[ad_1]

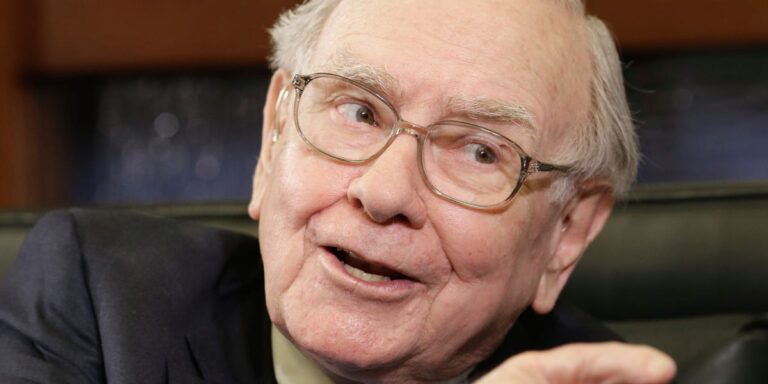

- Warren Buffett released his annual letter to Berkshire Hathaway shareholders on Saturday.

- In the letter, Centi Billionaire offered some investment advice.

- He says he plays the long game and ignores experts who offer financial projections.

Warren Buffett released his annual letter to Berkshire Hathaway shareholders on Saturday, offering nuanced investment advice to readers looking to grow their wealth like centibillionaires. I have it.

Buffett has written a letter every year since 1965, analyzing the holding company’s investment performance and offering his views on financial trends and pitfalls.

The Wall Street Journal has also given him years of advice, including warning investors about high-growth companies, which he calls “the worst kind of business,” and dissecting fear and greed. The Wall Street Journal pointed out in an analysis of each letter. , the inevitable “super-epidemic” that plagues the investment community. Buffett suggested in 1987 that smart investors should try to reverse the two, saying, “We seek to fear only when others are greedy, and only when others are afraid.” Just trying to be greedy.”

Here’s what Buffett suggested to investors in this year’s letter:

Always ignore the experts

Mr. Buffett began by praising his sister Bertie, saying that although she is by no means an expert in economics or prepared for the CPA exam, she is very well read and understands a lot of accounting terminology. I am. Her intuition formed his first important piece of advice.

He writes: “She is wise— very Wise — Instinctively knows what experts should do. everytime It will be ignored.After all, if she If we could reliably predict tomorrow’s winners, would we be able to freely share our valuable insights and increase competitive buying? It’s like passing it to . ”

If you find a great business, be patient

Buffett then details Berkshire’s successful examples of “long-term fractional ownership” investing: American Express and Coca-Cola, which began operations in 1850 and 1886, respectively.

Berkshire Hathaway invested heavily in Coca-Cola in 1988 and in American Express in 2001, but Buffett said that even though the companies sometimes failed in their attempts to expand or were mismanaged, However, he pointed out that it has remained untouched for decades since then.

“The lesson from Coke and Amex? When you find a really great business, stick with it,” Buffett wrote. ”patience Money will be paid, and one great business can make up for the many mediocre decisions that are inevitable. ”

Don’t risk losing your capital forever

Mr. Buffett went on to say that the stock market has become increasingly like a casino, ignoring his long-term investment strategy, and that “frenzied activity” has brought out the ignorant and the malicious. He said that he is exposed to the temptation every day to transfer his holdings to other companies. of woodwork.

He writes: “At such times, any foolish thing can be sold. intention It is vigorously promoted, always by someone, but not by everyone. ”

He points out that if people don’t get fooled by stupid marketing, things will get ugly and the average investor may walk away “embarrassed, poorer, and sometimes vengeful.”

“One of Berkshire’s investment rules has remained the same: I never have There is a risk of permanent loss of capital. Thanks to America’s tailwinds and the power of compound interest, the field in which we operate has been and continues to be challenging. if you make some good decisions in your lifetime and Avoid major mistakes. ”

[ad_2]

Source link