[ad_1]

If you want to compound your wealth in the stock market, you can do so by purchasing index funds. However, investors can increase their returns by choosing and owning stocks in companies that are outperforming the market. Ajinomoto (Malaysia) Berhad (KLSE:AJI)’s share price is up 27% over the past year, clearly outperforming the market return of around 12% (not including dividends). By our standards, this is a solid performance. However, the long-term returns have been less impressive, with the stock only up 18% over the past three years.

So let’s do some research and see if the company’s long-term performance is in line with the progress of its underlying business.

Check out our latest analysis for Ajinomoto Berhad Malaysia.

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

Berhad, a subsidiary of Ajinomoto (Malaysia), turned from a deficit to a profit last year.

If a company has just moved into profitability, earnings per share growth isn’t necessarily the best way to watch its share price move.

We’re skeptical that the 0.5% dividend yield will attract buyers to the stock. We think some investors might be interested in the 12% earnings growth. We do see some companies suppressing earnings in order to accelerate revenue growth.

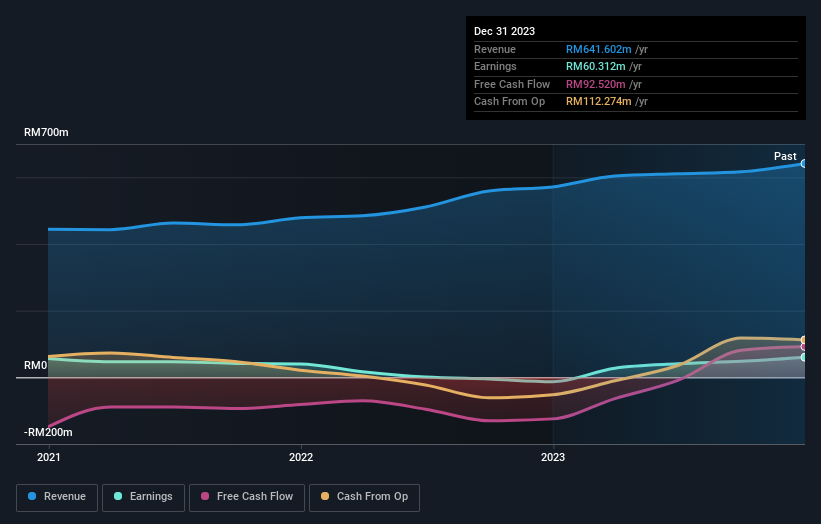

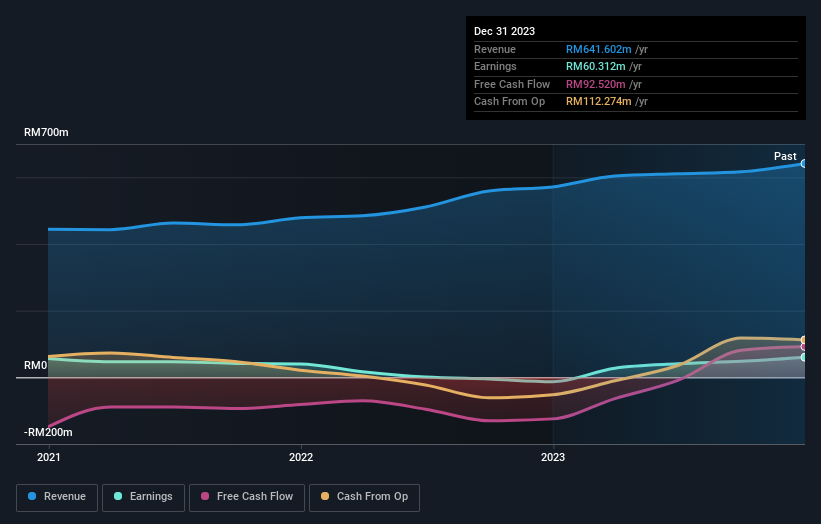

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is important.It might be well worth taking a look at ours free Report how your financial situation has changed over time.

different perspective

It’s good to see that Ajinomoto Malaysia Bhd returned a total return of 27% to shareholders in the over the last twelve months. That includes dividends. This growth rate is better than the five-year annual TSR (3%). So sentiment around the company seems to be positive lately. Optimists might think that the recent improvement in TSR indicates that the business itself is improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, taking risks – Ajinomoto Malaysia’s Berhad 1 warning sign I think you should know.

If you want to check out another company with potentially better financials, don’t miss this free A list of companies that have proven they can grow revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link