[ad_1]

Bridge Investment Group (NYSE:BRDG) has been analyzed by 5 analysts over the past 3 months with varying opinions from Bullish to Bearish.

The table below provides a concise summary of recent ratings by analysts, provides an insight into how sentiment has changed over the past 30 days, and shows how it compares to the previous month from a holistic perspective.

| strong | Slightly bullish | indifference | Slightly bearish | bearish | |

|---|---|---|---|---|---|

| Total number of ratings | 0 | Four | 1 | 0 | 0 |

| the last 30d | 0 | 0 | 1 | 0 | 0 |

| 1 minute ago | 0 | 3 | 0 | 0 | 0 |

| 2 minutes ago | 0 | 0 | 0 | 0 | 0 |

| 3 minutes ago | 0 | 1 | 0 | 0 | 0 |

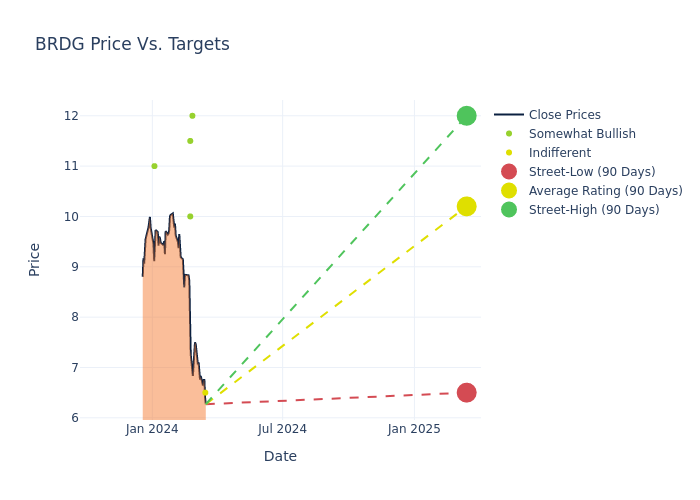

In evaluating 12-month price targets, analysts have revealed their insights for Bridge Investment Group, with an average price target of $10.2, a high forecast of $12.00 and a low forecast of $6.50. It has experienced a 15.0% decline, and the current average is lower than the previous average price target of $12.00.

Understanding Analyst Ratings: A Comprehensive Analysis

Studying recent analyst action can provide some insight into how financial professionals perceive Bridge Investment Group. The overview below provides an overview of the key analysts, their recent reviews, and their ratings and price target adjustments.

| Analyst | analyst company | action taken | evaluation | Current target price | Previous target price |

|---|---|---|---|---|---|

| adam beatty | UBS | lower body | neutral | $6.50 | $9.50 |

| michael cypris | morgan stanley | lower body | Overweight | $12.00 | $13.00 |

| Finian O’Shea | wells fargo | lower body | Overweight | $10.00 | $12.00 |

| Kenneth Worthington | JP Morgan | lower body | Overweight | $11.50 | $13.50 |

| bill kirk | TD Cowen | present | excellent | $11.00 | – |

Key insights:

- Action taken: Analysts update their recommendations in response to dynamic market conditions and company performance. Whether they “maintain”, “increase” or “decrease” their stance – it indicates their reaction to recent developments related to Bridge Investment Group. This insight provides a snapshot of analyst perspectives on the current state of the company.

- evaluation: Analysts analyze trends and provide qualitative ratings ranging from “outperform” to “underperform.” These ratings convey expectations for Bridge Investment Group’s relative performance compared to the market as a whole.

- target price: Analysts evaluate price target trends and provide estimates of the future value of Bridge Investment Group stock. This comparison reveals long-term trends in analyst forecasts.

Consider these analyst ratings in conjunction with other financial metrics to develop a comprehensive understanding of Bridge Investment Group’s market position. Stay informed and make informed decisions with our rating charts.

Get the latest information on analyst ratings for Bridge Investment Group.

If you’re interested in tracking small-cap stock news and performance, you can start tracking it here.

Delving into the background of Bridge Investment Group

Bridge Investment Group Holdings Inc is a vertically integrated investment manager diversified across specialized asset classes. The firm combines a national operating platform with a dedicated team of investment professionals focused on a variety of specialized and synergistic investment platforms including real estate, credit, renewable energy and secondary strategies. Its wide range of products and vertically integrated structure allow it to capture new market opportunities and offer investors a variety of investment objectives. The company operates in a single segment, Alternative Investment Management, and is diversified across specialized and synergistic investment platforms.

Unraveling Bridge Investment Group’s financial story

Market capitalization analysis: The company’s market capitalization is above the industry average, indicating its impressive size compared to its peers and indicating its strong market position.

Decrease in revenue: Over a three-month period, Bridge Investment Group faced challenges that resulted in a decline in sales of approx. -1.41% This means a decline in the company’s top-line profits. Compared to its competitors, the company faced challenges with lower growth rates than the average of its peers in the financial sector.

Net profit margin: The company’s net profit margin is below industry benchmarks, indicating potential difficulty in achieving high profitability.The net margin is -6.0%, Companies may need to address challenges in effective cost management.

Return on equity (ROE): Bridge Investment Group’s ROE is below the industry average, indicating that it faces challenges in efficiently utilizing its capital. ROE is -7.5%, The company may face hurdles in generating optimal returns for shareholders.

Return on assets (ROA): Bridge Investment Group’s ROA is below the industry average, suggesting that it is challenged to maximize returns from its assets. ROA is -0.44%, Companies may face obstacles in achieving optimal financial performance.

Debt management: Bridge Investment Group’s debt-equity ratio is significantly higher than the industry average.in the ratio of 6.46the company has a high reliance on borrowings, indicating a high level of financial risk.

Analyst Rating Basics

Analysts who are experts in banking and financial systems specialize in reporting on specific stocks or defined sectors. Their comprehensive research includes attending company conference calls and meetings, analyzing financial statements, and working with insiders to create what they call analyst ratings for stocks. Typically, analysts evaluate and rate each stock once a quarter.

Some analysts also provide forecasts for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance on what to do with a particular ticker. It is important to remember that although stock and sector analysts are experts, they are also human beings and can only predict their own beliefs to traders.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

[ad_2]

Source link