[ad_1]

If there is one company listed on Wall Street that represents the ups and downs of the Chinese economy, it is Alibaba (New York Stock Exchange: Baba). You may be ready to buy into Alibaba stock now, especially if you’re optimistic that China will turn the corner this year. In the very long term, I’m bullish on BABA stock, but today I urge caution as a make-or-break event is on the horizon.

Alibaba is basically the Chinese equivalent of America’s Amazon (NASDAQ:AMZN). Like Amazon in the United States, Alibaba is a Chinese e-commerce giant that has also found success in niche markets outside of e-commerce.

China is perhaps on the verge of an economic recovery of epic proportions. It’s hard to know for sure. Nevertheless, if Alibaba releases positive numbers and provides reassuring guidance in its upcoming earnings report, a bull market in BABA stock could become virtually impossible.

Is Alibaba stock too cheap to ignore?

First and foremost, I have to mention some eyebrow-raising comments made by a reputable analyst firm. Specifically, Barclays (New York Stock Exchange:BCS) Analysts reportedly went so far as to declare that Alibaba stock was “too cheap to ignore.”

Admittedly, it’s hard to argue with the “cheap” moniker. Last year, while US technology stocks soared, BABA stock fell like a sinking ship. So, if you truly believe in buying low and selling high, investing in Alibaba should make perfect sense.

Applying traditional evaluation metrics seems to support this point. Alibaba’s 12-month GAAP P/E ratio of 10.6x is certainly more attractive than the sector median of 17.51x.

Barclays analyst Jing Xiao also weighed in on Alibaba’s valuation. Xiao called Alibaba’s valuation “the most compelling” after seeing that the company generated $27 billion in free cash flow over the past 12 months. Additionally, Hsiao believes that BABA stock “selects as one of the world’s most undervalued major tech stocks,” and assigned an overweight rating to the stock.

If this isn’t enough motivation, here’s another piece of news worth mentioning. Apparently, some serious insider buying is happening at Alibaba. In particular, Alibaba co-founder Jack Ma reportedly bought $50 million worth of shares in the company.

Not only that, Alibaba’s chairman reportedly bought $151 million worth of BABA stock in the fourth quarter of last year. This is a sure sign of the confidence of his two Alibaba insiders who have deep knowledge of Alibaba.

Traders are excited about Alibaba, but be careful now

You’re excited about the rise in Chinese tech stocks, but does that mean you should invest in Alibaba right now? That’s not always the case, as waiting may be the wisest policy.

This excitement is not limited to Alibaba, but applies to Chinese companies in general. The move comes as the People’s Bank of China plans to add $139 billion worth of long-term liquidity to the country’s economy by lowering banks’ cash reserve requirements. Additionally, Chinese authorities are reportedly considering a massive $278 billion bailout, bailout, and stabilization package.

As a result, stock traders have recently gobbled up shares in Alibaba and other China-linked tech stocks. Therefore, in the short term, one could argue that the Chinese central bank’s strong measures have been successful.

On the other hand, it would be premature to simply declare victory and think Chinese stocks will continue to rise throughout the year. Government intervention in the economy and markets is not always the ideal solution to a stock market crash. For example, you may remember when Chinese authorities restricted short selling to support the domestic stock market. This tactic did not work in the long run.

It remains to be seen whether Beijing’s intervention will be successful in supporting the country’s economy and markets. Indeed, some would argue that the U.S. stock market has benefited every time the Federal Reserve injects liquidity into the banking system. So perhaps this strategy will work in China and have a positive impact for Alibaba.

That being said, now is probably not the ideal time to jump into BABA stock right away. Alibaba is due to report its all-important financial results on January 31st. It would be a huge shame if the company breaks its impressive track record of consistently beating EPS estimates.

The stakes are high and so are the expectations. Wall Street expects Alibaba to report her fiscal third quarter 2024 EPS of $2.73. This is higher than any quarterly EPS forecast in Alibaba’s recent history. Could there be a big disappointment in store?

Is BABA stock a buy, according to analysts?

At TipRanks, BABA is rated as a Strong Buy based on 18 buy ratings and 2 hold ratings assigned by analysts over the past three months. Alibaba’s average price target is $118.60, suggesting % upside potential.

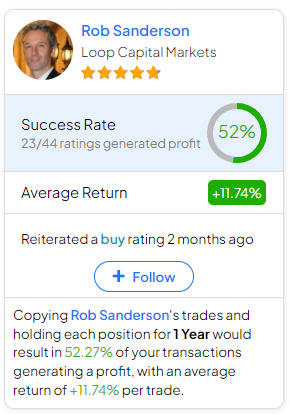

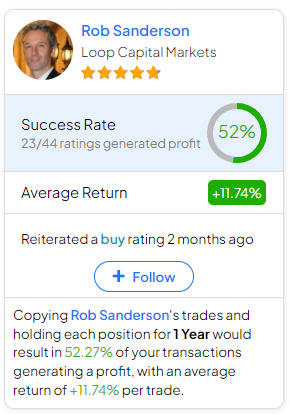

If you’re wondering which analyst to follow if you want to buy or sell BABA stock, the most profitable analyst covering the stock (over a 1-year period) is Rob Sanderson of Loop Capital Markets. The average return is 11.74%. Per rating, his success rate is 52%. Click on the image below for more information.

Bottom line: Should you consider BABA stock?

I’m bullish on Alibaba’s growth prospects, but only in the very long term. For now, there is uncertainty regarding Chinese intervention and Alibaba’s impending financial results. Therefore, we feel that waiting a little longer is a wise policy. Even though Alibaba could make a grand comeback in 2024, I’m not ready to consider an equity position in BABA stock at this time.

disclosure

[ad_2]

Source link