[ad_1]

Portfolio growth can come from a variety of sources. While areas like artificial intelligence (AI) and genomics are currently gaining traction, one investment area that rarely goes out of style is dividend investing.

Dividends can be a lucrative source of passive income. And thanks to the power of compounding, reinvesting dividends and holding on to winners for the long term can be especially helpful for investors in building wealth for generations.

Let’s take a look at 10 stocks with ultra-high dividend yields and evaluate why each one is worth watching in 2024.

1. Hercules Capital: Dividend yield 10.6%

Hercules Capital (NYSE:HTGC) is a business development company (BDC) that specializes in funding venture-backed startups. Hercules is different from regular banks because it tends to offer more flexible financing options. As such, Hercules may be assuming more risk than banks typically take on, but the company charges higher coupon rates on term loans and typically also negotiates warrants as part of the deal structure. This provides Hercules with additional sweetener in the event that one of its portfolio companies is liquidated in an initial public offering (IPO) or acquisition.

Because Hercules is a BDC, it is required to pay out 90% of its taxable income to shareholders in the form of dividends each year. This inherently makes Hercules attractive to dividend investors, and the company’s operating results have proven to be strong. As such, shareholders have been rooting for this stock for quite some time. Hercules stock’s total return over the past 10 years is 230%.

Given its strong long-term performance and high dividend yield of 10.6%, passive income investors may want to snap up shares of Hercules stock.

2. Ares Capital: Dividend yield 9.5%

Another BDC on my list is ares capital (NASDAQ:ARCC). What makes Ares a little different from Hercules is that the company tends to focus on lower-middle market businesses across a wide range of industries. Given its size, Ares also has greater financial flexibility than typical BDCs. The company specializes in more complex transactions, for example leveraged buyouts.

What makes Ares particularly unique is its status as a Warren Buffett holding. Buffett is primarily known for his berkshire hathaway Oracle of Omaha actually has another investment vehicle. New England Asset Management (NEAM) is a subsidiary of Berkshire, and one of its positions is none other than Ares.

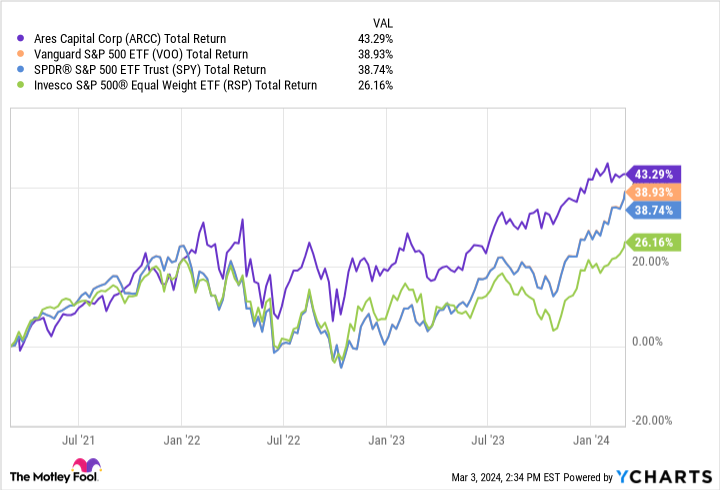

The graph below tracks the total return of Ares stock and a number of major stocks. S&P500-Thematic Exchange Traded Funds (ETFs). Considering the superior performance compared to SPDR S&P 500 ETF Trust, Invesco S&P 500 Equal Weight ETFand Vanguard S&P 500 ETFinvestors could follow Buffett’s lead and enjoy market-beating returns with this little-known BDC.

3. Horizon Technology: Dividend yield 11.1%

horizon technology (NASDAQ:HRZN) He is one of Hercules’ biggest rivals. The firm also specializes in venture debt for startups in the technology, life sciences, and sustainable energy industries.

With dividend reinvestment, Horizon stock has returned 131% over the past 10 years. Although this lags behind Hercules’ performance, investors shouldn’t discount Horizon.

The company’s price-to-book ratio (P/B) of 1.2 is slightly lower than Hercules’ 1.6, so we believe Horizon is a good hedge position against other BDCs. Now may be a good time to pick up the stock at an 11% yield, a significant discount to its top rivals.

4. Energy Transfer: Dividend yield 8.4%

energy transfer (New York Stock Exchange:ET) It specializes in natural gas transportation and storage. Energy Transfer operates as a master limited partnership (MLP) as a pass-through entity. This means that both profits and losses are passed through limited partners (such as investors).

Energy Transfer’s price-to-earnings ratio is currently 13.9 times, about half its long-term average. Given its recent acquisition of Crestwood Energy Partners, we suspect investors are discounting Energy Transfer’s future growth impact.

With the stock trading at a significant discount to historical valuation levels, now may be a good time to enter into a position with an 8% yield.

