsets. will be the latest in innovation. Applying risk transfer models to carbon emissions is still at an experimental stage, mainly due to the difficulty in assigning a monetary value to such risks and the lack of rules to guide such construction. This is because it does not exist.

Meanwhile, banks face increasing pressure from regulators to reduce emissions through lending. In Europe, where ESG regulations are more advanced than in other regions, major industry watchdogs have already issued warnings to lenders.

In October, the European Banking Authority announced that it would revise its framework for setting industry-wide capital requirements, known as Pillar 1, to incorporate environmental and social risks. The EBA says the changes mean banks will need to review the probabilities of ESG defaults and losses in their portfolios, as well as the risk weights used when deciding how much capital to set aside in each customer account.

Read more: EU’s historic ESG crackdown tells banks to reevaluate their customers

Read more: Wall Street isn’t making any progress in transitioning to energy finance

So-called emissions-weighted risk transfer allows banks to use “the same kind of mental models that have been built on the regulatory capital side to reasonably state that they have reduced the emissions intensity of their portfolio,” Horns said. Ta.

The Carbon Accounting and Finance Partnership, the global standard setter for funded emissions reporting, does not provide guidance on such securitizations. CDP, a nonprofit organization that advises public and private organizations on how to measure and report carbon emissions, said such transfers do not address the broader challenge of reducing emissions in absolute terms.

Amir Sokolowski, CDP’s climate director, said emissions-weighted risk transfer “is not innovation, it’s engineering.” “The aim of this financial engineering tool appears to be to break the link between emissions and risk,” but the consequences could “threaten both direct action and sustainable finance directions,” he said. said.

However, the financial appeal of these products has attracted the attention of other structured credit specialists beyond Newmarket Capital. Ryan Dunfield, CEO of Canadian private credit investment firm SAF Group, said he has also been in discussions with banks about taking on emissions risks. Like Mr. Horns, he declined to name the bank because the negotiations remain private.

Dunfield said the demand for such measures largely depends on the regulatory landscape. “Ultimately, regulators will say increase capital density, and the economics will actually drive that.” [banks] to start those trades,” he said.

Mr Dunfield said the structures SAF had discussed with banks also included so-called black carbon pools. The idea is to create a vehicle by which banks can “transfer all of their emissions-intensive lending,” he said. The SAF will then aim to match them with carbon offsets, he added.

Read more: BlackRock managers predict 40% jump in bank risk transfer transactions

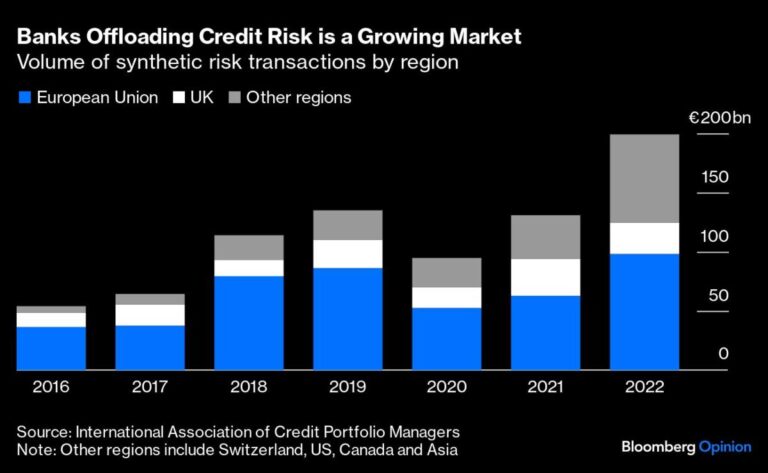

Meanwhile, banks are increasingly willing to transfer credit risk. Synthetic risk transfer transactions reached about $20 billion last year as banks reduced their exposure to about $200 billion in loans. Horns estimates this is about double the level of transfers to third parties a decade ago.

European banks such as Santander, Barclays and Société Générale and Canadian financial institutions such as Bank of Montreal, Royal Bank of Canada and Bank of Nova Scotia have traditionally been the biggest users of synthetic risk transfer. Wall Street is rapidly catching up.

BlackRock said the market could grow at about 35% a year as financial products gain acceptance and stricter capital controls take hold. Meanwhile, major investment firms such as Ares Management, KKR & Co and Blackstone are also pouring resources into considering such deals.

Additionally, capital relief through emissions-weighted risk transfer will allow banks to direct more funds to green projects, Horns said.

New Market Capital already classifies two types of synthetic risk transfers as impact deals. The first is structured around green underlying assets such as renewable energy projects. The other is structured around non-green underlying assets, with banks pledging to use the freed-up capital for environmental and social projects.

“Conventional energies will likely continue to require financing for much of the next century. They represent good credit risk and are important tools for human flourishing,” Horns said. Ta. “We will continue to invest.”

–With assistance from Laura Benitez, Esteban Duarte, and Frances Schwartzkopff.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link