[ad_1]

- Earnings per share: Adjusted 54 cents, expected 45 cents.

- revenue: $15.4 billion vs. $15.15 billion expected

For the first quarter of fiscal 2024, Intel expects earnings of 13 cents per share on revenue of $12.2 billion to $13.2 billion, while LSEG expects earnings of 13 cents per share on revenue of $14.15 billion. is expected to be 33 cents.

Intel had net income of $2.7 billion, or 63 cents per share, compared with a net loss of $700 million, or 16 cents per share, last year.

Intel reported a 10% increase in fourth-quarter revenue from $14.04 billion in the year-ago period, marking the company’s seventh straight quarter of revenue declines. Intel’s gross margin was 40%, down 2.6 points for the year.

Intel’s stock price has risen more than 74% over the past year. The company is the largest chip maker by revenue, but its market capitalization is lower than Nvidia and AMD on Wall Street, according to market research firm Gartner.

Big-spending cloud providers and big tech companies are paying attention to the AI boom, which explains Nvidia’s recent outperformance. Once upon a time, the most important part of a server was the central processor made by Intel. AI servers can now connect up to eight Nvidia or AMD graphics processing units (GPUs) to one or two Intel CPUs.

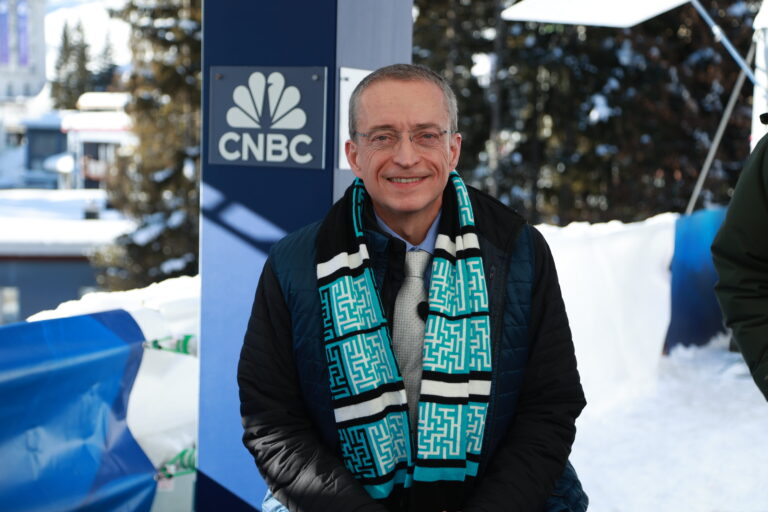

Intel also remains focused on the five-year plan executed by Chief Executive Officer Pat Gelsinger, who took over the chipmaker in 2021. Intel wants to catch up with Taiwan Semiconductor Manufacturing Co. in its ability to provide manufacturing services to other companies, while also improving its own technological capabilities. Own brand chips.

“This quarter capped a year of significant progress in Intel’s transformation,” Gelsinger said in a statement.

Intel has been cutting costs by cutting jobs and offloading smaller parts of its business. The company announced last year that it would spin off its programmable chip unit after turning its self-driving car subsidiary Mobileye into an independent company in 2022. Intel CFO David Zinsner said in a statement that Intel cut costs by $3 billion last year. .

Intel’s largest division is its client computing group, which includes laptop and PC processor chips. The PC industry as a whole has been in the doldrums for two years, but has recently begun to show signs of growth again. Intel reported that fourth quarter revenue was $8.8 billion, an increase of 33%.

Revenue from Data Center and AI, Intel’s second-largest division, fell 10% to $4 billion. This unit contains the server’s CPU and GPU. Intel’s Network & Edge division, which sells components for carriers and networking, reported sales of $1.5 billion, down 24% from a year ago.

Intel Foundry Services, which makes chips for other companies, is still in its infancy, with sales of $291 million and growth of 63% annually.

Intel announced that it paid a dividend of $3.1 billion in 2023.

[ad_2]

Source link