[ad_1]

(Bloomberg) – Hong Kong is being asked to introduce stablecoin rules this quarter, drawing interest from companies such as the international arm of Chinese asset manager giant Harvest Fund Management, people familiar with the matter said. said.

Most Read Articles on Bloomberg

The three companies, Harvest Global Investments, fintech specialist RD Technologies, and Venture Smart Financial Holdings, which aims to create a cryptocurrency exchange-traded fund, are in what is known as a regulatory sandbox, the people said, asking not to be named. The Hong Kong Monetary Authority is reportedly in talks with the Hong Kong Monetary Authority about a stablecoin pilot plan. The meeting is not open to the public.

The HKMA and the Financial Services and Treasury Department began consultations on stablecoin rules last month, saying the sandbox would help inform the regulator’s expectations. There is no guarantee that the next framework will be completed by the end of March, or that everyone who wants to participate in the trial will get the green light, the people said.

Stablecoins are typically pegged 1:1 to fiat currencies and are backed by cash and bond reserves. These account for $136 billion of the $1.7 trillion digital asset market. Blockchain-based tokens facilitate cryptocurrency trading and lending, but some commentators argue that they could be widely used for payments.

strange history

Stablecoins have a history of chaotic crashes and depeggings, and some tokens have been criticized for their opaque reserves. As a result, countries such as the European Union, Japan, Singapore, Hong Kong and Dubai are stepping up efforts to regulate the sector, which is poised to become a hub for digital assets.

A spokesperson for the HKMA said that the HKMA is preparing to launch a stablecoin sandbox and will announce details in due course. Hong Kong-based Harvest Global Investments did not respond to a request for comment.

Venture Smart Financial (VSFG) said it expects the sandbox to launch in the first quarter. Rita Liu, chief operating officer of RD Technologies, said the company will participate pending regulatory approval and aims to launch the HKDR stablecoin for uses such as cross-border payments between companies. He said there was.

“A powerful alternative”

Sean Lee, senior advisor and head of stablecoins at VSFG, said the Hong Kong dollar reference token could be a “strong alternative” to rivals linked to the US dollar, given the city’s developed financial sector. Stated.

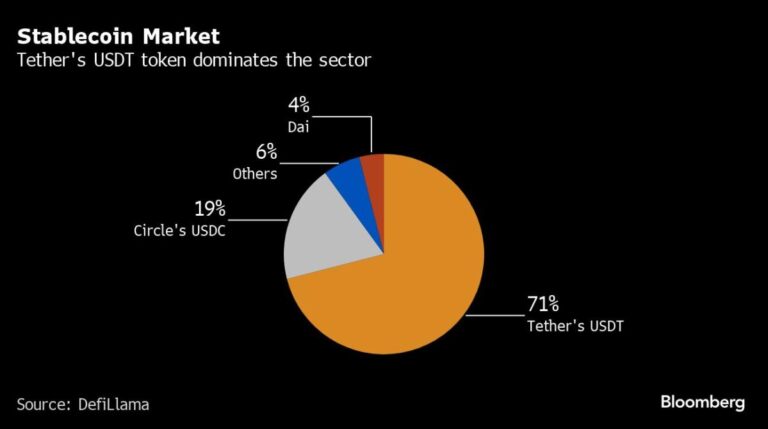

The stablecoin market is currently dominated by Tether Holdings Ltd. and Circle Internet Financial Ltd.’s dollar-pegged tokens USDT and USDC. The sector is infamous for the collapse of stablecoin variant TerraUSD in 2022, which wiped out at least $40 billion, exacerbating the crypto crash and being part of the collapse of the FTX digital asset exchange. It was the cause.

Hong Kong’s virtual asset rulebook, established eight months ago, aims to protect investors from such risks while fostering innovation, raising questions about whether compliance costs will be a hurdle for some companies. is occurring.

–With assistance from Zhang Dingmin.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link