[ad_1]

After a brutal market decline in 2022, excitement around artificial intelligence (AI) has boosted the economy. Nasdaq CompositeLast year it was up 43%. “Magnificent Seven” stock — Amazon (NASDAQ:AMZN), apple, alphabet, microsoft, Meta, Nvidiaand tesla — contributed much of the market profit.

Microsoft and Alphabet started the AI revolution with splashy investments in startups like ChatGPT developer OpenAI and Anthropic.

Amazon didn’t seem to be moving at the same pace as big tech companies when it came to AI. But over the past year, the company has been quietly expanding into the space, and investors are starting to understand its potential as an AI leader.

Let’s dig into what Amazon is doing and how AI can open up the next growth frontier.

Tea leaves give you energy

Over the past half-century, the Nasdaq has had negative annual returns 14 times. But interestingly, the only two periods in which it has decreased for more than one year in a row are from 1973 to 1974 and from 2000 to 2002.

Since 2001, the Nasdaq index has experienced annual declines of more than 30% three times: in 2002, 2008, and 2022. However, after the market crashes of 2002 and 2008, the index soared in subsequent years. From 2003 to 2007, the index returned an average of 16% per year, ranging from 1.4% to 50%. And in 2009 and 2010, it increased by an average of 30%, increasing by 44% one year and 17% the next.

If history repeats itself, the Nasdaq will rise this year. Will history repeat itself? No one knows.

However, the general idea is that capital markets are resilient and tend to recover relatively quickly, even though no one knows what will happen. Amazon has also been hit hard on the e-commerce front due to declining consumer confidence and on the cloud computing front as companies rein in spending, but there are a number of particularly optimistic views encouraging investors. strategic measures are being taken. Toward a strong build for Nasdaq in 2024.

Amazon’s AI Empire

Amazon made headlines following its investment in Alphabet-backed Anthropic in late 2023. While this may have given the impression that Amazon was catching up with Microsoft and Alphabet, the deal included a number of important features.

First, Anthropic will be using Amazon Web Services (AWS) as its primary cloud provider. Anthropic also plans to use Amazon’s own chips to train future generative AI models. This partnership is important for several reasons.

First, AWS revenue growth has slowed for many quarters. Adding Anthropic to his AWS ecosystem should open the door to countless new AI-powered applications and breathe new life into the cloud computing leader.

The AI semiconductor market is dominated by Nvidia and Advanced Micro Devices at the moment.

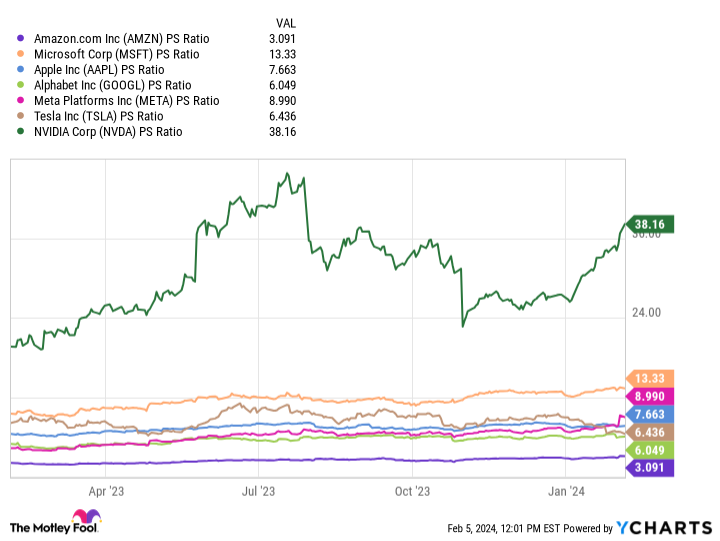

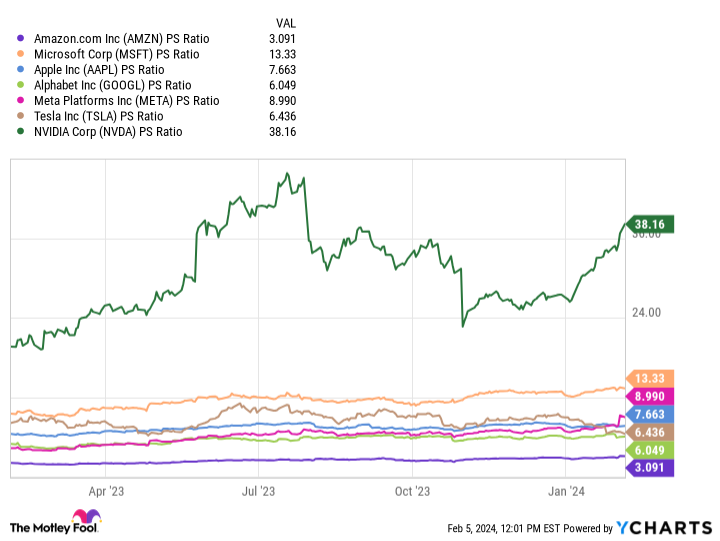

The chart below shows Amazon’s price per sales (P/S) multiple benchmarked against the Magnificent Seven cohort. This metric shows how much investors are paying for a company compared to its sales.

Amazon stock looks great

The company’s P/S of 3.1 is not only the lowest among its big tech competitors, but also flat compared to its 10-year average.

I find Amazon’s flat profit and loss both interesting and perplexing, given how much the company has evolved over the past decade. To me, investors are underestimating the company’s partnership with Anthropic and perhaps thinking it will be too difficult to fend off competition from Microsoft and Alphabet. But I think that’s a mistake.

AWS is entering a new phase of evolution, with AI at its core. As generative AI becomes a focus of IT budgets, I think sooner or later we will see enterprise software spending shift from primarily on-premises applications to more cloud-based protocols.

Amazon’s development of its own chip and deal with Anthropic are important steps to capitalize on this trend. Investors may not yet see rocket-ship growth, but the company’s position in AI shouldn’t be taken lightly. While the long-term outlook looks encouraging, now is an attractive time to start raking in some stocks using dollar-cost averaging.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 5, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Adam Spatacco has held positions at Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

History says the Nasdaq could skyrocket in 2024. Here’s one artificial intelligence (AI) stock that’s poised for growth.Originally published by The Motley Fool

[ad_2]

Source link