[ad_1]

In a shortened week of trading, Disney’s DIS Barclays BCS made headlines on Monday after its stock hit a 52-week high following an analyst upgrade..

Cost-cutting efforts paid off, and Disney reinstated its dividend late last year after deferring payments during the pandemic.

Investor sentiment for Disney stocks is high again, with DIS soaring +3% today and poised to rise +31% in 2024, outperforming many of its peers in the Zacks Media Conglomerates industry, including Paramount Global PARAA. There is. and Madison Square Garden Entertainment MSGE.

Image source: Zacks Investment Research

barclays upgrade

Barclays upgraded Disney shares from equal weight to overweight. This is based on the premise that the multimedia conglomerate is likely to see positive earnings revisions to support its valuation, given its outperformance so far this year.

Most recently, it beat fiscal first-quarter earnings estimates in early February, and Disney’s first-quarter EPS of $1.22 beat the Zacks Consensus of $0.97 per share by 26% and beat the comparable quarter’s $0.99 per share. It rose sharply from the dollar.

Image source: Zacks Investment Research

Barclays raised its price target for DIS from $95 to $135, implying a 13% upside from the current $119 per share level. Barclays, which is not named as one of 24 brokers covering Disney stock and providing proprietary data to Zacks, has already surpassed the Zacks average price target of $112.81. It is worth noting that.

Image source: Zacks Investment Research

Regarding revisions to performance forecasts

Notably, the Zacks Media Conglomerates industry is currently in the top 27% of over 250 Zacks industries, with Disney joining Paramount Global and Madison Square Garden in positive earnings estimate revisions. I’m starting to receive it.

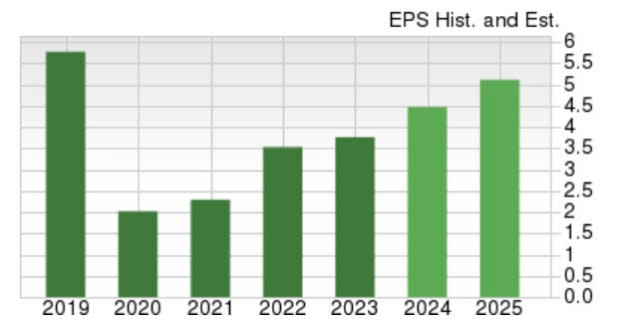

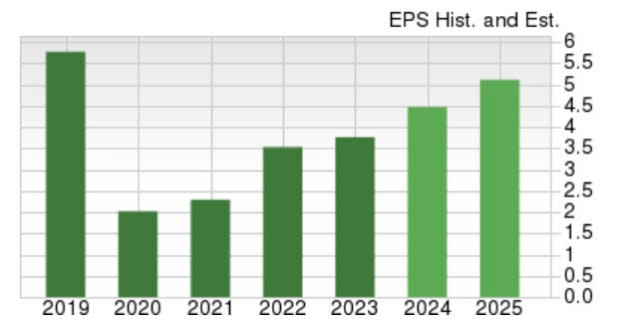

While not as convincing as Paramount Global’s or Madison Square Garden’s recent upward revisions, Disney’s 2024 EPS estimate has risen 4% over the past 60 days, while its 2025 EPS estimate has risen 2%.

Image source: Zacks Investment Research

Additionally, Disney’s earnings are expected to expand 21% this year and rise another 19% to $5.47 per share in FY25.

Image source: Zacks Investment Research

Evaluation and cost reduction efforts

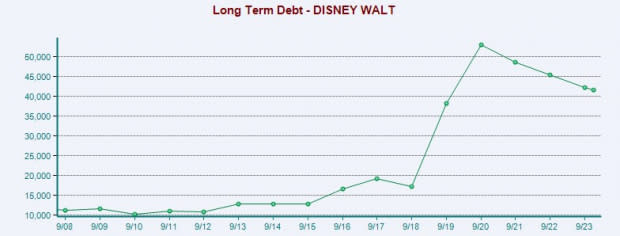

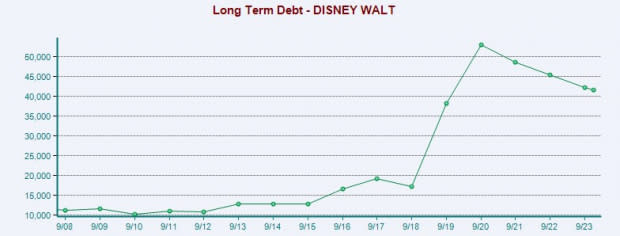

Cost-cutting efforts have paid off since CEO Bob Iger returned in 2022, with Disney’s long-term debt at $42.1 billion, compared to a peak of $52.91 billion in 2020. decreased to

Image source: Zacks Investment Research

Regarding rising earnings estimates supporting Disney’s P/E valuation, DIS is trading at 25.3x forward earnings, well below its 10-year high of 134.3x and the median price of 21x. Close to. However, Disney’s stock trades at a premium of 22.5 times the industry average and 22 times the S&P 500.

Image source: Zacks Investment Research

Re-distribution dividend

Taking advantage of Disney’s return to dividends, the company will pay a semi-annual dividend of $0.45 per share, 50% higher than the initial post-pandemic $0.30 per share in early January, following strong first-quarter results. Become. The ex-dividend date is July 5th and the payment date is July 25th.

Image source: Zacks Investment Research

remove

The turnaround in Disney stock has been quite impressive, with DIS stock currently sporting a Zacks Rank #3 (Hold) after a strong year-to-date rally. That said, there may be better buying opportunities down the road, but long-term investors could still benefit.

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

The Walt Disney Company (DIS): Free Stock Analysis Report

Barclays PLC (BCS): Free Stock Analysis Report

Madison Square Garden Entertainment Corp. (MSGE): Free Stock Analysis Report

Paramount Global (PARAA): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

[ad_2]

Source link