[ad_1]

If you get your annual tax summary from HMRC, you’ll see that 10% of the money the government collects from you goes toward your state pension.

It gives the impression that you, the taxpayer, are saving up a sizable nest egg to protect you in retirement.

The phrase ‘National Insurance Contributions’ (NIC) suggests that this tax goes into a fund that is used to pay the state pension at retirement and to help with benefits if needed.

Unfortunately, anyone who gets that impression is making a big mistake. No money is saved. Taxes and NICs currently paid to HMRC are directly used to pay pensioners who are currently claiming redundancy payments.

Each generation of pensioners depends on the taxes of younger workers, and this is an intergenerational agreement that depends on continued participation.

In the second of a three-part series on the future of the state pension, we look at how the myth of the ‘state pension pot’ has evolved and what it means for the country.

National Insurance is set to generate just over £176 billion in revenue for the government next year. Spending on pensioners (covering the state pension, pension credits, housing benefit for retirees and other support) will total £152 billion.

This would theoretically leave £24bn available for future pension payments. But instead, the money will go toward spending on health care, Social Security, and any other area of the state that needs cash.

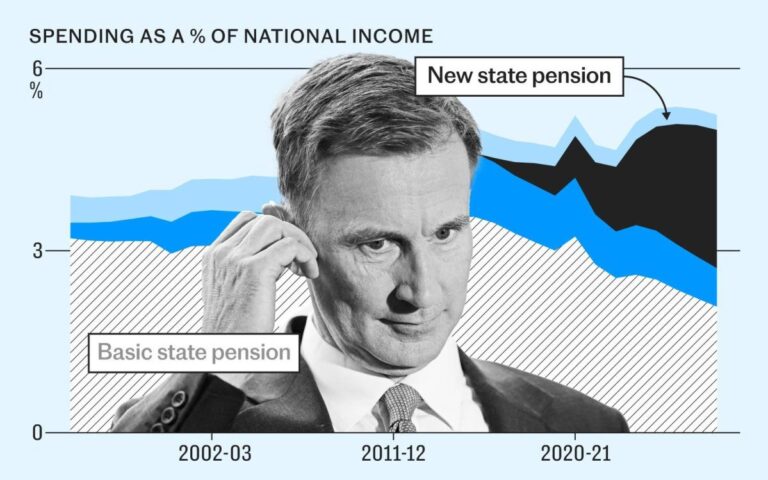

The problem is that there is no real ring-fenced pension pot. The UK’s population is aging, which means an increasing number of pensioners.

Due to the ratchet effect of the triple lock, the national pension has also increased at the same time.

Under the current system, more retirees will rely on the taxes of a relatively small number of workers and demand increasingly generous payments.

In the short term, taxpayers will be squeezed to cover the costs. The Office for Budget Responsibility (OBR) estimates that National Insurance payments will rise to £25bn by 2028-29 as thresholds are frozen during times of high inflation and more workers have to pay tax. It is expected to increase.

Payments to pensioners are expected to rise by around £20bn over the same period, meaning the books will even out.

But how long this arrangement will last politically is an open question.

National Insurance contributions have increased the tax burden to levels not seen since World War II. This issue is becoming more politically toxic day by day.

The strategy of asking current workers to pay for retirees’ pensions risks reaching a breaking point.

The ‘pay-as-you-go’ method of funding the National Pension has been part of the system since it was created in its modern form in 1948.

William Beveridge, a Liberal politician who helped build the welfare state, wanted a different model. He urged workers to pay first before becoming eligible for pension benefits.

But the government was reluctant to tax workers for years before introducing pensions, given the poverty and war-torn state of the country. Instead, it introduced an immediate financial safety net funded by current taxes.

The system details have since changed. Past schemes have included income-based supplementary pensions, which allow people to pay additionally into a higher pension, or for those on low incomes to earn their second state pension. Now you can receive it.

Currently, the new national pension introduced in 2016 is a simple fixed amount system. Those eligible will receive £203.85 per week, with this figure increasing each year in line with the triple lock (inflation, average wage or 2.5% maximum).

Workers must pay National Insurance contributions for 35 years to receive their full pension.

If you earn more than £1,048 a month, your contributions will be automatically deducted from your paycheck.

However, there are other ways to qualify. For example, registering for unemployment benefits while looking for a job also counts toward the 35-year requirement. Similarly, parents who receive child support can also receive the credit. The policy is meant to ensure that people who take time off from work to support their families don’t burn a hole in their retirement savings.

According to the Institute for Fiscal Studies (IFS), the generosity of the current system means that the UK is “rapidly moving towards a state pension system in which most people who live in the UK throughout their adult life receive their full state pension.” ” is said to mean.

IFS’s Jonathan Cribb points out that people who take government-backed training courses can also qualify. This means that the burden on the national pension will increase, even though national insurance income will not increase.

Additionally, there are additional schemes in place to help people who are not receiving their new full state pension to supplement their living costs, such as pension credits and housing benefit. This will be supplemented by benefits for seniors such as winter fuel payments and free bus passes.

All of this is good news for those who are currently retired.

“It’s a good source of basic income, especially for couples, especially if they own their own home,” Cribb says. “He has two full state pensions, so that definitely puts him in poverty.”

However, in terms of funding, this system is not very consistent. For example, the link with National Insurance is inconsistent.

When Chancellor Rishi Sunak increased National Insurance rates in April 2022, pensions and future allowances did not rise. Pensions and future benefits were also not reduced when Prime Minister Kwasi Kwarteng reversed the rise, and when Jeremy Hunt cut taxes further earlier this year.

Meanwhile, those who have completed 35 years of NI contributions will still be charged National Insurance contributions, even though they will no longer help their final pension entitlement.

This contradiction highlights the increasingly unstable position of the national pension system.

Politicians have long recognized that the problem is getting worse, but past attempts to solve it have proven futile.

In 1997, the Conservative Party proposed replacing the ‘pay-as-you-go’ system with a ‘fully-funded’ system. Workers will pay the same tax and national insurance, but part of it will be invested like a private pension pot and expected to grow over time.

But pension reform was not the issue of the day, and Tony Blair’s Labor Party defeated John Major’s Conservative Party in that year’s election. The proposal was left gathering dust.

The Coalition Government took steps to address this issue in 2012 by introducing a car-based private pension.

Unless workers opt out or meet the minimum income threshold, a portion of their earnings will go into a savings plan that will provide them with a pension upon retirement. As a result, the proportion of employees receiving private pensions rose from less than half to almost 80%.

In theory, auto-enrolment pensions should wean future retirees from dependence on the state pension and give the government more scope to reform how pensions are funded and how much they are paid.

However, the huge success of the triple lock introduced by the Coalition government around the same time effectively nullified this opportunity. Successive governments have struggled to do anything other than increase the generous provision of the national pension.

Rishi Sunak plans to maintain a “triple lock” on the state pension even if he wins the next election, the Telegraph revealed this week. It is a sure vote winner, but the question remains of who will pay for these future promises sustainably and how.

Broaden your horizons with award-winning British journalism. Try The Telegraph for free for 3 months. Get unlimited access to award-winning websites, exclusive apps, savings and more.

[ad_2]

Source link