[ad_1]

Whether you’re a casual investor or someone who trades professionally, you’re probably aware of the artificial intelligence (AI) boom that started last year. OpenAI’s announcement of his ChatGPT reignited interest in the technology, prompting countless technology companies to pivot their businesses toward high-growth sectors.

As a result, the AI market is expected to expand at a compound annual growth rate of 37% until 2030, reaching just under $2 trillion. This industry is rapidly expanding, making it one of the best places to make long-term investments.

Two stocks currently leading the way in the AI space are: Advanced Micro Devices (NASDAQ: AMD) and Nvidia (NASDAQ:NVDA), whose recent stock prices have increased 149% and 257% year-over-year, respectively. These companies are prominent chip manufacturers that supply the hardware needed to train and run AI models. As the market develops, the company’s stock price may rise further in the coming years.

So let’s compare the businesses of these companies and decide whether AMD or Nvidia is the better AI stock this March.

Advanced Micro Devices

Last year, AMD was slightly overshadowed by Nvidia’s lead in AI chips, as Nvidia captured an estimated 80-95% market share in AI graphics processing units (GPUs).

But the industry’s huge potential suggests that AMD doesn’t need to unseat Nvidia to reap significant benefits from AI. So even though AMD has spent years prioritizing its position in central processing units (CPUs), it has shifted its focus to developing GPU technology and expanding in the emerging AI market.

Last December, the company announced the MI300X AI GPU. The chip is designed to compete directly with Nvidia’s products and has already attracted the attention of the technology industry’s most prominent players.

In November 2023, Microsoft announced that Azure would be the first cloud platform to use AMD’s MI300X to optimize AI capabilities. Microsoft has a close partnership with his ChatGPT developer OpenAI, making the company a strong ally for AMD. The deal with Meta, which also aims to use new chips, also helps brighten AMD’s future in AI.

Additionally, AMD isn’t just looking to steal market share from Nvidia in GPUs. AMD is looking to lead its own way in the AI space by investing in AI-powered PCs. According to research firm IDC, PC shipments are expected to increase significantly this year, with AI integration acting as a key catalyst. Additionally, a report from Canalys predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

Nvidia

Nvidia captivated Wall Street last year when its chips became the gold standard for AI developers around the world.

Nvidia’s revenue soared as demand for AI GPUs soared. The company’s revenue for the fourth quarter of 2024 (ending in January) increased 265% year over year to $22 billion. Meanwhile, operating profit rose 983% to nearly $14 billion. This impressive growth was primarily due to his 409% increase in data center revenue, which reflected increased chip sales.

In addition to surging revenue, NVIDIA’s free cash flow increased 430% last year to more than $27 billion, significantly more than AMD’s $1 billion.

So even as competitors release new GPUs, Nvidia’s lead in AI gives it even more cash reserves to continue investing in technology and maintain its market dominance. Further progress is possible.

Nvidia has a strong position in the AI space and is unlikely to disappear anytime soon. Thanks to its huge success in the AI field, the company’s market capitalization exceeded $2 trillion this year. AMD’s market capitalization is significantly lower at approximately $327 billion. However, this could mean AMD has more room to maneuver in the long run, as it is still in the early stages of its AI journey.

Which is a better AI stock: AMD or Nvidia?

AI has the potential to power countless industries, from cloud computing to consumer products, self-driving cars, video games, and more. With so many sectors prioritizing power generation technology, chip demand is likely to continue increasing for some time.

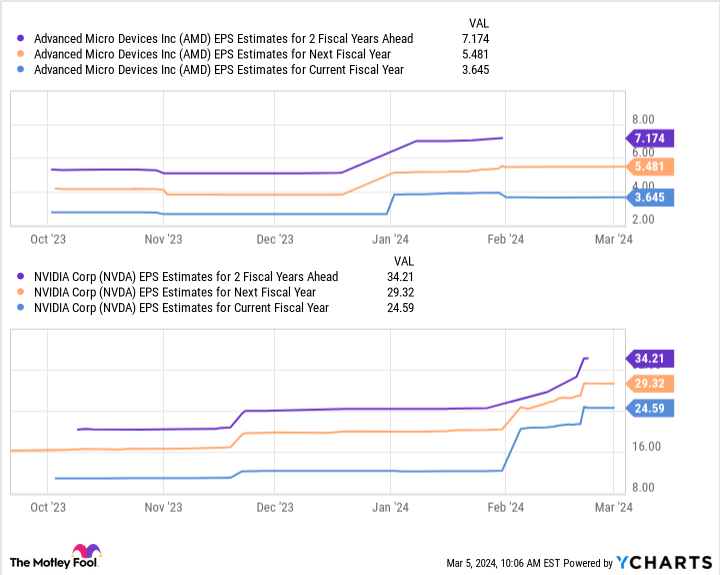

As a result, AMD and Nvidia are two attractive options for investing in AI. However, earnings per share (EPS) estimates indicate that AMD has even stronger growth potential in the near term.

This chart shows that AMD’s earnings could reach just over $7 per share over the next two fiscal years, while Nvidia’s earnings could reach $34 per share. On the surface, Nvidia appears to be the clear winner. However, if you multiply these numbers by both companies’ expected price-to-earnings ratios (AMD 56, Nvidia 35), you get a stock price of $403 for AMD and $1,197 for Nvidia.

Considering both companies’ current positions, these forecasts would see AMD’s stock price rise 99% and Nvidia’s stock price 41% by 2026.

In addition to having significant investments in AI and potentially more room to run, AMD is a better AI stock than Nvidia and has been a screaming buy this month.

Where to invest $1,000 right now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Advanced Micro Devices made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Dani Cook has no position in any stocks mentioned. The Motley Fool has a position in and recommends Advanced Micro Devices and his Nvidia. The Motley Fool has a disclosure policy.

The first edition of Improving AI Stocks: AMD vs. Nvidia was published by The Motley Fool

[ad_2]

Source link