[ad_1]

Important points

- Deutsche Bank analysts say the rise of elite tech stocks has made the S&P 500 the most concentrated it has been in at least a century, creating risks and spillover effects for other assets.

- Among fund managers surveyed by Bank of America, 61% said the Long Magnificent Seven was currently their busiest trade.

- Given their high valuations, one could liken the current tech-stock euphoria to the dot-com bubble of 1999-2000, but today’s situation is very different.

Investors are rushing into stocks of the Magnificent Seven, an elite group of major technology companies, on hopes for growth in artificial intelligence (AI)-related businesses, sending stocks soaring and falling behind major indexes. has reached an all-time high. Supports ongoing profits.

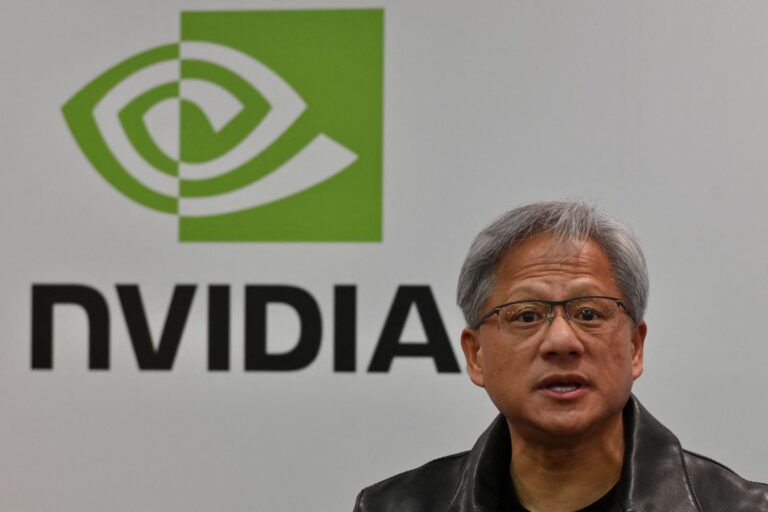

However, investors in “Mag 7” members Alphabet (GOOGL, GOOG), Amazon (AMZN), Apple (AAPL), Meta Platform (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) interest is rapidly increasing. ) Not without risks.

Deutsche Bank analysts led by Jim Reid wrote: “Mag7’s rise puts the S&P 500 at its most concentrated level in at least the past 100 years. “This is probably the first time since the 1929 bubble,” he said. I wrote in my research notes on Tuesday. “In turn, their future performance is likely to influence, to some extent or significantly, a large portion of the world’s assets in the years to come.”

deutsche bank

Is there a price for perfection?

While the AI boom, network effects and U.S. government incentives could further boost Magnificent Seven stocks, Deutsche Bank analysts say potential headwinds include increased regulation of big tech companies and AI in general. They cite increased public scrutiny as well as geopolitical factors.

“Furthermore, no one has any idea how AI will develop or who will win,” Deutsche Bank said in the report. “Technology changes rapidly over time. The current high valuation assumes Mag 7 will always win.”

That seems to be the conventional wisdom for now. According to Bank of America’s latest Global Fund Manager Survey, also released on Tuesday, 61% of fund managers say their most crowded trade is currently the “Long Magnificent Seven,” followed by “Short China Stocks.” ” is considered to be 25%. Allocations to tech stocks are at their highest level since August 2020, according to the survey.

It’s different from the dot com bubble.

The current euphoria in tech stocks has been likened to the dot-com bubble of 1999-2000, but the current situation is very different, according to the Mann Institute.

“Markets aren’t just valuing unproven business models, as they were during the tech bubble,” the institute said in a note Tuesday. It is driven by a proven business model that generates “With significant capital spending and the acceleration of artificial intelligence (AI) algorithms, there is sufficient momentum to suggest a solid foundation for current and (likely future) valuations to drive real economic growth.”

Shares of all members of the Magnificent Seven fell on Tuesday. This is in line with a broader market decline prompted by data showing that U.S. inflation in January did not slow as much as economists expected, and optimism that the Federal Reserve could start cutting interest rates. views have weakened. soon.

Nevertheless, with the exception of Tesla (down 12%), the stock prices of each member of the group have registered significant increases over the past year. The biggest gainer was Nvidia stock, which had tripled in the past year through Tuesday’s close, with Meta stock up 156%. Amazon’s stock price rose nearly 70%, Alphabet and Microsoft each rose about 50%, and Apple about 20%.

[ad_2]

Source link