[ad_1]

Hedge funds, which enjoyed record results last year thanks to catastrophe bonds, are now cutting back on positions on expectations that the market is headed for rough waters.

Tenax Capital has a 100 million euro ($110 million) portfolio of insurance-related securities, an asset class dominated by catastrophe bonds, and the strategy gave it an 18% return last year. . Marco Della Giacoma, who manages the portfolio, told Bloomberg that the fund is now converting the majority of its holdings into cash.

Toby Pugh, an analyst at London-based Tenax, said in an interview that it’s not the best time to get into cat bonds when “everyone is trying to buy and no one wants to sell.” .

Huge hedge fund returns trigger demand spiral for catastrophe bonds

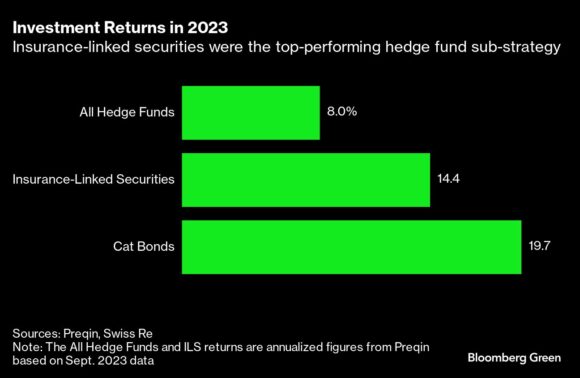

Tenax is one of the few hedge funds, along with Fermat Capital Management and Tangency Capital, to post record returns in 2023 thanks to investments in insurance-related securities. According to Preqin, a consultancy that provides data on the alternative asset management industry, ILS had the best performance of all hedge fund strategies last year, achieving an overall performance of over 14% compared to 8% for the benchmark. did. Cat bonds rose 20% in 2023, according to Swiss Re data.

Catastrophe bonds reward buyers for assuming insurance market risks associated with natural disasters such as hurricanes and earthquakes. In the event of a major disaster, bondholders will pay out. Otherwise, they will be able to make huge profits.

GAM Investments, which holds cat bonds on behalf of clients, said issuance is expected to reach $20 billion this year, up about 20% from 2023. Professional investors in insurance securities agree that 2023’s huge returns are unlikely to continue into 2024, but Tenax is more cautious than most.

Fermat, the world’s largest cat bond investor, isn’t exiting, “but it’s becoming a little more cautious about what risks we allocate capital to,” said Brett Houghton, managing director at the hedge fund manager. he said. He also said the market has “grown significantly in terms of issuers and bond types” and “gives us more choice.”

Global insured losses $1 billion

Last year, it all came together as a uniquely profitable cocktail for securities investors. The panic caused by Hurricane Ian in 2022 reduced the number of catastrophes, but the supply of double-digit coupon bonds remained plentiful.

Since then, that dynamic has changed. Increased investor interest is driving up the prices of existing bonds and pushing down the coupons of new bonds, hurting their potential returns.

Tenax said it has exited several trades in recent weeks, including Deutsche Cat bonds with a 5% risk premium. Another bond offered a 6% risk premium for northeastern U.S. wind risk, Pew said, the type of bond that last year would have given investors an 8% premium.

Tenax currently aims to move 15% of its portfolio to cash by August, up from the current 8%. By holding your position in cash, you can quickly return to the cat bond market when prices become more attractive.

“We are reluctant to invest at this point,” said Della Giacoma of Tenax. “Psychologically, people realize we’ve reached the top.”

Other cat bond investors are also making adjustments.

New York-based Neuberger Berman, which oversees a $3.3 billion ILS portfolio that includes $1.4 billion in Cat bonds, decided now was “a good time to reassess whether there are any positions worth selling.” said Peter DiFiore, managing director of the company. Hard. “We are opportunistically reducing some positions in anticipation of the potential for spreads to widen.”

How does cat bonding work?

Investors in cat bonds make payments to insurance companies if a contractually specified disaster occurs and certain conditions, such as hurricane wind speeds, are met. Investors may lose some or all of their funds, which will be used to pay insurance claims.

The return on a cat bond consists of a risk premium to compensate for the possibility of disaster occurring, and a risk-free amount (usually the prevailing U.S. Treasury rate). The risk premium for a set of so-called multiperil cat bonds tracked by Swiss Re Capital Markets fell to about 8% in January from about 13% a year earlier. The risk premium for riskier cat bonds has fallen to about 6% from 9% in the same period.

The main driver of the pricing change was the large number of cat bonds that matured in January, flooding investors with cash they needed to reinvest.

Maria Giovanna Gattelli, chief investment officer at Swiss Re Insurance Linked Investment Advisors Corp., which manages about $1.5 billion in assets, said the maturities “put a lot of capital back into the system.” Stated. She says that’s part of the reason why “spreads are a little out of sync because new issuance is still increasing.”

GAM Investments expects the risk premium to be 8% to 9% this year, which is still higher than the historical range of 4% to 6%.

Even at the forecast level, the spread in 2024 is about four times the average expected loss for bonds one year ahead, which is about 2.1%. By comparison, short-term corporate bonds with similar credit rating profiles have spreads of only 1.4 times expected losses.

Ralph Gasser, GAM’s head of fixed income investment specialists, said Cat bonds “receive much better compensation for each unit of risk you take” than many other fixed income bonds, and that his clients receive three GAM The company has invested approximately $5 billion in the securities. Fermat serves as an advisor – LaBelle Fund.

Bloomberg Intelligence says:

“Insurance losses have increased by 360% over the past 30 years due to an increase in the frequency and intensity of natural disasters, causing insurance companies to raise premiums and retreat from high-risk areas. At the same time, the assets backing these liabilities are increasing. The transition risks associated with this are putting pressure on insurers to reduce the coverage of polluting sectors in their investment portfolios.”

The fate of the cat bond market depends in part on how weather patterns evolve, and this variation is increasingly influenced by climate change. An area of the tropical Atlantic Ocean known as Hurricane Alley experienced July-like temperatures in mid-February. And a March report from the National Oceanic and Atmospheric Administration warned of an “increasing probability” of a La Niña event this summer.

AccuWeather says rising ocean temperatures and La Niña conditions are a powerful combination that could lead to a “major” storm season. Another forecaster, Weatherbell, warned of a “hurricane season from hell.”

Tenax says this is another reason to be cautious.

“This season could be pretty active,” Pugh said. “I feel like we’re in for a bit of a disaster.”

Photo: Yachts stacked on the shore after Hurricane Ian in Fort Myers, Florida, October 3, 2022. Photo credit: Eva Marie Uzcategui/Bloomberg

Related:

Copyright 2024 Bloomberg.

topic

catastrophe

[ad_2]

Source link