[ad_1]

-

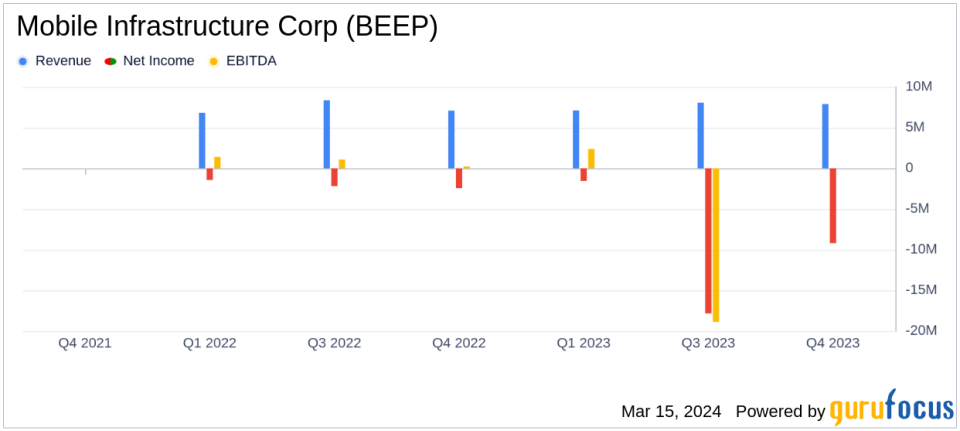

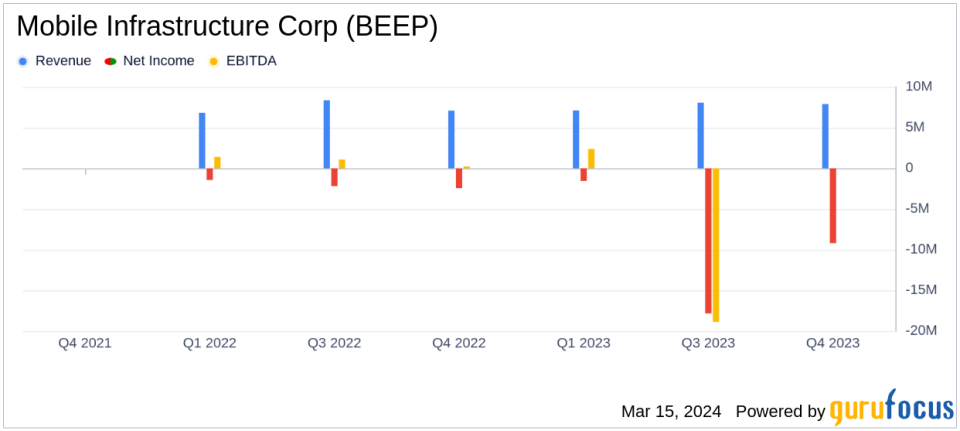

revenue: Increased to $7.9 million in the fourth quarter of 2023, an increase of 14.3% year-on-year.

-

Net operating income (NOI):Increased 27.7% to $5.5 million in the fourth quarter of 2023.

-

net loss: In the fourth quarter of 2023, it will increase from $5.2 million in the previous year to $9.2 million.

-

debt reduction: Paid $29.1 million, improving financial situation.

-

Adjusted EBITDA: 36.5% increase to $3.4 million in the fourth quarter of 2023.

-

Guidance for 2024: Revenues are expected to be $38 million to $40 million, with NOI expected to be $22.5 million to $23.25 million.

On March 14, 2024, Mobile Infrastructure Corporation (BEEP) released its 8-K filing detailing its fourth quarter and full year 2023 financial results. The company specializes in the acquisition, ownership, and leasing of parking facilities and related infrastructure. We reported that the performance of our national parking asset portfolio improved significantly compared to the previous year.

Company Profile

Mobile Infrastructure Corp focuses on strategic real estate acquisitions in major metropolitan areas. The company’s portfolio includes parking garages and garages targeted at key locations in urban areas near demand drivers such as airports, government buildings, and entertainment venues. This strategic position is critical to the company’s success in the construction and real estate industry.

Financial performance and challenges

Fourth-quarter revenue increased to $7.9 million, an increase of 14.3% from $6.9 million a year ago. This growth is due to favorable rental trends and lower operating expenses. However, net loss for common stockholders widened to $9.2 million ($0.69 per diluted share) from $5.2 million ($0.40 per diluted share) a year earlier. This loss included significant non-cash charges related to the company’s merger and public listing, which are not expected to recur in future periods.

Despite these challenges, the company’s net operating income (NOI) increased 27.7% to $5.5 million, demonstrating the operating leverage inherent in its mobile infrastructure business model. Adjusted EBITDA also increased significantly by 36.5% to $3.4 million, reflecting improved NOI and partially offset by higher professional fees and general and administrative expenses.

Financial results and materiality

Mobile Infrastructure Corp.’s financial results, including $29.1 million in debt repayments and the valuation of a parking asset portfolio of more than $520 million, are critical to the company’s growth and stability. These achievements will enhance the company’s creditworthiness and investment attractiveness, which is critical in the capital-intensive construction industry.

Key financial indicators

The company’s balance sheet lists net investments in real estate of $402.9 million and total assets of $423.2 million. The decline in total debt from $219.7 million to $192.9 million year-on-year reflects the company’s stronger financial position. The importance of these indicators is that they reflect a company’s asset value and debt management ability, which are important indicators of financial health for investors.

Management commentary

“Our asset portfolio performed well in the fourth quarter, with net operating income increasing more than 27% year-over-year,” said Manuel Chavez III, CEO of Mobile Infrastructure Corporation. Stated. He also highlighted that the company has converted two-thirds of its portfolio into mobile infrastructure. Management contracts offer increased flexibility and optimized pricing and utilization potential.

Analysis and outlook

Looking forward, Mobile Infrastructure Corp expects growth to accelerate in 2024, with revenue of $38 million to $40 million and NOI of $22.5 million to $23.25 million. The company aims to increase operational efficiencies, evaluate ancillary revenue opportunities, and position itself as the acquirer of choice in the fragmented parking industry.

As stated by CEO Manuel Chavez III, the company is focused on improving its operations and strengthening the performance of its existing asset portfolio, which is expected to deliver strong returns in the coming period.

For more information on Mobile Infrastructure Corp.’s financial results, investors are encouraged to review its entire 8-K filing.

For more information, see Mobile Infrastructure Corp’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link