[ad_1]

(Bloomberg) — A slowing U.S. economy could prompt the Federal Reserve to eventually cut interest rates more than it is currently indicating, leading to lower maturities in U.S. Treasuries, according to JPMorgan Asset Management. may encourage an increase in

Most Read Articles on Bloomberg

“The market is pricing in a rate cut of about 1.5%, which is probably a reasonable central case,” said Seamus Mac Gollaine, head of global rates in London at the money manager, which manages about $2.9 trillion. ” he said. “The negative economic outcomes could be much larger.”

He said the asset manager is buying five-, seven- and 10-year bonds, while underweighting 30-year bonds because it believes the Fed’s interest rate cuts will cause the U.S. yield curve to steepen. It is said that there is.

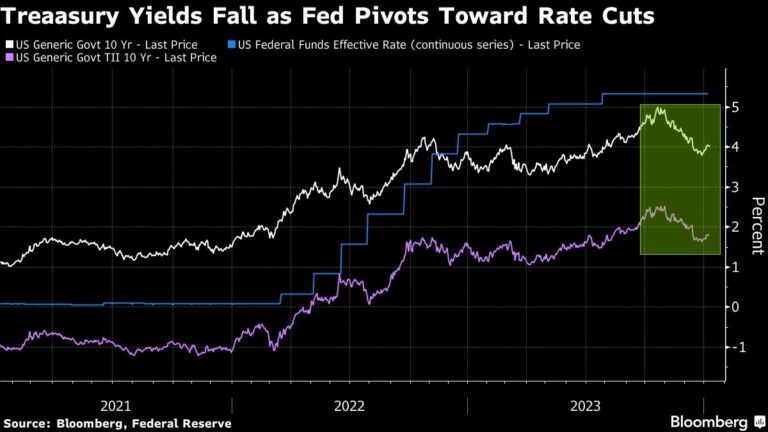

There has been significant disagreement in recent months about how much the Fed is likely to lower interest rates this year. Central bank policymakers expect a rate cut of 75 basis points by year-end on a quarterly dot plot, according to median forecasts updated Dec. 13. The market has been much more active, with prices rising to nearly 160 basis points in late December based on interest rate swaps, before returning to around 140 basis points this week.

This divergence has roiled markets over the past year and was a key factor in pushing the 10-year Treasury yield into the 180 basis point range in 2023. Many investors, including JPMorgan Asset’s Mac Gorain and Eurizon SLJ Capital, predicted the end prematurely. That was due to the Fed’s tightening last year, but that didn’t happen because the U.S. economy turned out to be stronger than expected.

‘Big Surprise’

“It was a big surprise to us and others that inflation actually went down” in the absence of significant economic weakness that would have caused the Fed to cut interest rates, said Mac Gollan. I mentioned my previous outlook. “For most of last year we thought we were going to be in a recessionary environment, but clearly that wasn’t the case.”

Looking ahead to 2024, he said: “Given the progress we’ve seen so far on various anti-inflation measures, it seems much more likely that the central bank will be back on target.”

Mac Gollaine said the Fed’s easing of monetary policy could push the benchmark 10-year Treasury yield down about 50 basis points from current levels this year, to around 3.50%.

He said the best trades going forward are expected to include “steep stocks anchored in the belly of the curve” as curves tend to steepen significantly during easing cycles. .

Read more: $2 trillion new debt mountain threatens bond rally

Mac Gollaine helps oversee many of the asset manager’s strategies, including its global government bond fund, which returned 1.1% over the past year, according to data compiled by Bloomberg. He also helped manage the EU sovereign debt strategy, which rose 3.7% in the same period.

JPMorgan Asset’s base case for the U.S. economy remains a soft landing, but a recession cannot be completely ruled out, making it a compelling reason to hold U.S. Treasuries, says Mac Gollaine. Stated.

“A real yield of 1% is the level you would reach in a recession,” he said. “The benefit of owning duration here is that you can at least get a reasonable real yield.”

–With assistance from Malavika Kaur Makol.

(Updated to add name of new investor in fifth paragraph. A previous version of this article was corrected to remove the word “hawk”)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link