[ad_1]

shares of Nvidia (NASDAQ:NVDA) The company has soared significantly since the beginning of 2023, with the stock market amply rewarding the company’s outstanding sales and bottom line growth, posting an astronomical 441% rise; It became extremely expensive.

Nvidia stock currently trades at 41 times sales, significantly higher than the average sales multiple of 17.7 times over the past five years. on the other hand, S&P500 The average price-to-sales ratio for the index is 2.7. Nvidia’s price-to-earnings ratio (P/E) is also very expensive at 97. Nasdaq-100 The average P/E ratio of the index in which Nvidia participates is 34.

These valuation multiples indicate that Nvidia isn’t exactly a value pick right now. But this is only half the story, and a closer look at NVIDIA’s future price multiple and potential growth outlook suggests otherwise.

Do you think Nvidia stock is overvalued? Think again.

Nvidia looks expensive based on its stock price history, but the picture changes completely when it comes to the company’s future stock price. The forward P/E ratio for this stock is 33x. This is roughly in line with the expected P/E multiple of 30 times using the Nasdaq 100 Index as a proxy for tech stocks.

Given Nvidia’s leading position in the market for chips used to train artificial intelligence (AI) models – a driver of the company’s outstanding performance in the recently concluded fiscal year 2024 – why the company’s forward revenue multiple is significantly lower. is easy to understand. . The chipmaker’s revenue grew by a staggering 126% in fiscal year 2024 (ending Jan. 28) to about $61 billion. Non-GAAP (generally accepted accounting principles) earnings soared to $12.96 per share from $3.34 a year ago, nearly quadrupling in value.

It’s worth noting that Nvidia’s growth in the last two quarters of fiscal 2024 was impressive. For example, her third quarter revenue was $18 billion, up 206% year over year. Subsequently, last quarter’s revenue increased 265% year-over-year to $22.1 billion. The company expects revenue for the quarter to be $24 billion at midpoint, an increase of 234% from a year ago.

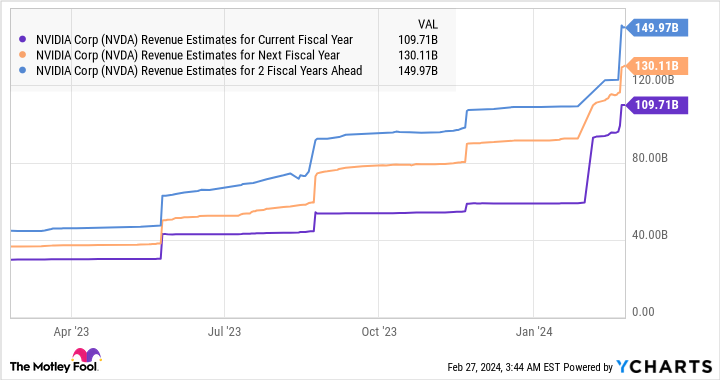

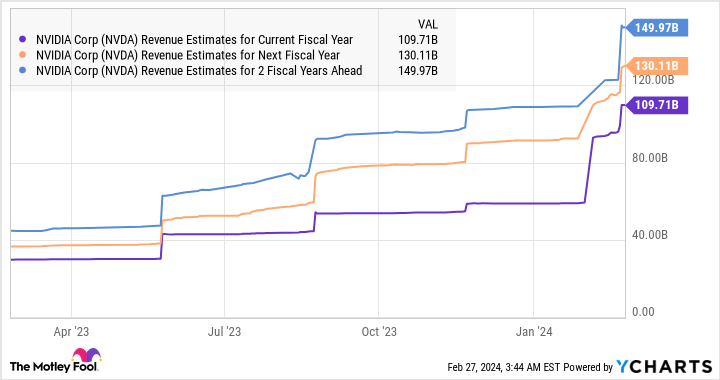

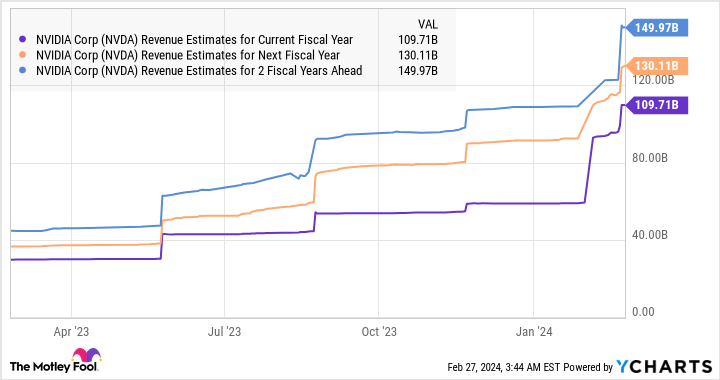

But the good part doesn’t end there, as analysts expect Nvidia’s revenue to grow significantly in the new fiscal year and beyond.

