[ad_1]

Rapidly rising average temperatures and frequent extreme weather events make it difficult to rethink efforts towards a low-carbon future. But as Julian Bishop, co-portfolio manager at Brunner Investment Trusts, points out, the transition away from fossil fuels is an “unprecedented, decades-long restructuring of the entire global economy.”

And with politicians facing many conflicting pressures, there is certainly no guarantee of a smooth journey. For example, the UK government has extended the ban on new cars with internal combustion engines by five years. Meanwhile, in Germany, the Building Energy Act was “a bit disappointing in terms of the timeline for phasing out fossil fuel boilers,” said Fotis Cha, co-portfolio manager at Impax Environmental Markets Investment Trust (IEM). Tsimichalakis says.

Unforeseen crises can also divert political attention and throw competing short-term priorities aside. A typical example is the soaring energy prices caused by Russia’s war with Ukraine. In that case, the disproportionate impact of rising energy bills on low-income households in the UK could see energy security issues return to the table as Chancellor Rishi Sunak announces plans for further investment in domestic oil and gas extraction. Became.

But what do these short-term policy shifts mean for investors? Should we reconsider our focus on renewable energy, or aim to capitalize on new fossil fuel developments?

Mike Fox, head of sustainable investing at Royal London Asset Management, said this disruption to the clean energy transition would create “a short-term crisis for investors in an industry previously expected to decline more rapidly.” “It creates new opportunities and may actually give them more time.” Those industries will transition. ” He points to traditional car manufacturing.

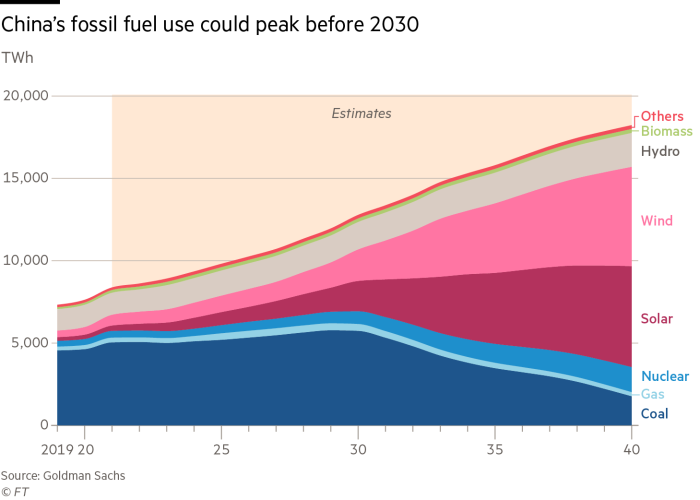

However, the long-term trend away from fossil fuels remains unabated.

Ed Simpson, head of energy and infrastructure at Gravis Capital Management, argues: “Hydrocarbons will be needed for many years to come, both for power generation and as feedstock for the chemical industry, but the science shows we need to move away from them. .We capture carbon dioxide that still needs to be burned. This means we don’t need to use fossil fuels in energy and transport in the long term.”

As a result, supporting expensive new fossil fuel facilities represents a risky investment proposition based on the expectation that a return will be made before the asset becomes obsolete and “stuck.”

In fact, industry leaders themselves are keen to follow the general direction of travel. When the UK government postponed the ban date for internal combustion engines, the car industry largely stuck to its electrification plans and stressed the importance of policy consistency.

Given the length of time required to develop a new product, Simpson said, “manufacturers will be forced to buy EVs on the assumption that consumers will demand EVs for cost, efficiency and environmental reasons, regardless of government targets.” is continuing its plans for electric vehicles anyway.”

At the same time, there are compelling arguments for investment in the macro and ‘micro’ infrastructure required for a successful transition to renewable energy.

Kate Elliott, head of sustainable research at Greenbank Investments, says many green technologies are already the same cost as high-carbon alternatives, and in some cases cheaper, making them doubly attractive. He claims that it is a proposal.

“The opportunities go beyond what many think of as ‘green’ investments…covering areas such as upgrading energy transmission networks to accommodate greater electrification; making energy systems smarter; “Deployment of connected systems that enable comprehensive monitoring and management; and energy efficiency measures in the housing stock,” she explains.

One of the recent investments added to the IEM portfolio is Prysmian, a company that manufactures electrical cables and fiber optics. Power grid upgrades are needed not only to meet increasing electricity demand, but also to address intermittency in energy generation and deliver renewable power from where it is produced to where it is needed.

But returns from direct investments in renewable energy themselves have been disappointing in recent years, Bishop said. Although the cost of energy production itself is decreasing, challenges such as the intermittency of solar and wind power and surplus energy storage remain.

Battery storage is attracting investors, but it’s not necessarily the best solution. “Battery manufacturing is a capital-intensive primary industry that has its own environmental impacts,” Fox says.

Bishop agrees. Currently, the best and most cost-effective way to store excess energy is through pumped hydropower, he says. Excess energy “is used to pump water up the hill.” [into a reservoir] It is then flowed back to power a hydroelectric generator, allowing it to release energy as needed.

As well as reducing gas emissions, SSE, the energy company favored by both executives, is investing heavily in a hydropower scheme in Scotland’s Coyle Grass.

At Gravis, Simpson supports diversification as an effective response to the challenges of unreliable renewable energy. As well as solar and wind power, asset managers are also exposed to anaerobic digestion (generating energy from methane produced from waste) and ‘waste-to-energy’ schemes.

Such an approach also increases your bottom line. “If we are technology and geography agnostic, we can buy the best assets anywhere,” Simpson explains.

However, asset managers have shown limited enthusiasm for nuclear energy solutions. At IEM, Chatsimikalakis declined to make a statement, insisting that the economic and environmental costs of nuclear power plants still outweigh the benefits of solar and wind power. “Technology like small modular [nuclear] For the past 40 years, nuclear reactors have been “10 years away,” he said.

Other executives agree that while investing in new nuclear power plants may be an important aspect of the world’s greener landscape, the British public remains unconvinced. They believe there are more popular, lower risk and cheaper opportunities elsewhere.

Nevertheless, Bishop accepts that it is impossible to generalize. “In France, reactor design has been standardized and costs have been kept down, making nuclear power a cheap and important part of the energy mix,” he points out. And, more importantly, China, which is responsible for more than 30 percent of the world’s carbon emissions, is also now embracing the nuclear option to reduce its climate impact.

[ad_2]

Source link