[ad_1]

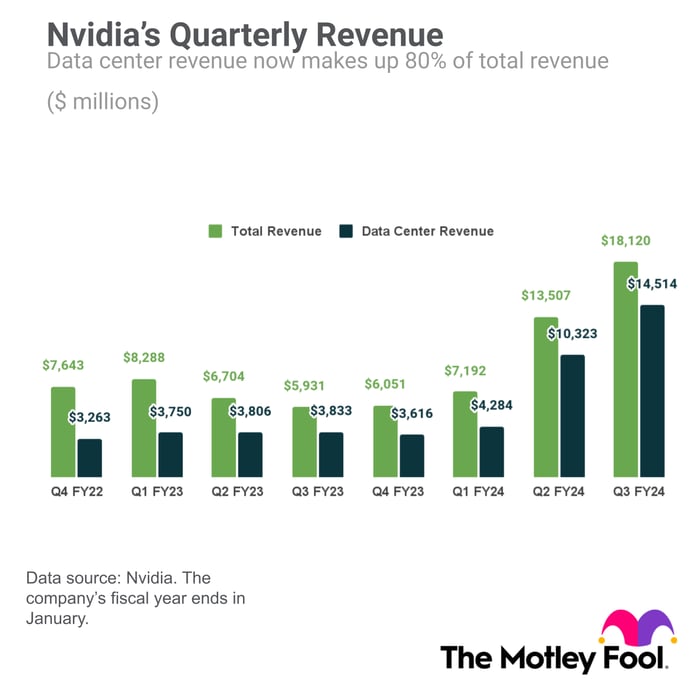

Nvidia (NVDA) was the perfect stock to capitalize on the demand for artificial intelligence (AI) computing in 2023. The graphics processing unit (GPU) leader saw explosive growth over the year. Third-quarter revenue increased 206% year-over-year. This significant growth has pushed the stock price up 238% in 2023.

It’s not common for a company as large as Nvidia, with billions of dollars in annual revenue, to suddenly experience this level of growth. It’s clear that AI chips are in high demand, but investors are probably wondering how much more the stock will rise in 2024. After all, NVIDIA’s guidance points to slower growth.

Here’s what you need to know about NVIDIA’s growth prospects before you decide to buy the stock.

Key risk factors to watch in 2024

Most of the rise in stock prices occurred in the first half of this year. Since the end of June, Nvidia stock has risen just 16%. Looking ahead to 2024, there are several factors that will weigh on stock prices.

The U.S. government’s chip export restrictions to China have created some uncertainty about Nvidia’s near-term momentum. The US recently extended these restrictions to Vietnam and other countries, where revenue accounts for up to a quarter of Nvidia’s data center business. However, management expects strong growth in other regions to more than offset this headwind in the short term.

Another risk factor is the limited supply of AI chips and the desire of other tech companies to design their own processors. Google’s parent company alphabet, microsoftand intel, it features a proprietary chip that offers a better price-performance ratio than Nvidia’s more expensive H100 and H200 GPUs, among other things. But none of these alternatives could match the horsepower offered by Nvidia’s data center chips, which are the standard for all major cloud service providers.

The biggest challenges at hand may arise from: Advanced Micro Devices, just launched new data center GPUs designed for AI workloads. But AMD expects these GPUs to generate just $2 billion in revenue in 2024, which is a small number next to Nvidia.

Nvidia’s data center revenue exceeded $14 billion in the fiscal third quarter alone, which translates to an annualized rate of $56 billion.

Nvidia expects total revenue to be about $20 billion in its fourth fiscal year, compared to just $6 billion in the year-ago period. The significant increase in revenue has been a godsend for the company’s profits. As we’ll see, this factor alone could justify further stock price gains in 2024.

Growth is slowing, but stock valuations are attractive for long-term investors

Nvidia’s guidance is for a slower rate of increase compared to the previous quarter. The market expects growth to slow next year. However, the stock still appears undervalued given Nvidia’s earnings growth.

Advanced AI chips generate higher profit margins than other chip sales. A favorable mix shift toward higher-margin chips is boosting his Nvidia’s revenue, with his earnings per share increasing 1,274% year over year last quarter.

The company’s stock trades at just 25 times forward earnings. Nvidia’s forward P/E ratio is cheap for a company serving the fast-growing AI market.

AI is one of the biggest growth opportunities in recent decades. It is becoming the basis for products and services that consumers use every day. Nvidia is a blue-chip AI stock that everyone should consider stashing in their nest.

Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. John Ballard holds positions at Advanced Micro Devices and his Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: Long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

[ad_2]

Source link