[ad_1]

Investors are always looking for high returns, and the signs are currently lining up in favor of the high-yield dividend segment. Dividend payments ensure a regular source of income regardless of market conditions, and high yields can provide solid investment returns.

Dividend stocks are also popular with defensive investors and tend to be less volatile during market ups and downs. This is an important point at this point. Even if the consensus suggests that the economy will have a soft landing, there is still a chance that the economy will weaken.

This background is reflected in a recent note from Desh Peramnetileke, head of microstrategy at investment bank Jefferies, pointing out that high-dividend stocks are a healthy option given today’s circumstances.

“The outlook for dividend strategies has improved after a difficult 2023,” the Jefferies team said. “The Fed is increasingly expected to cut rates for the first time in June, indicating that growth will be a bigger challenge than inflation. However, ultra-defensive fixed income agents may continue to struggle as the probability of a hard landing is low. Instead, it is high-quality yields that are best positioned to capture the cycle. I think there is.”

Jefferies’ Omar Nokta, a five-star analyst who ranks in the top 4% of stock experts on the Street, follows this line of thinking by selecting a number of specific stocks. He tags two high-dividend stocks as buys and selects up to eight stocks with potential returns. % dividend yield. To get a broader picture of these stocks, he used the TipRanks database and found that these stocks have a consensus rating of Strong Buy.Click here for details

DHT Holdings (DHT)

We’ll start with tanker company DHT Holdings. The company is one of the independent operators in the global marine transportation sector, specializing in the transportation of crude oil. The DHT name is an acronym for “double-hull tanker,” a modern tanker construction designed to increase safety and prevent leaks. The company is a pure operator of VLCCs, or “very large crude carriers,” which are large tankers ranging from 299,000 to 320,000 dry weight tonnage (DWT). These are the largest crude oil tankers currently sailing the oceans.

DHT’s 28 VLCCs are wholly owned by the airline and operated primarily on a charter basis. The prevalence of long-term charter contracts in the company’s operating model provides DHT with a high level of reliable fixed income.

Fleet quality is a critical factor for ocean-going tanker companies, and DHT has a relatively young fleet. All but four of the company’s vessels have been built since 2011, with the five newest ships currently in service built in 2018. The company’s fleet consists of a total of 28 of her VLCCs, including four tankers that the company recently contracted to build. These four ships will be built at a Korean shipyard and each will weigh 320,000 tons. Each ship has an average price of $128.5 million and is expected to be delivered in 2026.

In its last quarterly results from Q4 2023, DHT reported adjusted net revenue totaling $94.5 million. This was down 19% year-over-year, but he was $1 million better than expected. The company’s GAAP-measured EPS came to 22 cents per share. This is 1 cent more than expected and fully covers the company’s latest dividend announcement.

A dividend of 22 cents per common share was announced with the fourth quarter results. This dividend represents a 15.7% increase from the previous payment and was paid to common shareholders on February 28th. The common stock will pay an annualized $0.88 per share, representing a return of 8%.

Jefferies analyst Omar Nokta was impressed with the quality of DHT’s vessels and operations, writing: “DHT is a pure VLCC shipowner with exposure to the spot market, and its eco-designed and scrubber-equipped vessels have tremendous revenue potential, especially with increased non-OPEC production and OPEC+ The potential for additional exports is expected to further strengthen tanker’s future momentum. We expect our shareholders to benefit from our dividend payout ratio of 100% of quarterly profit.”

Moving forward, Nokta upgrades DHT’s rating from “buy” to “hold,” with a price target of $14, indicating around 26% one-year upside potential. (Click here to see Nokta’s track record)

