[ad_1]

apple (NASDAQ:AAPL) made headlines last week with its most significant product launch in nearly a decade. On February 2, the company released the Apple Vision Pro, a virtual/augmented reality (VR/AR) headset, or as Apple describes it, a “spatial computer.”

This new product features the same chip found in the MacBook Air, enabling the Vision Pro to perform everyday computing tasks such as web browsing, word processing, video editing, and various entertainment tasks. It will be.

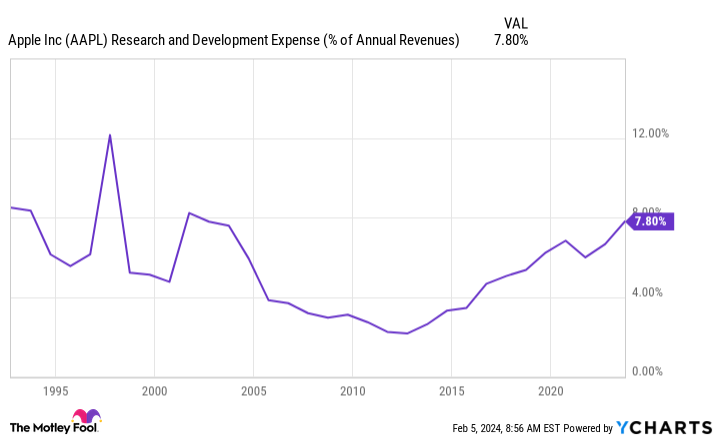

It remains to be seen how successful this headset will be, but this chart shows that Apple currently devotes about 8% of its annual revenue to research and development. The last time this number was high was when the technology company was gearing up to launch its first iPhone. So whatever the company has in store now could have big implications for Apple over the next decade.

The company faced some challenges last year, but with its large cash reserves and strong brand, I have confidence in its long-term success.

Here’s why it’s never too late to buy Apple stock.

Overcoming difficult market conditions

The past year hasn’t been easy for Apple. In 2023, macroeconomic headwinds caught up with the company, leading to four consecutive quarters of declining revenue.

Apple’s most recent quarter finally broke that streak, with Q1 2024 revenue increasing 2% year over year to $120 billion. The company beat Wall Street expectations by more than $1 billion.

But the better-than-expected results weren’t enough to allay investor concerns about the iPhone business, with the company’s stock price down 3% since the beginning of the year. Smartphone sales increased by 6% in the first quarter of 2024, but fell by 13% in China. The East Asian country has tightened regulations on the iPhone, threatening business from Apple’s third-largest market. China accounts for approximately 17% of the company’s sales.

Sales in China are unlikely to improve anytime soon, or perhaps forever, due to the rise of rivals such as: xiaomi And Huawei. But while growth in other regions could offset losses in China in the long run, the company is gradually restructuring its business to become less dependent on the iPhone. In the first quarter of 2024, product sales in Europe, Apple’s second largest market, recorded a 10% year-over-year revenue increase. Meanwhile, sales in Japan soared 15%.

Additionally, despite recent setbacks, Apple’s free cash flow rose 10% last year to about $107 billion, and slowing sales in China haven’t had as much of a negative impact as the company’s stock price decline might suggest. It shows. Furthermore, it is The company has the capital to overcome current headwinds and continue investing in other high-growth technology areas.

Apple’s outlook is solid, but the stock may require patience

Apple’s research and development expenses reached just under $8 billion last quarter. It’s unclear what the company’s roadmap will look like over the next 10 years. However, market trends and the launch of the Vision Pro headset suggest that it will include further forays into artificial intelligence (AI), VR/AR, and digital services. Consistent growth in these areas could help Apple reduce its dependence on product sales and, more importantly, the iPhone in the long run.

The AI market itself is expected to grow at a compound annual growth rate (CAGR) of 37% through 2030, reaching over $1 trillion. Meanwhile, according to Fortune Business Insights data, the VR market is expected to grow at a CAGR of 31% over the same period. Apple is well positioned to benefit greatly from both industries due to its brand loyalty and large cash reserves.

Additionally, digital services are gradually becoming Apple’s best-performing business, potentially overtaking the iPhone. Services include revenue from subscription platforms such as the App Store, Apple TV+, Music, and iCloud. Digital business is his second most profitable division at Apple, accounting for about 20% of the company’s revenue.

Meanwhile, growth in services has outpaced iPhone for more than a year, with the segment’s revenue increasing 11% year over year in the first quarter of 2024, compared to 6% for iPhone.

It will take time for Apple’s investment to pay off and be reflected in its stock price. But now may be the perfect time to make a long-term investment in Apple’s business. The company’s stock offers significantly better value than some of its rivals, suggesting it’s less risky than other “big tech” stocks.

This graph shows that Apple’s future price-earnings ratio (P/E) and price-to-free cash flow are significantly lower than Apple’s future price-to-earnings ratio (P/E) and price-to-free cash flow. microsoft and Amazon. Apple’s lower readings on both metrics suggest that the company’s stock is trading at a much better price.

Along with expanding positions in AI, VR/AR, and digital services, Apple stock is a great buy for long-term investors.

Should you invest $1,000 in Apple right now?

Before buying Apple stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Apple wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 5, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Microsoft. The Motley Fool has a disclosure policy.

Is it too late to buy Apple stock? Originally published by The Motley Fool

[ad_2]

Source link