[ad_1]

Some investors rely on dividends to grow their wealth. If you’re one of those dividend experts, you might want to know the following: Barrel Royalty Income Fund (TSE:KEG.UN) goes ex-dividend in two days. The ex-dividend date will be one day before the record date. The record date is the date on which a shareholder must appear on the company’s books in order to receive the dividend. When buying or selling stocks, the ex-dividend date is important because it takes at least two business days for the trade to settle. In other words, an investor can purchase Keg Royalties Income Fund shares until March 20th in order to receive the dividend, which will be paid on March 29th.

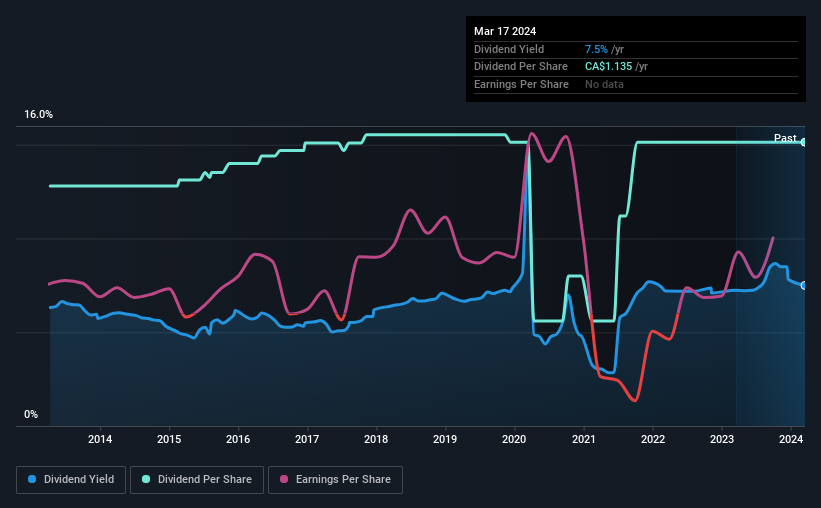

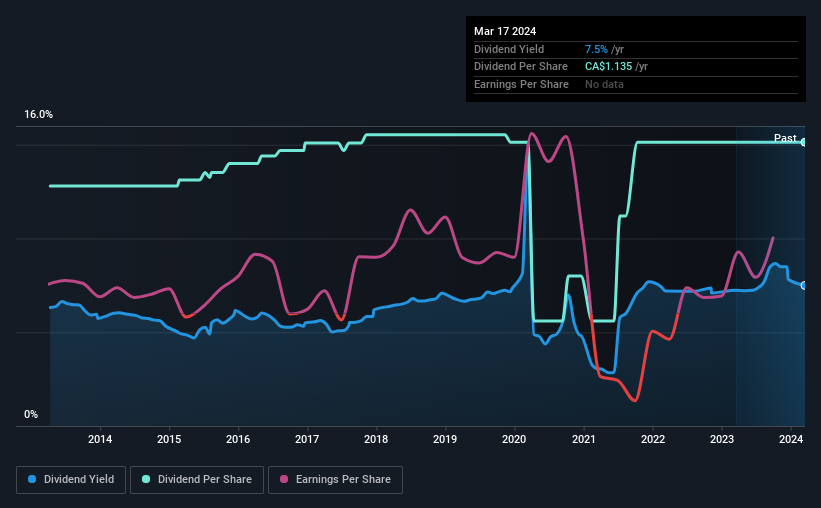

The company’s next dividend payment will be CA$0.0946 per share, following last year’s total distribution of CA$1.14 to shareholders. Based on the last year’s worth of payments, Keg Royalty Income Fund stock has a yield of approximately 7.5% on the current share price of CA$15.14. We love to see companies pay dividends, but it’s also important to make sure our golden goose doesn’t die by laying golden eggs. We need to see if the dividend is covered by profit and if it’s growing.

Check out our latest analysis for Keg Royalty Income Fund.

Dividends are usually paid out of a company’s profits. If a company pays more in dividends than it earned in profit, then the dividend might become unsustainable. Keg Royalties Income Fund paid out 56% of its income to investors last year. This is the normal payout level for most businesses. But cash flow is more important than profit for assessing a dividend, so we need to see if the company generated enough cash to pay its dividend. It distributed 47% of its free cash flow as dividends, which is a comfortable dividend level for most companies.

It’s reassuring to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don’t drop precipitously.

Click here to see how much profit Keg Royalties Income Fund paid out in the last 12 months.

Are profits and dividends growing?

Companies with consistently growing earnings per share usually make the best dividend stocks, as it is easier to grow dividends per share. If profits decline and the company is forced to cut its dividend, investors could see the value of their investments explode. With that in mind, we’re encouraged by the steady growth of Keg Royalties Income Fund, which has seen earnings per share increase by an average of 6.0% over the past five years. The healthy growth of his earnings per share in the past suggests that Keg Royalties Income Fund has effectively grown value for shareholders. However, it currently pays out more than half of its profits as dividends. If management raises the payout ratio further, we would view this as an implicit signal that the company’s growth prospects are slowing.

The main way most investors assess a company’s dividend prospects is by looking at its historical dividend growth rate. Keg Royalties Income Fund has an average annual dividend increase of 1.7% per year, based on the past 10 years of dividend payments.

final point

Is Keg Royalties Income Fund worth buying for its dividend? With modest earnings per share growth, Keg Royalties Income Fund paid out more than half of its profits and less than half of its free cash flow, but which… The dividend payout ratio is also within the normal range. In summary, although it has some positive characteristics, we are not inclined to rush to buy Keg Royalty Income Fund today.

With that in mind, while Keg Royalty Income Fund has an attractive dividend, it’s worth knowing the risks associated with this stock. To solve this, we discovered the following: 2 warning signs for Keg Royalty Income Fund What you need to know before investing in stocks.

Generally speaking, we don’t recommend just buying the first dividend stock you see.Here it is A curated list of interesting stocks with strong dividends.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link