[ad_1]

No doubt, many artificial intelligence (AI) investors are kicking themselves for missed opportunities. Nvidiabig profits. His stock is up 280% in the last year and more than 1,800% in five years, making him one of the biggest beneficiaries of the AI space.

Nevertheless, Nvidia is not the only AI stock in the chip industry, and AI is about more than semiconductors. With a wide range of AI investment options, the industry should continue to present opportunities. Three of his Fool.com contributors offer ideas on where AI investors should look next. Amazon (NASDAQ:AMZN), trade desk (NASDAQ:TTD)and tesla (NASDAQ:TSLA).

There are many ways Amazon can win when it comes to AI.

Jake Larch (Amazon): ThThere are more buzzy AI stocks out there, but Amazon remains one worth watching and buying. Here’s why:

First, the company is the largest cloud service provider. Amazon Web Services (AWS) is estimated to have approximately 31% of the global cloud services market. This is important because new generative AI tools and applications often utilize cloud services such as AWS. As the AI revolution continues, Amazon is poised to benefit from its leadership in the cloud infrastructure market.

Second, Amazon’s large e-commerce business works well with a variety of AI applications. For example, the company has already introduced Rufus, a new AI-powered shopping assistant designed to assist people by answering questions, comparing prices, and generating product recommendations. Masu.

Additionally, Amazon uses AI in many other areas of its operations, including:

-

Streamline prescription drug delivery times and costs through Amazon Pharmacy.

-

Reduce your company’s environmental impact through AI-generated recommendations to reduce package usage.

-

Improve shopping recommendations through Amazon Fashion.

-

Update your Alexa-enabled devices to enhance conversations and interactions between you and Alexa.

On top of that, Amazon remains one of the best-run companies in the world. The share price is up 73% over the past 12 months, with revenue growth returning to a solid 13%.

That means Amazon remains a smart choice for AI-focused investors.

Trade desks benefit from tailwinds from AI and digital advertising

Justin Pope (The Trade Desk): Artificial intelligence is a hot topic today, but several years ago, when The Trade Desk was in its infancy, it began to disrupt the advertising business. Brands and other businesses can buy ads on The Trade Desk’s platform, which uses AI and user data to match ads to potential customers. This is much more effective than traditional advertising broadcast to a wide audience on television, radio, or print.

