[ad_1]

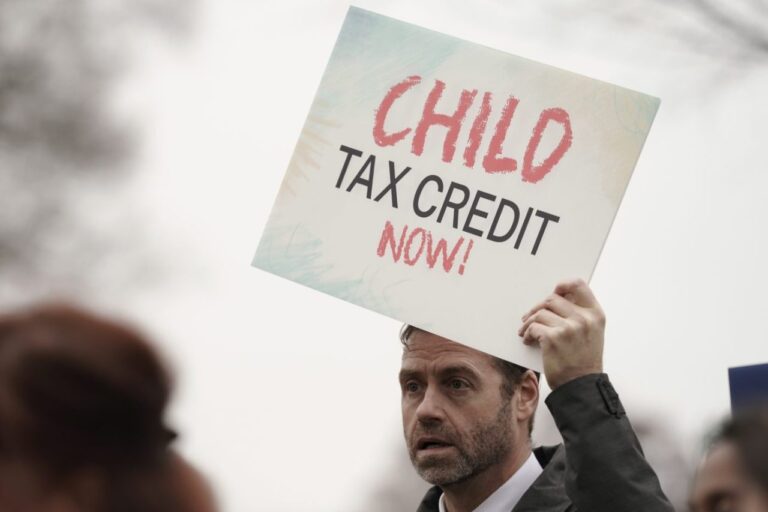

Congress’ top tax officials announced an agreement Tuesday morning that would strengthen the Child Tax Credit (CTC) and reinstate a business deduction stripped away as part of the 2017 Tax Cuts and Jobs Act to pay for lower corporate tax rates.

The CTC expansion would increase the maximum loan amount per child from $1,600 to $2,000 until 2025, while restoring business deductions for research and development expenses, interest payments and capital investments.

The agreement includes increased low-income housing tax credits and carve-out provisions for Taiwanese companies as the U.S. seeks to re-locate some of its high-end semiconductor industry based in the country. is also included.

Tax officials want to eliminate the Job Retention Tax Credit (ERC) to pay for the $80 billion deal. They claim that the ERC is being actively marketed within the tax industry and has become a hub for fraudulent corporate activity.

Ways and Means Committee Chairman Jason Smith (R-Missouri) said in a statement Tuesday morning that “American families need greater tax relief, stronger Main Street businesses, and better competitiveness with China.” will benefit from this bipartisan agreement that will create jobs.” .

Senate Finance Committee Chairman Ron Wyden (D-Ore.) said the proposal could help as many as 15 million children near the poverty line and increase the nation’s low-income housing stock. He said it would be.

“At a time when so many people in Oregon and across the country are struggling with soaring rents and home prices, this plan’s improvements to the Low Income Housing Tax Credit will create 200,000 new affordable housing units. “More than that will be built,” he said. In a statement.

“By encouraging research and development, the plan will also help foster innovation and strengthen economic competitiveness with China.”

Some policy experts welcomed news of the agreement, which emerged in various forms at the end of 2023 and 2022.

“If this proposal takes full effect in 2025, it would lift approximately 500,000 children above the poverty line and alleviate poverty for an additional 5 million children,” the left-wing nonprofit group said. The Center on Budget and Policy Priorities wrote in a paper. analysis.

“This proposal would benefit more than 80% of the 19 million children who receive partial credit or no credit at all because their family income is too low.”

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link