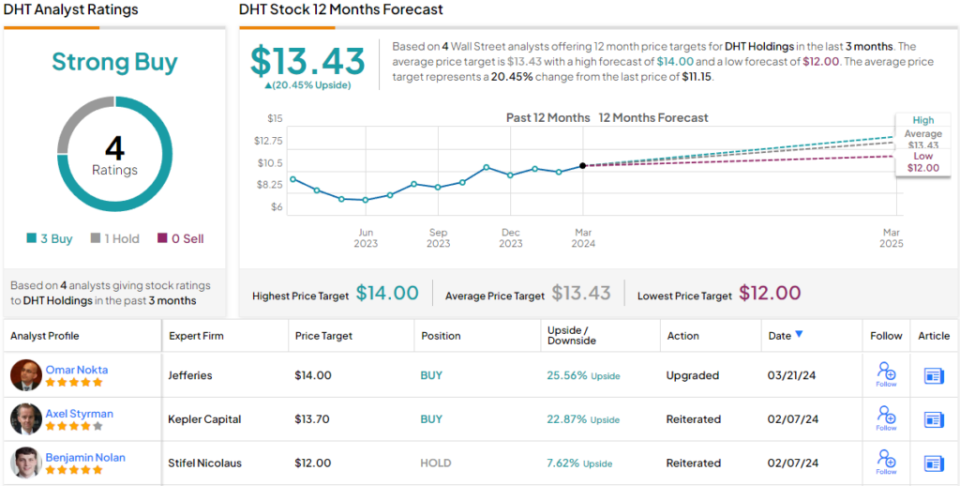

Overall, the stock’s Strong Buy consensus rating is based on 4 recent analyst reviews, with 3 Buys and 1 Hold. The stock is trading at $11.15, and the average price target of $13.43 suggests the stock could appreciate up to 20% over the next 12 months. (look DHT stock price prediction)

front line (Furo)

Jefferies’ next stock is Frontline, one of the world’s largest tanker companies. Frontline transports both crude oil and refined products and operates one of the industry’s largest and most modern fleets. The company has a fleet of 86 vessels, with the oldest built in 2009 and 20 built after 2020. The fleet consists of 43 VLCCs, the largest category of ocean-going tankers, as well as 25 157,000 DWT Suezmax vessels, the largest vessels capable of transiting the Suez Canal, and 18 110,000 tonne LR2/Aframax tankers. Contains ships. D.W.T.

Frontline has been in operation since 1985 and has seen solid success in recent quarters. Revenue last year increased compared to the previous year, increasing 27% from $1.44 billion in 2022 to $1.83 billion in 2023. The company’s stock price has also risen significantly, rising more than 60% in the past 12 months and nearly 17% for the year. up to now.

Now that the fourth quarter of 2023 is over, you can check Frontline’s earnings for the quarter. The company’s sales were $415 million, down 21% from a year ago and more than $5 million below expectations. Even better, the company’s adjusted earnings for the quarter came to his $102.2 million, or 46 cents per share.

This was more than enough to cover the common stock dividend of 37 cents per share declared on February 28 and payable on March 27. This declaration represents a 23% increase from the previous quarter, and the annual dividend of $1.48 results in a yield of 6.4%. Frontline has a history of adjusting its dividend payments to match current earnings.

In an interview with Jefferies, analyst Nokta is impressed with the company’s ability to consistently maintain a high payout ratio. He said of the stock: “Frontline is one of the world’s largest crude oil tanker operators with a young fleet and high scrubber exposure. Future trends for tankers are likely to continue, especially with increased non-OPEC production and the potential for additional OPEC+ exports. We expect dividends to remain a central part of Frontline’s story, and we expect shareholders to benefit from an unofficial payout ratio of 80% of quarterly earnings. Masu.”

Looking to the future, Nokta has upgraded this stock from a ‘hold’ rating to a ‘buy’ rating, similar to the DHT mentioned above. His price target is set at $30, suggesting he expects a 30% upside in one year.

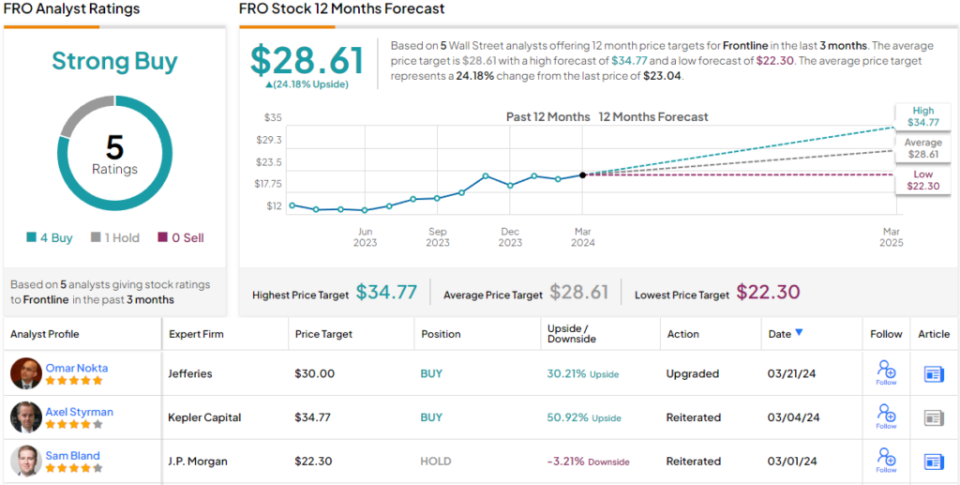

Overall, Frontline has 5 recent analyst reviews, including 4 Buys to 1 Hold for a consensus rating of Strong Buy by Street analysts. The stock’s average price target of $28.61 and current trading price of $23.04 represent a one-year upside of 24%. (look FRO stock price forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link