As the chart above shows, Nvidia’s revenue is expected to jump 2.5 times over the next three fiscal years compared to fiscal 2024. This is not surprising considering the potential growth opportunities in the AI chip market and Nvidia’s pole position in this field.

In its latest earnings call, Nvidia executives said the company’s data center revenue increased 409% year-over-year to $18.4 billion, with 83% of total revenue coming from strong demand for “both generative AI and large-scale data training and inference.” He pointed out that this was created due to strong demand. Language models across a wide range of industries, use cases, and geographies. ”

The company also added that the supply of data center chips is improving. But despite this, the company sees demand for its next-generation AI chips outstripping supply. This is not surprising since Nvidia reportedly controls over 80% of the AI chip market and customers are lining up to get their hands on products for AI training and inference. there is no.

More importantly, the company is focused on maintaining its leadership position in this lucrative market with its upcoming H200 AI graphics processing unit (GPU). Nvidia plans to begin initial shipments of this processor next quarter and claims it is already seeing solid demand for the product.

The AI chip market recorded nearly 38% annual growth through the end of the decade and is expected to reach $207 billion in annual revenue by 2030, and NVIDIA is capitalizing on this huge opportunity thanks to aggressive product planning. Ready to make the most of it. As a result, it’s no surprise that NVIDIA’s stock price will rise in the future, especially considering the impressive revenue growth the company is expected to achieve.

Nvidia stock price is expected to continue rising steadily

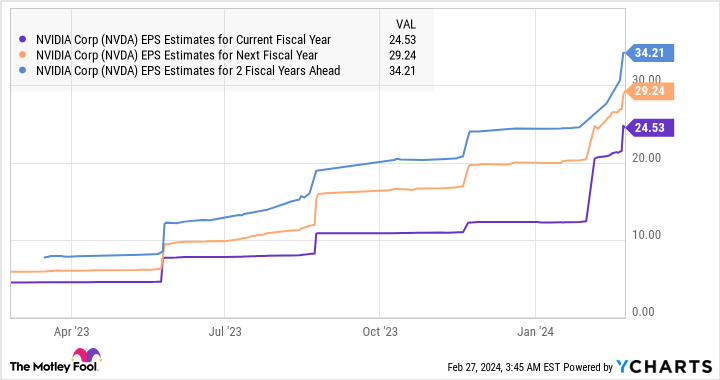

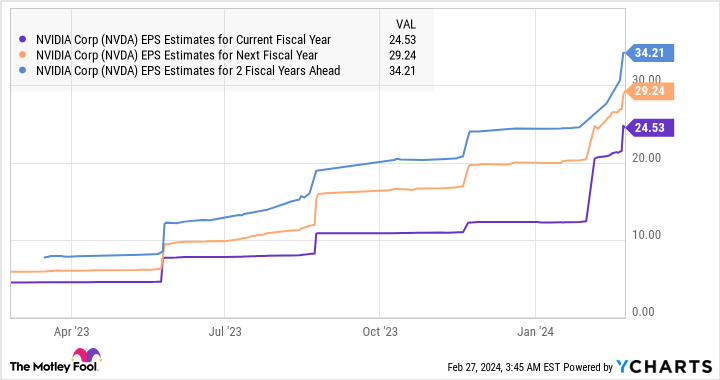

Nvidia earned $12.96 per share in fiscal 2024. As the chart below shows, analysts have significantly increased their earnings growth estimates.

As seen in the graph, if NVIDIA reaches 2027 earnings per share of $34.21 and maintains its current five-year average forward earnings multiple of 39.2, the stock price could rise to $1,341 . This would be a 70% increase from current levels.

Given that NVIDIA is currently trading at a lower forward earnings multiple, investors are now getting a nice deal on this AI stock, and its hot rally looks likely to be here to stay. , you should consider grabbing it with both hands.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is it too late to buy Nvidia stock? Originally published by The Motley Fool

[ad_2]

Source link