[ad_1]

The main purpose of stock selection is to find stocks that beat the market. But even the best stock picker can only win if: Several choice. Some shareholders may have doubts about investing in the company at this point. Cromwell European Real Estate Investment Trust (SGX:CWBU), since its share price has fallen 46% over the past five years.

With that in mind, it’s worth checking whether a company’s underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

See our latest analysis for Cromwell European Real Estate Investment Trust.

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

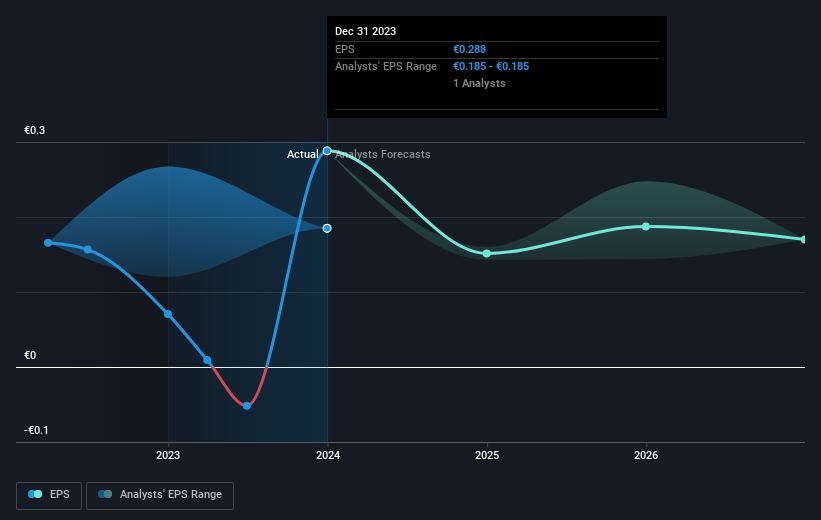

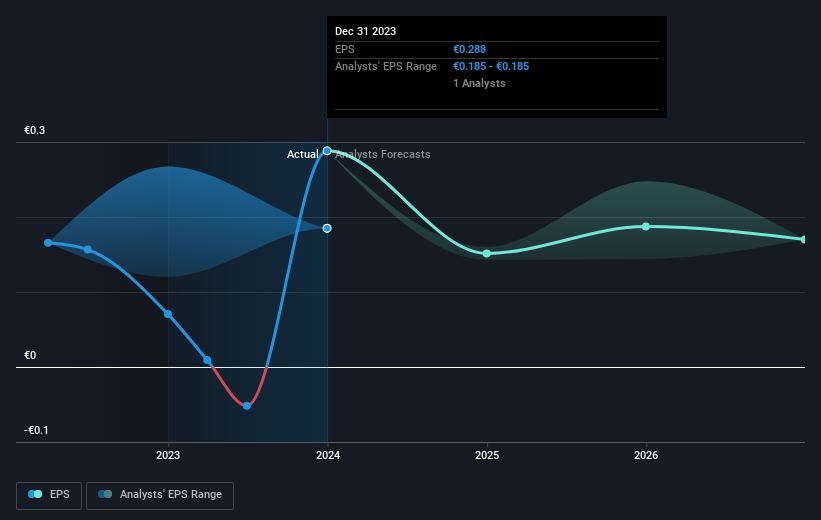

Over a five-year period when the share price fell, Cromwell European Real Estate Investment Trust’s earnings per share (EPS) decreased by 4.1% each year. Readers should note that the stock price has fallen faster than his EPS over this period, at a rate of 12% per year. This means that the market has become more cautious about this business lately. The low P/E ratio of 4.61 further reflects this reluctance.

The company’s earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

We know that Cromwell European Real Estate Investment Trust has improved its earnings lately, but will its earnings grow? Why not check this out? free A report showing analyst revenue forecasts.

What will happen to the dividend?

It’s important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that Cromwell European Real Estate Investment Trust’s TSR over the last 5 years was -17%, which is better than the share price return mentioned above. And there’s no kudos to speculating that dividend payments are the main explanation for the divergence.

different perspective

Cromwell European Real Estate Investment Trust shareholders lost 5.0% for the year (including dividends), while the market itself rose 1.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the 3% annualized loss over the past five years. Generally speaking, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. It’s always interesting to track stock performance over the long term. But to better understand Cromwell European Real Estate Investment Trust, you need to consider many other factors. for that purpose, 4 warning signs We found Cromwell European Real Estate Investment Trust (including two that are a little concerning).

However, please note: Cromwell European Real Estate Investment Trust may not be the best stock to buy.So take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singapore exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link