[ad_1]

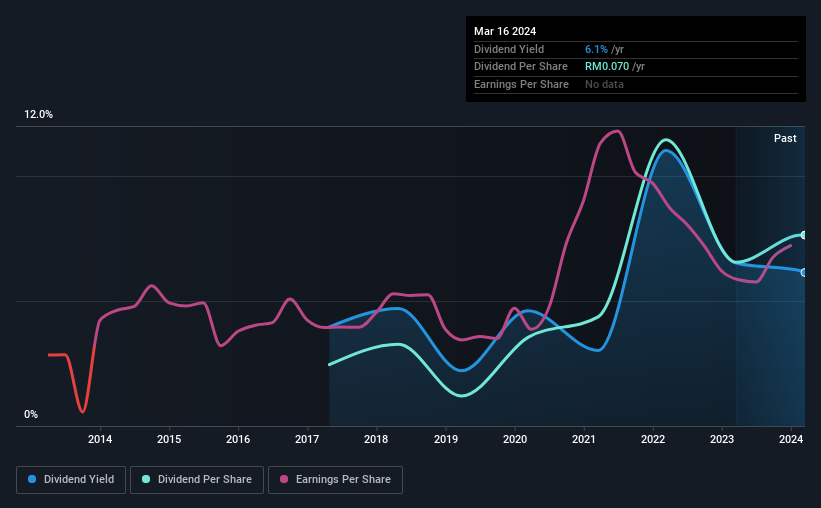

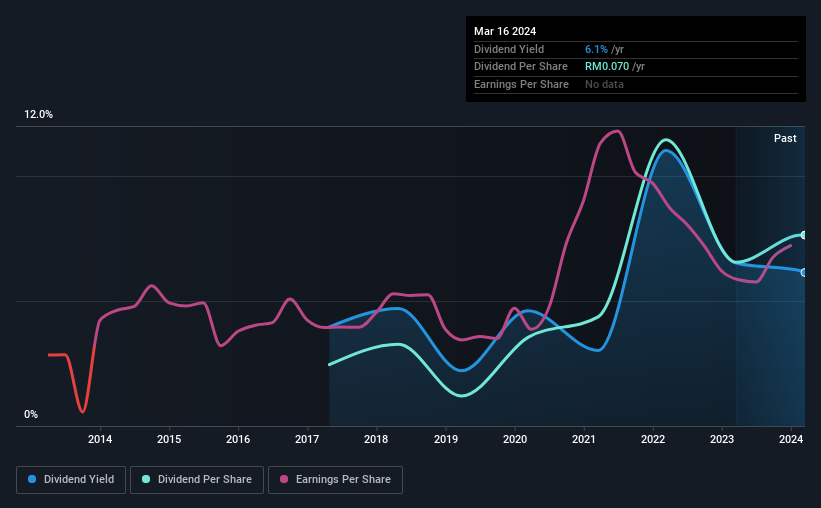

Kenanga Investment Bank Berhad (KLSE:KENANGA)’s dividend will increase to RM0.07 on April 16 from the same period paid last year. This results in an annual payout of 6.1% of the stock price, which is more than most companies in the industry pay.

Check out our latest analysis for Kenanga Investment Bank Berhad.

Kenanga Investment Bank Berhad’s profits easily cover distributions

We like to see solid dividend yields, but we don’t mind if the payments aren’t sustainable. Based on the last payment, Kenanga Investment Bank Berhad very comfortably earned enough income to cover its dividend. This indicates that a significant portion of the profits are invested in the business.

Looking ahead, if the trends of the past few years continue, earnings per share could grow 43.0% next year. Assuming the dividend continues in line with recent trends, the payout ratio could be 57% by next year, which would be well within a sustainable range.

Kenanga Investment Bank Berhad’s dividend has been inconsistent.

It’s reassuring to see Kenanga Investment Bank Berhad has been paying a dividend for a number of years, although the dividend has been cut at least once during that time. Even if a company has reduced its consumption once, this does not negate the possibility of reducing it in the future. For the past seven years, his annual payment was RM0.0225 in 2017 and for the most recent financial year he was RM0.07. This works out to be a compound annual growth rate (CAGR) of approximately 18% over that period. Dividends have increased rapidly during this time, but with a history of dividend cuts, we’re not sure if this stock will be a reliable source of income in the future.

Dividends are likely to increase

With a relatively unstable dividend, it’s even more important to see if earnings per share are growing. Kenanga Investment Bank Berhad’s EPS has grown at 43% per year over the past five years. It’s clear that Kenanga Investment Bank Berhad can grow rapidly while returning cash to shareholders, and is positioned to pay strong dividends in the future.

We really like Kenanga Investment Bank Berhad’s dividend

Overall, increasing dividends is always a good thing, and we think Kenanga Investment Bank Berhad is a strong income stock due to its track record and earnings growth. Profits easily cover distributions, and the company generates a lot of cash. Considering all these factors, we think this has solid potential as a dividend stock.

It’s important to note that companies with a consistent dividend policy generate greater investor confidence than companies with an erratic dividend policy. On the other hand, despite the importance of dividends, they are not the only factor that our readers need to know when evaluating a company. I took the discussion a little further and found the following: 1 warning sign for Kenanga Investment Bank Berhad That means investors need to be conscious moving forward.Looking for more high-yield dividend ideas? Try ours A group of people with strong dividends.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link