[ad_1]

Howard Marks said that instead of worrying about stock price fluctuations, “the possibility of permanent loss is the risk I worry about…and every practicing investor I know worries about that.” He expressed it well. So when you think about the risk of a particular stock, it might be obvious that you need to consider debt. Because too much debt can sink a company.Like many other companies Avantar Co., Ltd. (NYSE:AVTR) uses debt. But should shareholders be worried about its use of debt?

When is debt a problem?

Debt and other liabilities become a risk to a company if it cannot easily meet those obligations through free cash flow or by raising capital at an attractive price. In the worst case scenario, a company may go bankrupt if it is unable to pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, resulting in permanent shareholder dilution. Of course, many companies use debt to fund growth, and there are no negative consequences. When investigating debt levels, we first consider both cash and debt levels together.

Check out our latest analysis for Avantor

What is Avantar’s net debt?

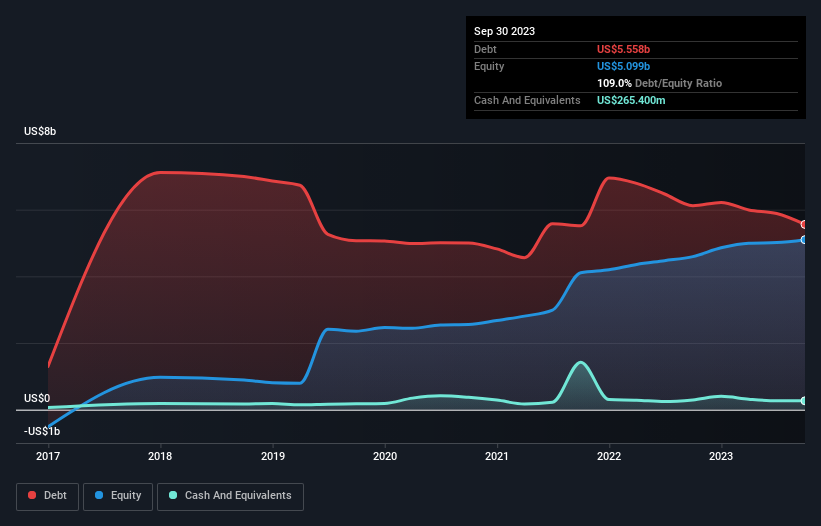

You can click on the image below for more information, but at the end of September 2023, Avantor had debt of US$5.56b, down from US$6.12b over one year. On the other hand, the company has his cash of US$265.4m, making its net debt around US$5.29b.

Avantor Debt Overview

According to its last reported balance sheet, Avantor had debt of US$1.49 billion due within 12 months, and debt of US$6.21 billion due beyond 12 months. did. On the other hand, it had cash of US$265.4m and receivables worth US$1.15b that were due within a year. So it has liabilities of US$6.28b more than its cash and short-term receivables, combined.

While this may seem like a lot, it’s not such a bad thing since Avantor has a hefty market capitalization of US$15.7b, so it could potentially strengthen its balance sheet by raising capital if needed. . However, it is clear that we need to take a close look at whether debt can be managed without dilution.

We use two main ratios to determine debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), and the second is how much earnings before interest and tax (EBIT) covers interest expense (or interest cover, for short). It’s about how many times you cover it. . The advantage of this approach is that it takes into account both the absolute amount of debt (net debt to EBITDA) and the actual interest expense associated with that debt (interest cover ratio).

Avantar’s debt-to-EBITDA ratio is 3.9, with EBIT covering interest expense 3.3 times. This suggests that debt levels are significant, but not problematic. To make matters worse, Avantor’s EBIT was down 21% over last year. If earnings continue at this rate over the long term, the chances of paying off the debt will increase as a result of a snowball effect. When analyzing debt levels, the balance sheet is the obvious place to start. However, what will determine Avantar’s ability to maintain a healthy balance sheet going forward is future earnings, more than anything else. So if you want to see what the experts think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while tax preparers may adore accounting profits, lenders only accept cold hard cash. So it’s clear that we need to check whether that EBIT is leading to corresponding free cash flow. Over the past three years, Avantor has generated solid free cash flow representing 75% of his EBIT. This is about as expected. This free cash flow puts the company in a good position to pay down debt as needed.

our view

Although Avantor’s EBIT growth rate was materially negative in this analysis, other factors we considered significantly improved this growth rate. For example, converting EBIT to free cash flow was refreshing. Considering all the factors discussed, it seems like Avantor is taking some risk by using debt. So while that leverage will certainly improve return on equity, we don’t really want it to increase from here. The balance sheet is clearly the area to focus on when analyzing debt. Ultimately, however, any company can contain risks that exist outside the balance sheet. We’ve identified 3 warning signs for you Avantor (at least one has serious potential) and understanding them should be part of your investment process.

Of course, if you’re the type of investor who prefers buying stocks without taking on debt, then don’t hesitate and discover our exclusive list of net cash growth stocks today.

Valuation is complex, but we help make it simple.

Please check it out Avantar Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link