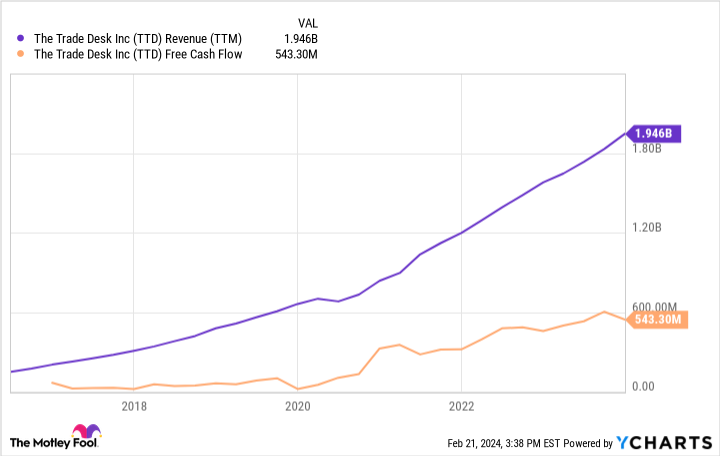

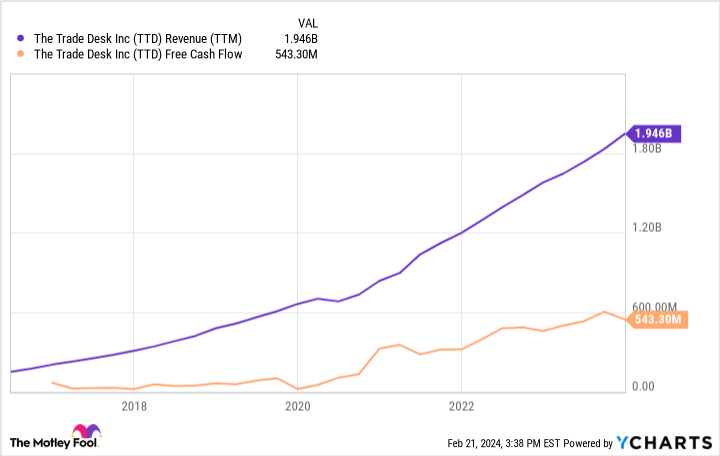

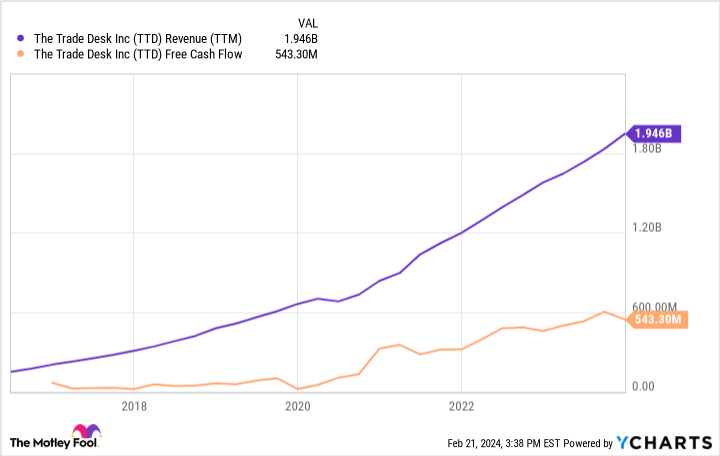

The Trade Desk has been steadily growing and profitable since its initial public offering in 2016. reason? Trade Desk is ideally located in the industry. Advertising dollars are shifting to digital media, and competitors are offering similar services. meta platform and alphabet Operating with limited transparency, The Trade Desk is providing more information to its customers, which has helped it win over them.

Total global ad spending in 2023 is estimated at $830 billion, meaning The Trade Desk’s total ad spend of $9.6 billion represents just over 1% of the market share. This leaves an incredible growth path for the company, which operates outside the closed ecosystem of big tech companies.

The Trade Desk’s long-term growth opportunity and profitable business model make this stock an easy AI investment to hold for the long term.

Tesla likely has an AI-powered surprise inside.

Will Healy (Tesla): While investors may tend to view Tesla as an automaker, it’s actually a diversified company that also has breakthrough developments in battery technology, solar energy solutions, and AI.

Rather than relying on chip companies like Nvidia for its technology, Tesla has developed its own semiconductor and robotics solutions. These include his Dojo chip, designed to power neural networks, and his FSD (fully self-driving) chip, which powers fully self-driving cars.

CEO Elon Musk wants to launch a robotaxi business based on Tesla technology. Analysts at Ark Invest, led by Cathie Wood, predict that the use of robotaxis will help Tesla’s sales reach at least $600 billion by 2027, more than seven times the 2023 level of $82 billion. I think it is possible to reach this goal.

Wood believes that growth could push Tesla’s stock price to $2,000 a share, more than 10 times its current level.

That may seem far-fetched, and Musk has a track record of being overly ambitious with his promises, but Wood predicts a 2018 split-adjusted price target of $267 per Tesla share. Was. Less than three years later, Wood’s prediction came true, so she may be right again.

Tesla’s stock price has fallen as the company lowers the price of its electric vehicles (EVs) to increase sales and stay competitive with emerging rivals. This pessimism caused the company’s P/E ratio to drop to 45 times, making it the lowest valuation in stock history.

Profits are expected to decline 1% this year, but analysts predict a 36% increase in 2025. These profit projections lend some legitimacy to Wood’s theory. Some of that optimism may be related to the expected launch of the lower-priced, compact EV Model 2 in 2025, with investors hoping the company will improve its AI and self-driving capabilities. is also likely to jump.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 20, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Jake Lerch has held positions at Alphabet, Amazon, Nvidia, and Tesla. Justin Pope has no position in any stocks mentioned. Will Healy has a position at The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, Tesla, and The Trade Desk. The Motley Fool has a disclosure policy.

Missing Nvidia? Buy these artificial intelligence (AI) stocks instead.Originally published by The Motley Fool

[ad_2]

Source link