[ad_1]

Chief Accounting Officer James Namkung sold 1,182 shares of Intercontinental Exchange (NYSE:ICE) stock on February 8, 2024, according to a recent SEC filing. Over the past year, insiders have sold a total of 3,431 shares of company stock, but bought no shares.

Intercontinental Exchange Inc operates regulated exchanges, clearinghouses, and financial and commodity market listing venues in the United States, United Kingdom, European Union, Singapore, Israel, and Canada. The company provides data services to commodity and financial markets, as well as mortgage technology and services.

Intercontinental Exchange’s insider trading history shows that there have been more insider sales than purchases over the past year, with 28 insider sales and no insider purchases recorded.

InterContinental Exchange’s stock was trading at $132.03 on the latest insider sale, giving the company a market cap of $77.58 billion. His price-to-earnings ratio of 32.34 exceeded both the industry median of 19.26 and the company’s historical median price-to-earnings ratio.

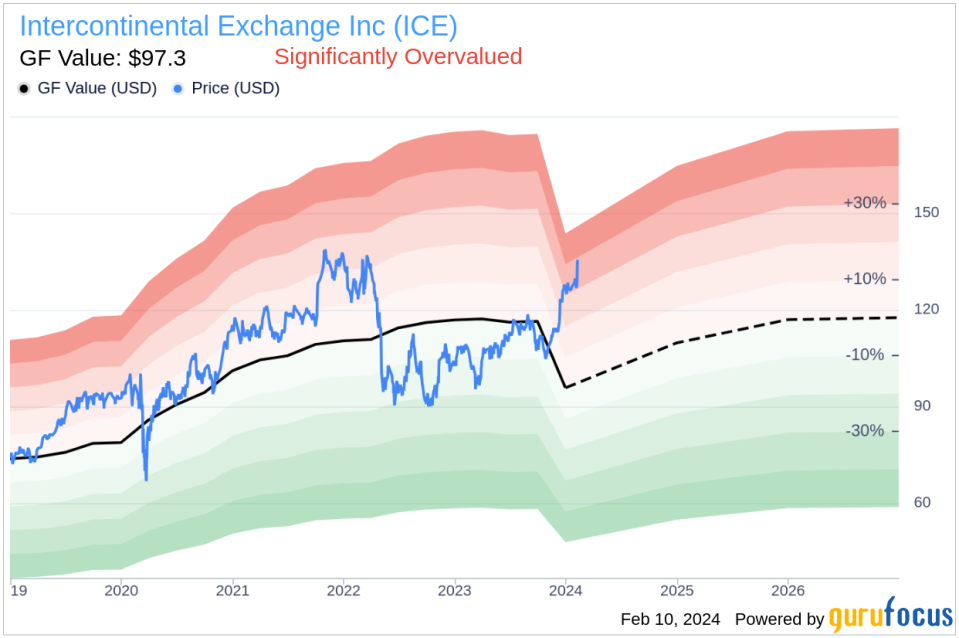

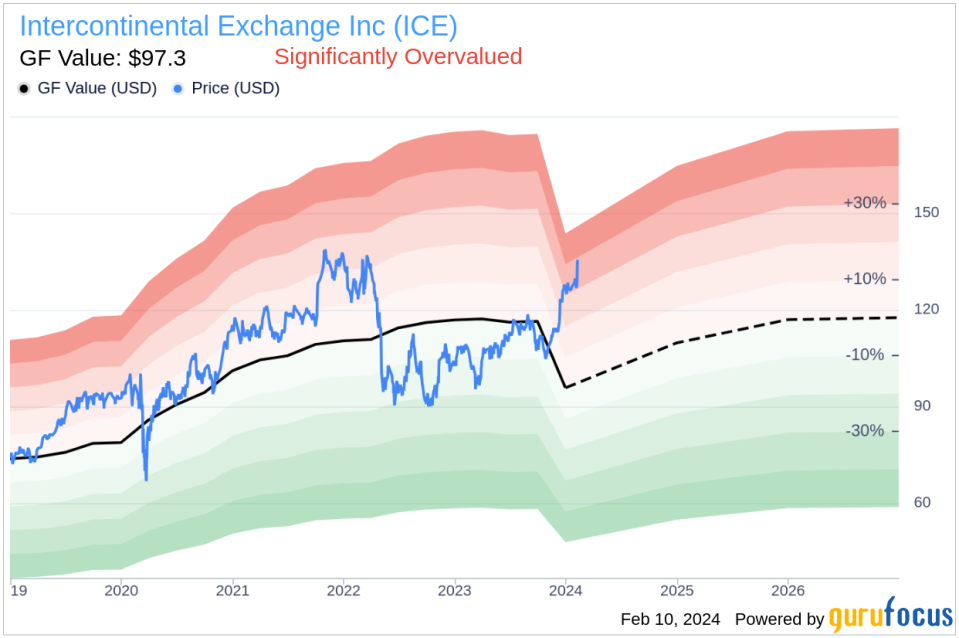

The Price to GF Value ratio of 1.36 and GF Value of $97.30 indicate that Intercontinental Exchange Inc. is significantly overvalued according to GuruFocus’ valuation model. GF Value is determined by historical trading multiples, GuruFocus adjustment factors based on past earnings and growth, and Morningstar analyst forecasts of future performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link