[ad_1]

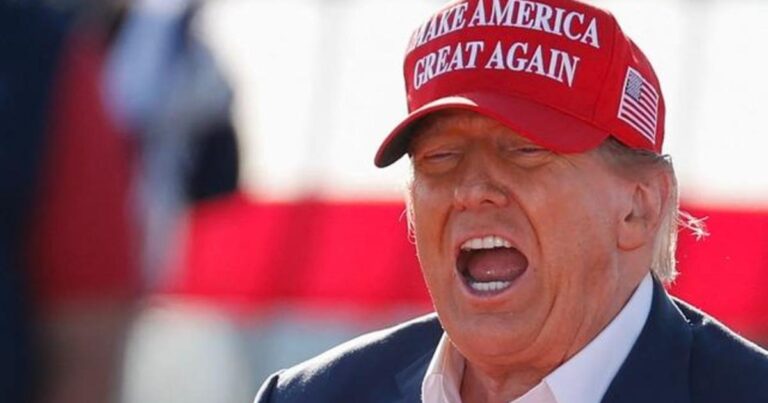

Former President Donald Trump will soon take a leadership role in a publicly traded company that trades under the ticker “DJT,” named after his initials, and has a potential valuation of more than $5 billion. I have little income.

Mr. Trump’s next move as head of a public company comes after he acquires ownership of the so-called blank check company Digital World Acquisition Corporation (DWAC). Also known as SPAC, approved the merger on Friday morning In partnership with Trump Media & Technology Group. Under the agreement, DWAC will merge with Trump Media & Technology Group and may soon begin trading under the latter’s name.

Investors typically put money into companies they believe will provide a solid return on investment despite long-standing fundamentals such as earnings and revenue growth, dividends, and stock price appreciation. But Trump Media’s main business, Truth Social, is a social media platform that lags behind rivals like Facebook and X (formerly Twitter), according to regulatory filings. It is scarce and losses are mounting.

But DWAC’s investors, some of whom appear to be Trump supporters, are undeterred, promoting the stock on Truth Social. “I’m holding but not selling! I believe in TRUTH and MAGA,” one member of the Truth Social group focused on DWAC stock posted Friday morning.

Typically, a company with a financial profile like Trump Media & Technology Group’s would have a hard time reaching a $5 billion valuation, but the company’s stock trades on traditional financial metrics such as sales and profits. Chief Christy Marvin said it doesn’t appear to be the case. Executives at SPACInsider.com.

“It has never traded on fundamentals, and I don’t expect it ever will,” Marvin told CBS MoneyWatch. “This is kind of a barometer for President Trump and his performance in the election.”

Marvin pointed out that the majority of DWAC shareholders are retail investors, meaning they are individual investors rather than institutional investors. Essentially, she added, DWAC is a “retail meme stock,” similar to its next iteration as Trump Media.

Meme stocks and SPACs

A special purpose acquisition company (SPAC) is a shell company formed to take a privately held business public without an initial public offering.

In 2021, DWAC announced its intention to merge with Trump’s Media Group, and Digital World’s stock price rose more than 800%. comparison With meme stock businesses like GameStop. At the time, SPACs received significant attention from small investors, with some gaining support from celebrities and investors alike.

Investors holding DWAC stock will receive one share of the new company for each DWAC share they own, according to a regulatory filing.

There will be approximately 136 million shares outstanding after the merger, and based on DWAC’s current price, the new business could be valued at $5.4 billion. Mr. Trump, who will become chairman of Trump Media & Technology Group, will own about 58% of the company, making his stock worth about 58%. $3.5 billion.

To be sure, there is no guarantee that the newly combined company will continue to trade at the same price as DWAC. Marvin noted that a company’s trading price may decline in the months following a SPAC merger as some early investors sell their shares.

“The original shareholders are being washed out,” she said.

However, Marvin said the newly combined company will likely continue to appeal primarily to individual investors, as some institutional investors may shy away from the company due to political concerns or other reasons. added.

Risk factors: bankruptcy, failure, prison

Investors in Trump Media & Technology Group are buying shares in a startup social media business that posted $3.3 million in revenue in the first nine months of 2023, according to regulatory filings.

But like many other tech startups, Trump Media has been bleeding money, with losses rising to $49 million a year ago. Of course, a company’s financial woes don’t necessarily prevent it from achieving high public acclaim, as seen in the example of his loss-making Reddit account. This week’s IPO The market capitalization was $8 billion.

Research firm Similarweb estimates that Truth Social had about 5 million active members (including mobile users and website visitors) as of February of this year. Truth Social does not disclose its user numbers.

By comparison, TikTok has 2 billion users and Facebook has 3 billion users. But in the so-called “alternative technology” space, Truth Social is faring better than rivals like Parler, which has been offline for more than a year, and Gettr, which has been offline for less than two years. The number of visitors in February was 1 million.

The question is whether Truth Social can attract new advertisers and increase revenue for a platform that critics say is focused squarely on Trump’s personality and conservative views. Expanding the user base will be key to success, according to risk factors listed in regulatory filings related to the merger.

That’s not the only risk to companies, according to the filing. These include Trump’s “death, incarceration, or incapacitation” as well as the Trump Taj Mahal bankruptcy in 1991 and the Trump Hotel and Casino Resort bankruptcy in 2004. Also includes some history of the business. Other bankruptcies.

“A number of companies associated with President Trump have filed for bankruptcy,” the filing states. “There can be no guarantee that [Trump Media & Technology Group] You won’t go bankrupt either. ”

—With a report by the Associated Press Board of Directors.

[ad_2]

Source link