5. Enterprise Products Partners: Dividend yield 7.2%

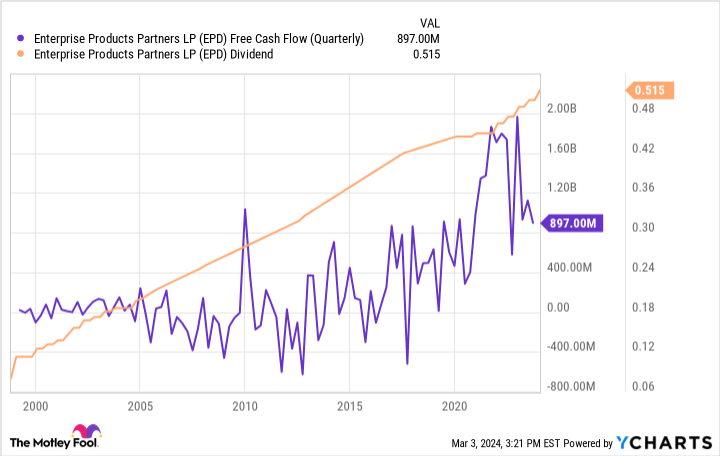

The graph below shows that even with unstable free cash flow, midstream energy companies enterprise product partner (NYSE:EPD) has succeeded in raising its dividend, with a yield of approximately 7.2%. I think this is a clear sign of strong shareholder value.

Currently, Enterprise Products Partners has a forward P/E ratio of just 10.3. With the S&P 500 trading at a forward P/E of 23.4, Enterprise Product Partners looks incredibly undervalued compared to the broader market.

We think investors may be discounting Enterprise Products Partners’ long-term potential, given the company’s recent acquisitions.

6. Enbridge: Dividend yield 7.8%

enbridge (NYSE:ENB) We store natural gas and manage pipelines. The stock has fallen 10% over the past year, significantly underperforming the broader market.

The energy sector has faced similar headwinds over the past year due to a combination of persistent inflation and geopolitical tensions. Nevertheless, Enbridge remains focused and, like the energy peers mentioned above, is relying on acquisitions to fuel new growth.

In September 2023, the company acquired three gas companies. dominion energy. Enbridge’s CEO called the deal a “once-in-a-generation opportunity” as the company builds North America’s largest gas utility.

Enbridge’s P/E ratio is just 16.5x, well below the five-year average of 26.4x. The jury is still out on the long-term impact of the Dominion deal, but it’s hard to sell the stock at such a deep discount and yielding nearly 8%.

7. Kinder Morgan: Dividend yield 6.5%

Last year was a challenging year. kinder morgan (NYSE:KMI). Revenue, EBITDA (earnings before interest, taxes, depreciation, and amortization), and free cash flow declined slightly, resulting in a modest decline in the stock.

But like the energy peers listed above, Kinder Morgan appears well-positioned to return to growth following its acquisition of STX Midstream. I’m optimistic that 2024 will be a year of recovery for the company, with the potential for even higher distributions to shareholders.

With a yield of 6.5%, now might be an interesting time to buy shares as Kinder Morgan looks to right the ship and return to growth.

8. Rhythm Capital: Dividend yield 9.1%

rhythm capital (NYSE:RITM) A real estate investment trust (REIT). Similar to BDCs, REITs are required to pay out 90% of their taxable income to shareholders in the form of dividends.

Rhythm stock currently trades more than 40% below its 10-year high. My suspicion is that sentiment surrounding the real estate industry has worsened in recent years, given the mixed macroeconomic outlook.

One thing to keep in mind is that REITs come in many different forms. Rithm is a mortgage REIT and competes with companies such as: Arbor Realty Trust, Analy Capital Managementand AGNC Investment Corporation. Rithm’s P/B is just 0.92, trading at the lowest multiple of this group.

Now could be a great time to buy Rism’s stock, as it trades at a discount to its peers and offers investors a high yield of 9.1%.

9. Altria: Dividend yield 9.6%

Artoria (NYSE:MO) Home to some of the world’s most famous tobacco brands. The company sells cigarettes under the Marlboro and Black & Mild names, as well as smokeless tobacco products. And NJOY.

The past few years have seen difficult conditions for the tobacco market. Prolonged inflation and high borrowing costs are straining consumer purchases. Wellness in general is also on the rise, making it more difficult for Altria to sell products to health-conscious consumers.

While growth is a concern for Altria at the moment, there’s one big reason to own this stock.

