[ad_1]

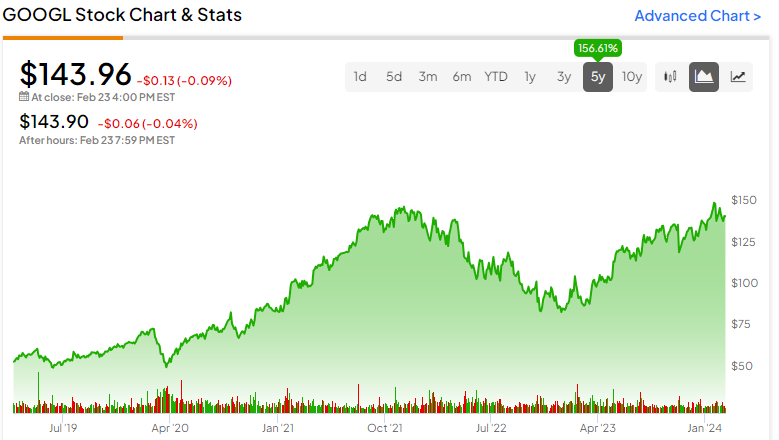

Magnificent Seven stock has been getting a lot of buzz as investors are drawn to its huge market share and exceptional returns. Over the past five years, the stock price of each of the Magnificent Seven has more than doubled. These assets significantly outperformed the market during that time. However, the alphabet (NASDAQ:GOOG) (NASDAQ:Google) stock has been significantly undervalued.

The company has amassed a market capitalization of $1.75 trillion, an increase of 56% over the past year. Still, this increase has been slower than most Magnificent Seven stocks. New opportunities and a superior valuation will help Alphabet gain momentum and accumulate long-term returns for investors. These catalysts have led me to take a bullish view on stocks.

Alphabet underperformed “Magnificent Seven”

The company owns the world’s largest search engine, but in recent years it has trailed shares of the Magnificent Seven. These are his 1-year and his 5-year returns for each stock in the cohort.

1 year return:

-

NVIDIA: 223%

-

Metaplatform: 171%

-

Amazon: 77%

-

Microsoft: 58%

-

Alphabet: 56%

-

Apple: 22%

-

Tesla: -2%

5 year revenue:

-

NVIDIA: 1,579%

-

Tesla: 882%

-

Apple: 320%

-

Microsoft: 260%

-

Metaplatform: 187%

-

Alphabet: 157%

-

Amazon: 106%

These are still impressive returns, outperforming the S&P 500 (SPX) and Nasdaq 100 (NDX). However, Alphabet loses to all Magnificent Seven stocks except Amazon (NASDAQ:AMZN) for the past 5 years.

Alphabet trades at a high price

Although the stock has underperformed its peers, Alphabet has a higher valuation than most tech companies. The stock trades at a P/E ratio of 24.5x and boasts a solid profit margin. The company’s net profit margin is typically above 20% and should increase significantly in the coming quarters.

Alphabet has three things going for it: revenue growth, profit growth, and cost-cutting measures. The technology giant reported a 13% year-on-year increase in revenue and a 51.8% year-on-year increase in net profit for the fourth quarter of 2023. Alphabet’s efforts to reduce its workforce have helped improve profit margins, and appear to be continuing.

Alphabet’s net income increase is driven by Google Cloud’s recent profitability. The cloud computing segment has become a larger share of revenue, accounting for more than 10% of his revenue in the fourth quarter of 2023. Google Cloud generated $9.2 billion of the company’s $86.3 billion in revenue. Google Cloud has grown from an operating loss of $186 million in the fourth quarter of 2022 to an operating profit of $864 million in the fourth quarter of 2023.

Google Cloud’s margins should improve significantly in the coming quarters, and the company’s P/E ratio should decline as revenue increases.

Advertising revenue is on a recovery trend

While it’s nice to see Alphabet expand in other areas, it’s no secret that advertising is the company’s main driver. Advertising sales slowed in 2022, but recovered in 2023. Fourth-quarter results further underscore this fact, suggesting Alphabet has more to gain.

