[ad_1]

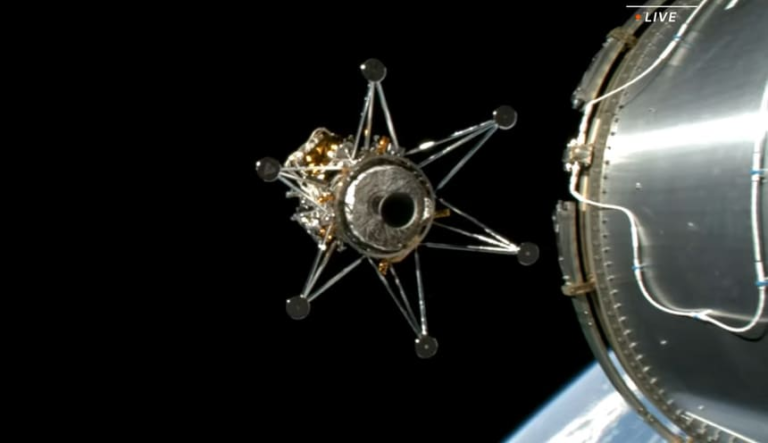

Intuitive Machines’ Nova-C Odysseus lander deploys from the upper stage of SpaceX’s Falcon 9 rocket to begin the IM-1 mission.

NASA TV

Shares of Texas-based Lunar, aptly ticked LUNR, currently trade at about $9 per share, a long way from January’s lows of nearly $2. At one point this week, as IM-1 was passing a milestone ahead of its landing attempt, the stock was trading above $13.

“We have never seen a listed company fall into financial crisis. [a moon landing attempt]. So this is new not only for investors but also for us as analysts,” Cantor Fitzgerald’s Andres Shepherd told CNBC.

“It’s a bit of a trade-off,” Shepherd said, likening Intuitive’s planned landing later Thursday to a biotech company waiting for FDA approval of a new drug.

Shepherd said Intuitive’s stock price could rise to nearly $15 a share if the landing was successful, but warned that a last-minute incident could cause the stock to fall.

And just in case further price increases occur, he said, “As people are getting caught up in the excitement and potential history of the IM-1 moon landing, its valuation has certainly exceeded the company’s financial position.” “There is,” he pointed out.

See chart…

Intuitive Machines stock is trading around its IM-1 moon mission.

Intuitive went public less than a year ago through a SPAC merger, but has traded below its initial price for most of that time. Only a handful of Wall Street analysts cover this billion-dollar space company. Of the companies listed by FactSet as covering Intuitive Machines, all four analysts rate the stock at the same level as a buy, and all four analysts believe the stock is below their pre-launch target price. We have confirmed that it will exceed.

Not only does IM-1 represent a technological and financial advancement for Intuitive Machines, analysts say it marks the first U.S. moon landing in more than 50 years, and the first moon landing by a corporation rather than a government agency. He pointed out his enthusiasm for surface landing. .

“We can see how these applications in space can capture the imagination and vision of investors,” benchmark analyst Josh Sullivan told CNBC. “Hopefully it’s a success. I think it will have an impact.”

Sullivan and Shepherd, along with Canaccord Genuity analyst Austin Mueller, agreed that retail investors, not institutions, are driving Intuitive Machines’ current rally. Shepherd said the firm estimates that about 80% of trades over the past week were made by individual traders.

“There’s a lot of momentum behind this from the retail industry,” Shepherd said.

Sullivan also cited the global coverage of Intuitive’s mission as a factor, which helped the company become more widely known.

“The accumulation of successful milestones [a moon company] is becoming a commercial reality and I think it’s starting to catch on,” Sullivan said.

IM-1 has steadily progressed through 16 milestones outlined by the company prior to its launch. But Intuitive is not only clearing the technical hurdles associated with its first spaceflight, it’s also checking the box to get paid by its biggest customer before attempting to land.

In a presentation on May 31, 2019, leaders from Intuitive Machines and NASA showed off a mockup of the company’s Nova-C lunar lander.

Aubrey Gemignani / NASA

Canaccord’s Moeller said IM-1 has achieved more than 90% of the milestones required for payment under the $118 million contract with NASA. Remaining payout milestones include safely landing and successfully collecting data from research on the spacecraft.

But as Sullivan pointed out, IM-1 doesn’t just get paid for existing contracts.

“It’s really about demonstrating a track record of success in the extremely harsh environment of space, which greatly increases your chances of getting a very large contract when you go to NASA in the future,” Sullivan said. he said.

A key element of NASA’s Commercial Lunar Payload Services (CLPS) program is a competition between companies bidding to deliver cargo on future lunar missions. One of his Intuitive Machines competitors, Astrobotic, had serious problems during its first lunar mission last month and was unable to attempt a landing.

Both companies, as well as others, have already secured contracts with NASA for additional missions. Analysts believe Intuitive’s progress to date will be a key differentiator in future bids.

“Even if the mission is not successful, [in landing], they already have two additional missions under contract. The next rocket is scheduled to launch in the coming months and will be able to leverage the data and learnings from this mission, which has been quite successful so far,” Moller said.

[ad_2]

Source link