[ad_1]

Hong Kong has spent HK$210 million (US$26.9 million) to subsidize issuance costs, contributing to a surge in bond sales linked to green and sustainable projects. Market players are calling for a three-year extension of incentives to match those offered by Singapore.

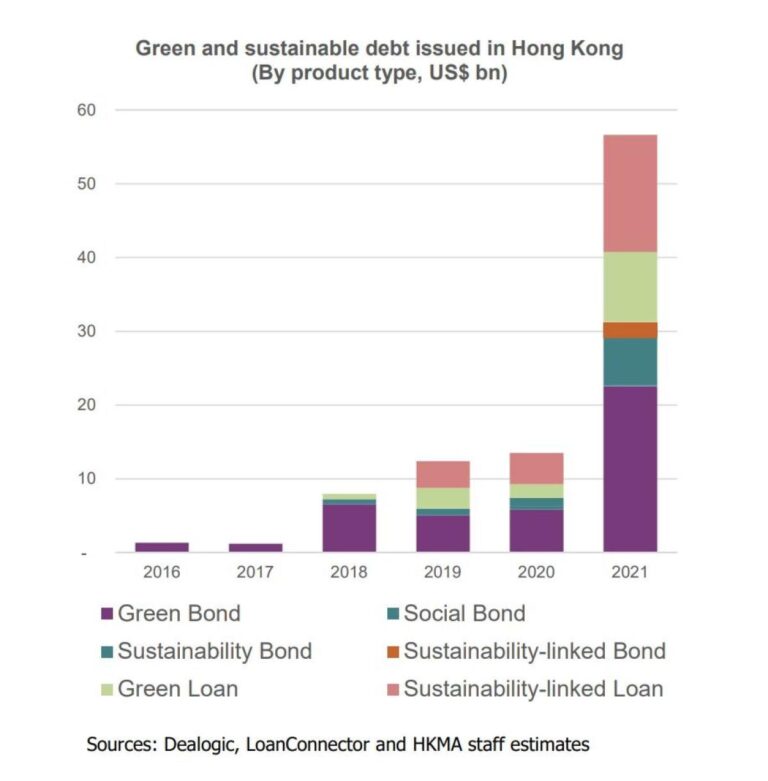

The city has approved more than $100 billion in grants for issuances, including bonds and loans, since the program was introduced in May 2021, according to the Department of Financial Services and the Department of Finance. According to official data, sustainable bond and loan issuance increased by 42% in 2022 to USD 80.5 billion.

BNP Paribas’ mainland China offshore and Hong Kong issuance estimates show that borrowing costs have soared due to successive interest rate hikes in the US since policy lifting in March 2022, and sales have fallen to around US$36 billion in 2023. . Industry experts said the subsidy plan would support an expected rebound in green bond issuance from 2024 onwards, as bets focused on interest rate cuts.

Do you have questions about the biggest topics and trends from around the world? Find your answers with SCMP Knowledge. SCMP Knowledge is a new platform of curated content with explainers, FAQs, analyzes and infographics brought to you by our award-winning team.

“With expectations of a rate cut in 2024 widespread, we hope this scheme will be extended,” said Chaoni Huang, head of Asia Pacific sustainable capital markets at BNP Paribas. “Trillions of dollars are needed to support China’s net-zero goal. Subsidy schemes will be one tool to incentivize markets to do so.”

“Supporting China’s net-zero target will require trillions of dollars, and subsidy schemes will be one of the tools to incentivize markets to do so,” said BNP Paribas’ head of APAC sustainable capital markets. Fang Chaoni says. alt=”Supporting China’s net-zero target will require trillions of dollars, and subsidy schemes will be one of the tools to incentivize markets to do so,” says BNP Paribas’ APAC Sustainable Capital Markets Mr. Fang Chaoni, the person in charge, said. >

Under the scheme, the city government will subsidize 50% of the costs up to a maximum of HK$2.5 million, and external review costs for each debt instrument will be capped at HK$800,000. Approximately HK$210 million was awarded to establish Hong Kong as a major hub for these instruments in the region.

A spokesperson for the agency said: “Once the GSF grant scheme expires, we will review its effectiveness and consider appropriate ways forward.”

Aaron Way, director of sustainable finance for ESG and business and relationship management at Fitch Ratings, said the grant supports issuers in a challenging bond market environment. This momentum should continue, driven by investor appetite and the United Nations’ efforts to help countries transition away from fossil fuels.

He said: “We are observing a continued increase in the adoption of sustainable finance labels in the bond market, both in terms of the number and proportion of labeled bonds.” “This trend is due to strong support from the system and the collaborative efforts of all participants.”

Sustained financial subsidies can play an important role in promoting the growth of Hong Kong’s financial market, thereby strengthening its position as a thriving hub of sustainable finance, Wei added.

Singapore has a similar program that covers the cost of external reviews for green bond issuers and loan borrowers.

Last year, the Monetary Authority of Singapore extended the Sustainable Bonds and Loan Grant Scheme by five years until the end of 2028, increasing the cap from S$100,000 to S$12, provided that eligible issuers comply with internationally recognized disclosure standards. It has been raised to S$5,000 (US$93,051).

Central bank data shows that total issuance of green, social, sustainability, sustainability-linked and transition bonds and loans in Singapore will decline by about 10% to S$32 billion in 2022. Ta.

Both Hong Kong and Singapore are expanding sustainable finance in the region, with the former expected to maintain its position as a ‘super connector’ and the largest venue for Chinese offshore sustainable bond listings. .

“By making significant efforts to harmonize China’s green bonds internationally, Hong Kong will play an even greater role in attracting international capital to green investments in mainland China,” said BNP Paribas’ Fan. Ta.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative news organization on China and Asia for more than a century. For more stories from SCMP, explore the SCMP app or visit SCMP on Facebook. twitter page. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

[ad_2]

Source link