[ad_1]

JPMorgan introduced a free cash flow intelligence AI tool for corporate clients last year, and the bank is now helping some clients reduce human-centered manual work by nearly 90%, according to a Bloomberg report. states that it is helpful.

The report says about 2,500 anonymous customers are using the AI tool, which has been so successful that JPMorgan will one day start charging for it.

“Cash flow forecasting is very complex and requires a lot of judgment,” Tony Wimmer, head of data and analytics for JPMorgan’s wholesale payments division, told Bloomberg.

Wimmer, who leads a team of about 300 data scientists, data engineers and other employees, remains a “firm believer” that “human-powered machines are not going away for a long time.”

Related: The evolution of AI in securing financial transactions

JPMorgan’s Analytics and Insights Solutions page refers to the tool as an “intuitive AI interface” that analyzes, classifies, and categorizes a company’s cash flow. It also helps clients create forecasts.

Other major banks are also implementing AI tools. Bank of America offers a free AI CashPro forecasting tool to track cash flow, and RBC offers a similar tool called NOMI.

Related: How AI is revolutionizing startup funding

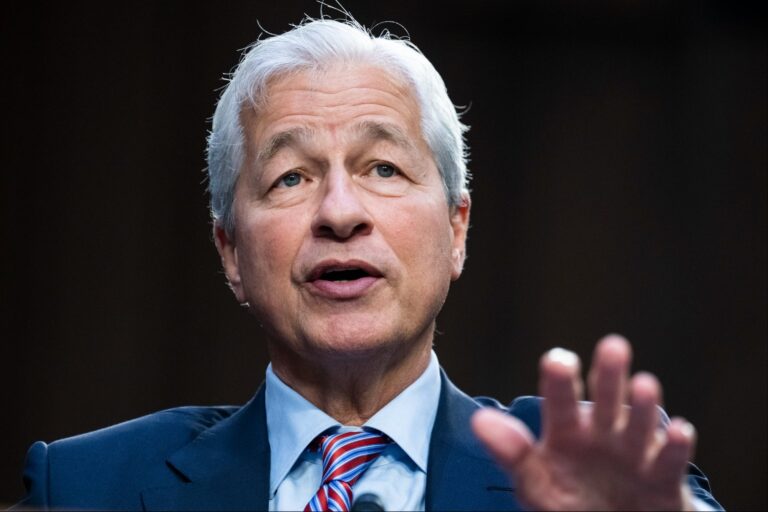

Jamie Dimon, CEO of JPMorgan Chase. Credit: Tom Williams/CQ-Roll Call, Inc, Getty Images

Jamie Dimon, CEO of JPMorgan Chase. Credit: Tom Williams/CQ-Roll Call, Inc, Getty Images

JPMorgan CEO Jamie Dimon predicted in October that the next generation will likely work 3.5 days a week thanks to AI. The company has set a goal that in 2023 he will create his $1.5 billion business value through AI.

[ad_2]

Source link