[ad_1]

it’s not a secret Nvidia (NASDAQ:NVDA) The company had one of the best years of any stock on the market in 2023. Nvidia’s profits were through the roof as many companies ramped up purchases of class-leading graphics processing units (GPUs) for artificial intelligence (AI) development. That boom isn’t over yet, but stock prices are already reacting to the incredible sales surge.

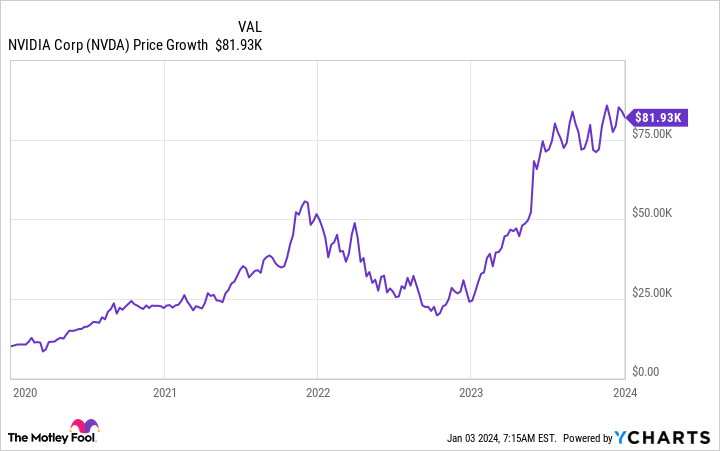

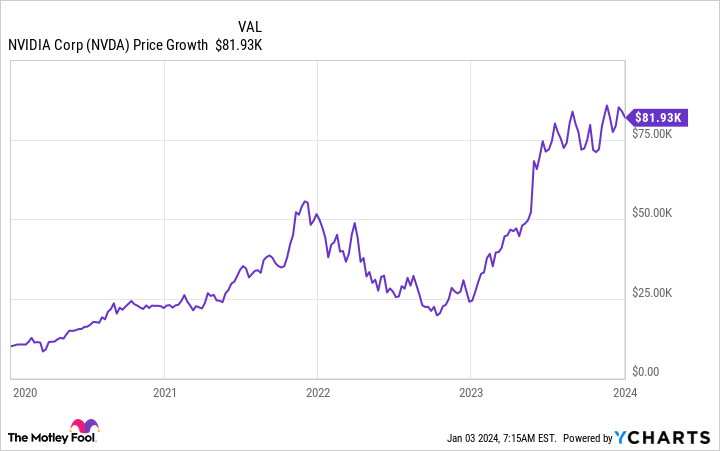

In 2023, the stock price rose nearly 240%. That’s a nice return, but what would have happened if he had held Nvidia a little longer than that, say from 2020? Now, the results and lessons learned might surprise you. .

A $10,000 investment had some ups and downs.

The first thing to understand about Nvidia’s business is that it’s cyclical. Its GPUs are used to run challenging workloads such as gaming graphics, engineering simulations, drug discovery, cryptocurrency mining, and AI model creation. When consumers have money to spare and businesses are willing to invest in computing power, business booms.

Before the AI gold rush, the last two Nvidia booms were fueled by crypto miners. Mining digital currency uses GPUs, so many people bought thousands of the company’s chips to perform this task. This led to a surge in sales in 2018 and his 2021.

But the problem with booms is that they usually come with crashes, and that’s exactly what happened with Nvidia.

When the crypto market collapsed in 2019 and 2022, demand for GPUs evaporated and the company posted multiple consecutive quarters of declining revenue. Before the AI race took off, Nvidia was still dealing with declining GPU sales, but the blow AI brought quickly reversed its fortunes.

So if you think about how much you would have made if you had invested $10,000 in Nvidia at the beginning of 2020, you’ve been through quite the roller coaster.

In late 2021 (the height of many tech stocks and crypto markets), Nvidia turned a $10,000 investment into more than $50,000. But that amount dropped to about $20,000 in just a few months. In 2023, AI causes the stock price to rise significantly, turning his original $10,000 into his incredible $82,000.

Nvidia’s historical cyclicality is a factor for investors to consider

There are two important lessons about Nvidia stock that can be gleaned from this what-if exercise.

-

We are a circular company. Most of its sales are not subscription-based, so today’s impressive revenue may not seem so incredible by next year. As a result, investors need to consider how much demand the AI market can support. Once this limit is reached, expect sales to decline and inventory to plummet.

-

You have to buy companies and hold them for the long term. Many investors likely sold when NVIDIA stock crashed in 2022. It was still up from its 2020 investment price, but not as much as it would have been if it had just held the stock through the difficult times.

So what should investors do with Nvidia stock now? In my opinion, if you don’t currently own Nvidia stock, it might not be the best time to establish a position due to the high valuation. I don’t know.

However, this could be a terrible decision if Nvidia’s GPU market is much larger than I expected. Therefore, taking a smaller position (less than 1% of your portfolio) may not be a bad idea.

If you’ve held Nvidia stock this long, its recent performance may mean it’s an important part of your portfolio. Stocks are expensive and (what many investors may forget) are still cyclical, so it’s smart to take some profits here.

Nvidia stock has gone through several boom and bust cycles. I don’t know when the next bust will come, but I think it’s wise to prepare in case it comes soon.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of December 18, 2023

Keithen Drury has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool has a disclosure policy.

“How Much Would You Get Today If You Invested $10,000 in Nvidia in 2020” was originally published by The Motley Fool

[ad_2]

Source link