[ad_1]

Stay informed with free updates

Just sign up for Indian business and finance myFT Digest — delivered straight to your inbox.

A surge in India’s stock market is fueling a rush for initial public offerings (IPOs), but some investors are starting to worry about the poor performance of many of Mumbai’s listed stocks.

Investors and analysts say a positive outlook for India’s economic growth, improving corporate earnings and strong demand from foreign investors are providing tailwinds for deals, Dealogic data shows. 21 deals totaling approximately $678 million ($17 million in the same period last year).

More listings are expected, with a total of 66 companies filing listing documents with Indian regulators, according to brokerage firm IIFL.

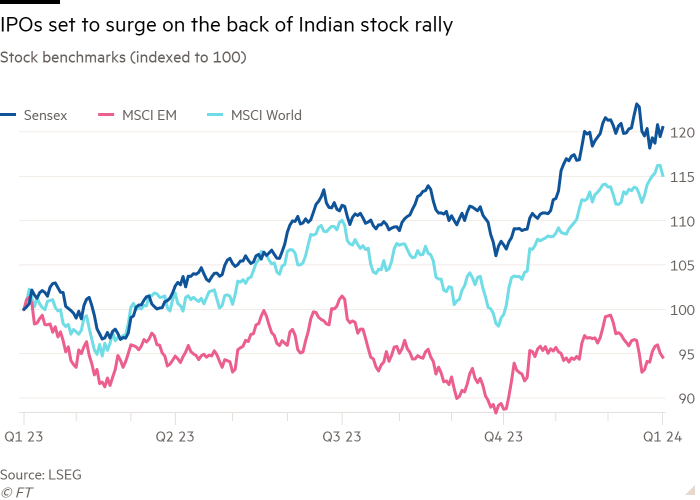

But analysts warn that India’s benchmark Sensex index has risen 20% in the past 12 months, pushing the country’s stock valuations to historic levels.

“In the short term, we expect the strong trend of IPOs to continue in India,” said Kunal Bora, head of India equity research at BNP Paribas, pointing to strong fundamentals and growth forecasts for next year. “The only remaining concern is the valuation issue.”

Expected deals include Ola Electric, which is expected to be one of India’s biggest IPOs in the last two years, and fintech group Mobicwick.

India’s IPO market rebounded last year, with stock prices recovering from little progress since late 2021 on the back of strong corporate earnings and growing enthusiasm from domestic and international investors. Many foreign investors were fleeing the steep decline in the Chinese market and were looking for attractive growth opportunities.

This newfound enthusiasm has pushed the market capitalization of stocks listed in India to around $4 trillion, overtaking Hong Kong to become the world’s seventh-largest market. Last year, Indian IPOs raised about $8 billion.

“The potential for Indian companies to go public and raise capital is huge but remains untapped,” said Nirmal Jain, founder of IIFL. On the other hand, “the older generation [of company founders] He was very conservative and wanted to keep information private. . . A new generation has arrived. ”

India has become one of the world’s fastest growing economies, with the economy expected to grow by 7% this year.

According to Société Générale, India has been the biggest beneficiary of concerns over China’s economy and geopolitical tensions with the West, with foreign investors pumping more than $8 billion into Chinese stocks in 2023. By comparison, it poured more than $20 billion into Indian stocks.

The country’s biggest listed companies are benefiting from Prime Minister Narendra Modi’s focus on infrastructure and digitalisation, with the government announcing on Thursday an increase in public spending in the Budget ahead of this year’s elections.

The digitalization drive has attracted millions of new retail investors to India, increasing the total number of trading accounts in India to a record close to 140 million by the end of 2023.

However, analysts at SocGen cautioned that Indian stocks are far more valuable than Chinese stocks, and that “the relative strength argument is fading a little.”

A return analysis of debut stock sales in Mumbai in recent years also highlights the poor performance of many Indian IPOs, which could lead to domestic and global investors eventually losing appetite for such listings. It could mean that.

Demand for IPO shares of companies listed in India since the beginning of 2021 exceeded available supply by an average of 44 times, and these shares soared by nearly a quarter on the first day of trading, according to a recent report from Investment Co. He continues to do so. YK2 PARTNERS LIMITED.

But the company says two-thirds of these listings lag the broader market, and Indian IPOs “may make sense for investors seeking initial public offerings (IPOs).” “No, but it doesn’t make sense for long-term investors.”

Among the most prominent examples is Paytm. Paytm was one of the first generation of technology startups to go public in 2021 and is currently trading at Rs 609 per share, about 70 per cent below its IPO price.

Paytm shares plunged on Thursday after the Reserve Bank of India ordered its payments banks to stop accepting deposits and providing banking services, cutting off a key growth area for the fintech group. RBI cited “continued violations and . . . supervisory concerns”. The company said it was complying with the order.

Concerns over the performance of IPOs have led some institutional investors in India to question the wisdom of participating in initial public offerings. Ramdeo Agrawal, chairman of Indian financial group Motilal Oswal, said his mutual fund will largely avoid IPOs this year and will instead raise money from companies already trading on public markets because of the greater financial transparency. He said he would give priority to

“If you’re serious about buying, you can avoid an IPO,” he said. “People apply for IPOs and expect big hits. . . . We’re playing an investment game, not a speculation game.”

[ad_2]

Source link