[ad_1]

Many investors, especially inexperienced investors, typically buy stocks in companies with a good story, even if the company is losing money. But as Peter Lynch said, One Up on Wall Street, “Long shots rarely pay off.” Investors should be careful not to put good money after bad money, as loss-making companies can act like sponges for capital.

So if this idea of high risk and high reward doesn’t suit you, you might be more interested in profitable growth companies such as: Hongryong Finance (SGX:S41). This doesn’t necessarily indicate whether it’s undervalued or not, but the profitability of the business is enough to justify some valuation, especially if it’s growing.

Check out our latest analysis for Hongryong Finance.

How fast is Hongryong Finance increasing its earnings per share?

The market is a voting machine in the short term, but a weighing machine in the long term, so ultimately we expect stock prices to follow the results of earnings per share (EPS). Therefore, it makes sense for experienced investors to pay close attention to a company’s EPS when doing investment research. We can see that over the last three years, Hong Leong Finance’s EPS grew by 15% per year. This is a pretty good rate if the company can maintain it.

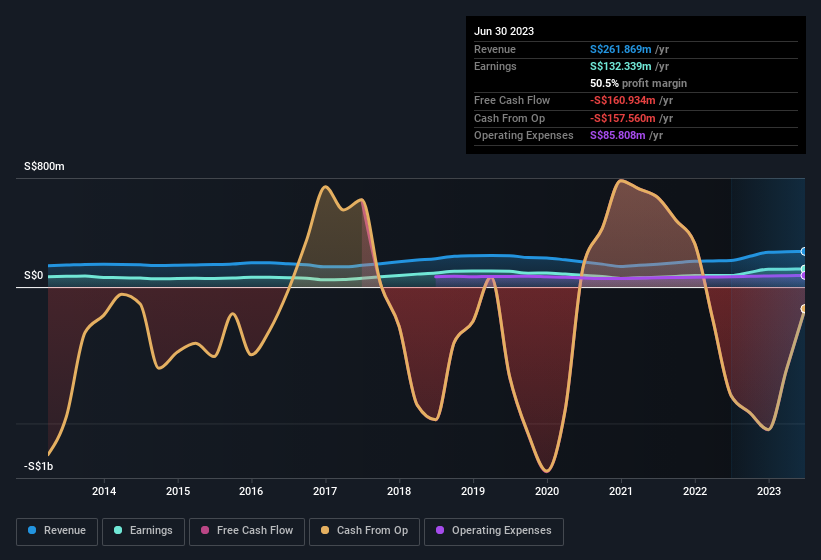

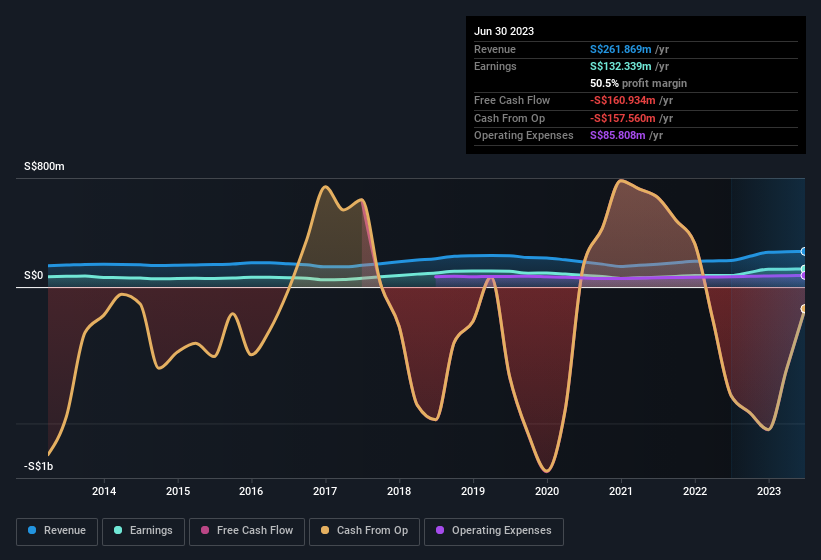

Revenue growth is a good indicator that growth is sustainable and, when combined with high earnings before interest and tax (EBIT) margins, can help a company maintain a competitive advantage in the market. This is an excellent method. What’s interesting to watch is Hong Leong Finance’s earnings. From management was lower than the previous 12 months’ revenue, which could skew the margin analysis. Hongleong Finance’s EBIT margin is little changed from last year, but the company should be pleased to see that its revenue increased 34% to S$262m in the period. That’s progress.

In the graph below, you can see how the company has grown its revenue and revenue over time. Click on the image for more details.

While profitability is an upside factor, smart investors also keep an eye on the balance sheet.

Are Hongryong Finance insiders aligned with all shareholders?

It’s nice to see company leaders putting their money on the line, so to speak. Because it increases the alignment of incentives between the people running the business and its true owners. So it’s good to see that Hong Leong Finance insiders have significant capital invested in the stock. In fact, they own S$45 million worth of shares. This significant investment should help increase the long-term value of the business. Although the company’s ownership is only 3.9%, this is still a significant amount at stake for the company to maintain its strategy of delivering value to shareholders.

Is Hongryong Finance worth paying attention to?

As we mentioned earlier, Hong Leong Finance is a growing business, which is encouraging. If that wasn’t enough, there’s also some pretty notable levels of insider ownership. The combination is very attractive. Yes, we think this stock is worth watching. Remember, there may still be risks. For example, we identified 2 warning signs for Hon Leong Finance What you need to know.

There’s always a chance that buying stocks will work out. is not Expanding profits and please do not Have insiders buy stock. However, when considering these important metrics, we recommend checking out companies such as: do It has those characteristics. Access a customized list of Singapore companies that have demonstrated growth with recent insider acquisitions.

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link