[ad_1]

(Bloomberg) — Japanese and South Korean stocks rose as trading resumed after the holidays, while U.S. stock futures fell slightly ahead of inflation data to be released later on Tuesday.

Most Read Articles on Bloomberg

South Korea’s benchmark Kospi index was on track to erase its losses since the beginning of the year amid continued expectations for stricter regulations to boost the domestic stock market. Markets in China, Hong Kong, Taiwan and Vietnam will be closed for the Lunar New Year.

The yen was little changed on Tuesday, hovering around 149 yen to the dollar, down from 140 yen at the beginning of the year. The recent weakness reflects comments from BOJ officials that the bank is in no hurry to withdraw from support measures. The economy suffered a severe recession in the summer, but is expected to return to annual growth of 1.2% in the fourth quarter.

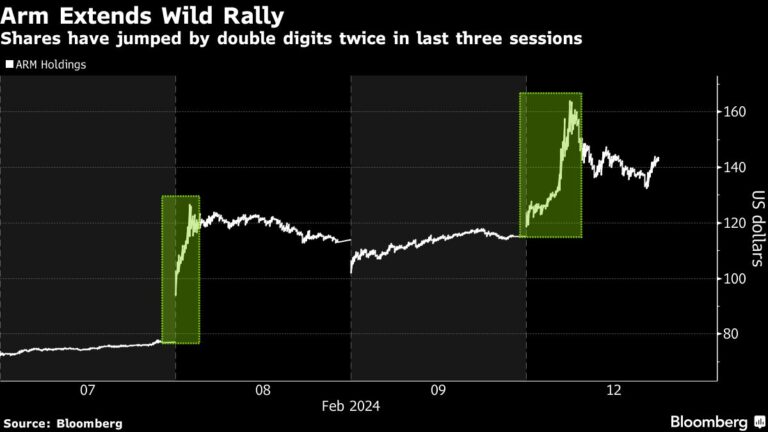

SoftBank Group, one of Japan’s largest listed companies, rose as much as 11% in early trading as arm Holdings, which owns the stock, rose further. Arm shares soared 29.2% in New York trading on Monday, nearly tripling since going public in September. Tokyo Electron Ltd., a Japanese chip manufacturing equipment manufacturer, has seen its stock price soar to an all-time high due to strong sales.

Strong demand for chips, fueled by hopes that the coming artificial intelligence boom will be a boon for manufacturers, pushed Nvidia’s stock price higher on Monday, briefly surpassing Amazon.com Inc.’s market capitalization.

“What we’re seeing here is an enthusiasm for anything that has to do with AI,” said Dennis Dick, a trader at Triple D Trading. “Argos are involved, retail traders are involved, people are buying options. It all just snowballs.”

U.S. Treasuries were unchanged in Asian markets on Tuesday, with the 10-year bond yielding about 4.17%, while Australian and New Zealand bonds were slightly ahead.

The dollar index remained firm, reflecting calm in the U.S. bond market ahead of the January U.S. consumer price index report scheduled for late Tuesday. The report is expected to show headline inflation below 3% year-on-year for the first time since March 2021, confirming the disinflation narrative that has driven stock gains in recent months.

“With the stock market rally continuing and the S&P 500 index still above 5,000, we are ready for a breather. It has nothing to do with triggering inflation,” said Vishnu, former Asia and Japan economist at Mizuho Bank. Mr. Barasan wrote in a memo. “The potential for inflation surprises to violently change the direction of policy has been overstated.”

Richmond Fed President Thomas Barkin said one of the lingering risks of inflation moving back toward the central bank’s goal comes from U.S. businesses. In recent years, many companies have boosted their profit margins by raising prices, a practice that is difficult to modify and can lead to upward pressure on inflation.

While bond traders are currently largely in line with the Fed’s interest rate trajectory, Citigroup strategists say the market is overlooking the risk of higher rates following an easing cycle.

“Markets should be pricing in some risk of future rate hikes. We need to look ahead to 1998,” Jason Williams, global market strategist at Citigroup, said in a note. This cycle “could be similar to the 1998 easing cycle, which led to further rate hikes in the short term. If inflation does not return to a stable 2%, the upside potential for future Fed rate hikes is limited to this very short period.” It should expand from the depressed levels.”

Elsewhere in Asia, a report on Tuesday showed Australian consumer confidence rose to a 20-month high in February, while investors were awaiting New Zealand inflation expectations later today. It was done.

Earlier, the European Union had proposed new trade restrictions on companies allegedly supporting Russia’s war effort in Ukraine, including three companies based in China. If adopted, it would be the first time the EU has imposed restrictions on mainland Chinese companies since the invasion.

Bitcoin has hit $50,000 for the first time since December 2021, boosted by the token’s record-breaking debut by a US exchange-traded fund.

After six days of gains ahead of the Organization of the Petroleum Exporting Countries (OPEC) market outlook, oil prices were firm as traders also watched developments in the Israel-Hamas war. Morgan Stanley has raised its forecast for oil prices at the end of the year, citing signs of tight supply. Gold prices fell slightly on Monday and were little changed after trading around $2,020 an ounce on Monday.

This week’s main events:

-

German ZEW survey forecast, Tuesday

-

US Consumer Price Index, Tuesday

-

Eurozone industrial production, GDP, Wednesday

-

BOE Governor Andrew Bailey testifies before the House of Lords Economic Committee on Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Wednesday

-

Japan’s GDP, industrial production, Thursday

-

US manufacturing industry, number of new unemployment insurance claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks on Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

Fed Director Christopher Waller speaks Thursday

-

ECB Chief Economist Philip Lane speaks on Thursday

-

U.S. Housing Starts, PPI, University of Michigan Consumer Sentiment, Friday

-

San Francisco Fed President Mary Daley speaks on Friday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Friday

-

ECB board member Isabel Schnabel speaks on Friday

The main movements in the market are:

stock

-

As of 9:56 a.m. Tokyo time, S&P 500 futures were down 0.2%.

-

Nikkei 225 futures (OSE) rose 1.6%

-

Japan’s TOPIX rose 1.1%

-

Australia’s S&P/ASX 200 little changed

-

Euro Stoxx50 futures fall 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was unchanged at $1.0772.

-

The Japanese yen remains unchanged at 1 dollar = 149.35 yen.

-

The offshore yuan was almost unchanged at 7.2178 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6528.

cryptocurrency

-

Bitcoin rises 0.5% to $50,100.76

-

Ether rose 1.4% to $2,668.16

bond

-

The 10-year Treasury yield fell 1 basis point to 4.17%.

-

Japan’s 10-year bond yield remains unchanged at 0.720%

-

Australian 10-year bond yield unchanged at 4.17%

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link