Google services revenue for the fourth quarter was $76.3 billion. This segment, which primarily consists of the company’s advertising, grew by 12.5% year over year. The Olympics and the upcoming presidential election should give advertising even more impetus.

Increased advertising revenue also leads to increased profits. The same is true for most companies, but Alphabet achieved his 35.0% operating margin in the Google Services division in the fourth quarter.

AI brings new long-term growth opportunities

Among the Magnificent Seven stocks, Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT) is the clear leader in the artificial intelligence industry. But Alphabet is also poised to capture a meaningful slice of the pie by leveraging existing technology and making new investments.

Alphabet recently launched Gemini to strengthen its AI presence. The technology company has also invested more than $2 billion in OpenAI competitors. Alphabet has been using artificial intelligence to improve its search results and cloud platform, and these investments represent the next step in gaining market share.

Alphabet could close the gap in the AI race with Microsoft. Two years after Amazon got a head start with Amazon Web Services, the company launched its Google Cloud. Google Cloud is now a key component of the company’s business. Alphabet has invested in a number of fast-growing ventures known as Other Bets. Although this segment makes up a small portion of total revenue, it’s worth monitoring the aggregation of businesses included in the overarching period.

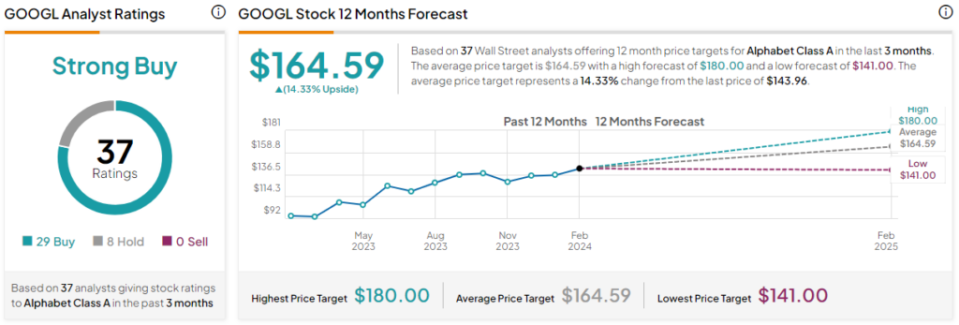

Is GOOGL stock a buy, according to analysts?

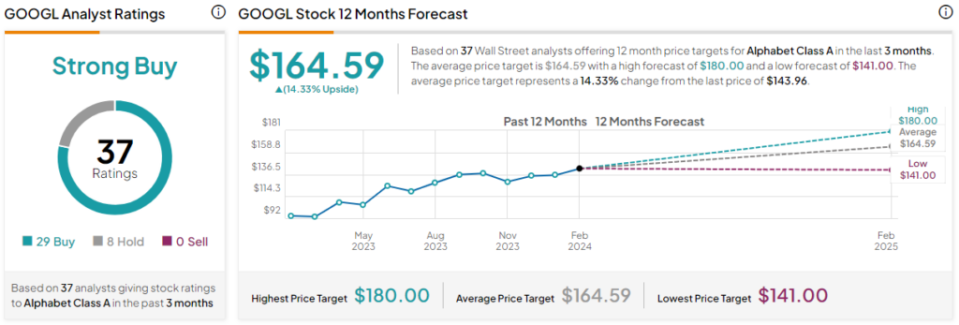

Most analysts are bullish on Alphabet stock. Analysts have 29 ratings for the stock as “buy” and 8 as “hold,” giving the stock a consensus rating of “strong buy.” GOOGL’s average price target of $164.59 implies an upside potential of 14.3%.

Alphabet Stock Conclusion

Alphabet is a (relatively) under-the-radar stock due to the impressive performance of the other Magnificent Seven stocks. The tech giant outperformed the market but underperformed most of its peers.

Increasing revenue and profits from advertising and cloud computing presents a huge opportunity. Alphabet also seems determined to capture more market share in the artificial intelligence space, which would be a big step forward for the company in the long term.

disclosure

[ad_2]

Source link