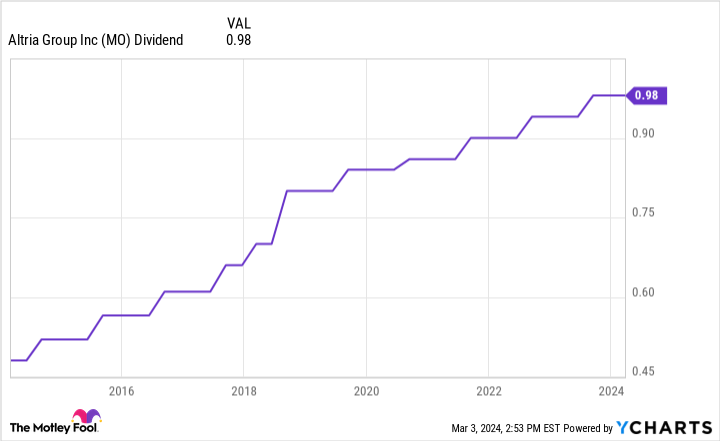

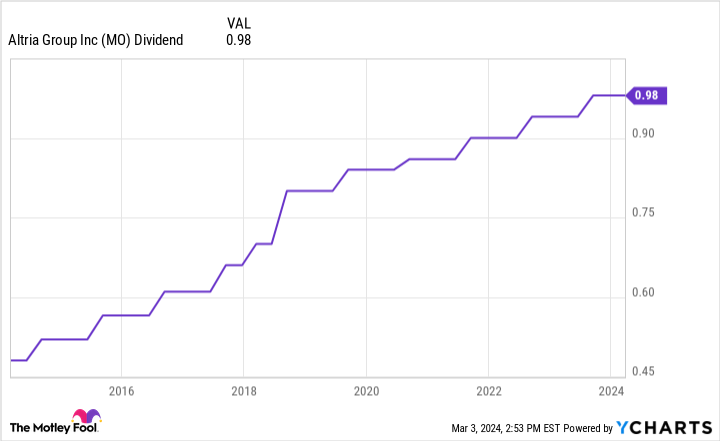

Altria has earned a spot on an exclusive list of Dividend Kings, or companies that have increased their dividends for at least 50 consecutive years. No matter what challenges the company faces, it always puts shareholders first and finds ways to not only continue paying dividends, but increasing them.

10. Verizon Communications: Dividend yield 6.6%

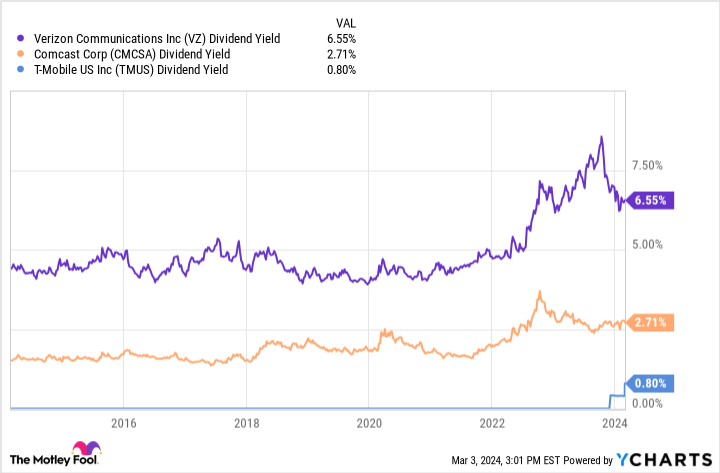

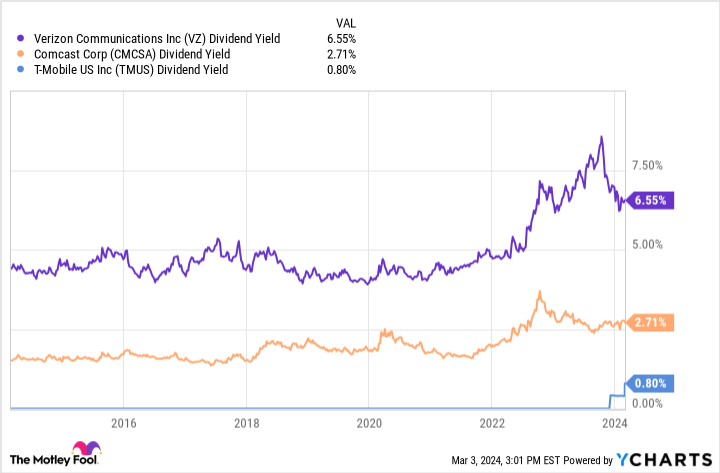

To put it bluntly, carriers verizon (NYSE: VZ) It’s not exactly synonymous with monster growth. The telecommunications industry is becoming increasingly commoditized, with major companies such as: AT&T, T-mobileand comcast They typically offer the same product and compete on price.

But like Altria, what makes Verizon more attractive than its peers is its historically increasing dividend.

In September 2023, Verizon raised its dividend for the 17th consecutive year. In contrast, AT&T cut its dividend several years ago and hasn’t increased it since. Meanwhile, T-Mobile and Comcast’s dividend yields both pale in comparison to Verizon’s.

Verizon may not offer the attractive growth prospects of hot tech stocks, but it’s one of the best when it comes to telecommunications providers. I consider the dividend to be safe, given that the company has increased its dividend every year for about 20 years.

Should you invest $1,000 in Hercules Capital now?

Before buying Hercules Capital stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Hercules Capital wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Adam Spatako has no position in any stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Enbridge, Kinder Morgan, and Vanguard S&P 500 ETFs. The Motley Fool recommends Comcast, Dominion Energy, Enterprise Products Partners, T-Mobile US, and Verizon Communications. The Motley Fool has a disclosure policy.

Top 10 Ultra-High Dividend Stocks to Buy in 2024 by The Motley Fool

[ad_2]

Source link