[ad_1]

Howard Marks says that instead of worrying about stock price fluctuations, “the possibility of permanent loss is the risk I worry about…and every practicing investor I know worries about that.” You expressed it well. So when you think about the risk of a particular stock, it might be obvious that you need to consider debt. Because too much debt can sink a company. Points to keep in mind are: NATIONAL ALUMINUM COMPANY LIMITED. (NSE:NATIONALUM) does have debt on its balance sheet. But the more important question is how much risk that debt creates.

What risks does debt pose?

Debt supports a company until the company has difficulty paying it back with new capital or free cash flow. Ultimately, if a company fails to meet its legal obligations to repay debt, shareholders could walk away with nothing. Although this is less common, we often see debt-laden companies permanently diluting shareholders as lenders force them to raise capital at distressed prices. Having said that, the most common situation is one in which a company manages its debt reasonably well and to its own advantage. The first thing to do when considering how much debt a company uses is to look at its cash and debt together.

Check out our latest analysis for National Aluminum.

What is National Aluminum’s net debt?

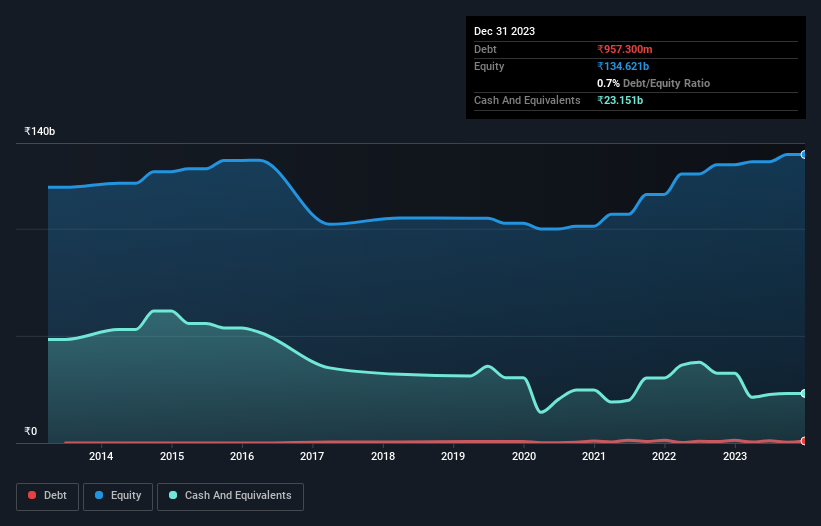

As you can see below, National Aluminum’s debt was ₹957.3m as of September 2023, down from ₹1.25ba in the same period last year. But on the other hand, it also held cash of ₹23.2b, giving it a net cash position of ₹22.2b.

How healthy is National Aluminum’s balance sheet?

The latest balance sheet data shows that National Aluminum had liabilities of ₹32.0b falling due within a year, and liabilities of ₹15.9b falling due after that. On the other hand, it had cash of 23.2 billion rupees and accounts receivable worth 1.66 billion rupees that were due within a year. So it has liabilities of ₹23.1b more than its cash and short-term receivables, combined.

Of course, National Aluminum has a market capitalization of ₹273.2b, so these debts are likely manageable. Having said that, it’s clear that we need to continue to monitor the balance sheet to make sure it doesn’t take a turn for the worse. Despite its notable debt, National Aluminum boasts net cash, so it’s fair to say it doesn’t have a significant amount of debt.

A low debt burden could be crucial for National Aluminum if management is unable to prevent a repeat of last year’s 31% EBIT reduction. When a company’s profits decline, its relationships with lenders may deteriorate. There’s no question that we learn most about debt from the balance sheet. But ultimately, National Aluminum’s ability to strengthen its balance sheet over the long term will depend on the future profitability of its business.If you’re focused on the future, check this out free A report showing analyst profit forecasts.

Finally, companies can only pay off debt with cold hard cash, not accounting profits. National Aluminum may have net cash on its balance sheet, but it’s still interesting to see how well the business converts earnings before interest and tax (EBIT) into free cash flow. . Because it affects both the company’s needs and its capabilities. To manage debt. Looking at the most recent three years, National Aluminum’s free cash flow was 31% of its EBIT, which was lower than expected. It’s not great when it comes to paying off debt.

summary

It’s always wise to look at a company’s total debt, but it’s very reassuring to see National Aluminum has net cash of ₹22.2b. Therefore, we are not troubled by National Aluminum’s use of debt. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet, far from it. For example, we identified 1 National Aluminum warning sign What you need to know.

If you’re more interested in fast-growing companies with rock-solid balance sheets, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we help make it simple.

Please check it out national aluminum Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link